আজকের Nuclear Family Concept এ যিনি যেখানে কর্মরত বা যেখানে তিনি নিজে কর্মরত এবং তার ছেলেমেয়েরা যেখানে লেখাপড়া করছে সেখানেই একটা Flat বা বাড়ি কিনে নিতে চান। এই চাওয়া টা সম্ভব হয়েছে Home Loan এর সুবিধা থাকার কারনে। আজকের দিনে একজনের যদি মোটামুটি একটা Income থাকে, তাহলেই Bank গুলো Home loan দেওয়ার জন্য Ready হয়ে বসেই রয়েছে। Interest Rate ও যথেষ্ট সস্তা, 6%- 6.5% এর কাছাকাছি। প্রচুর পরিমাণে Income Tax এ ছাড় পাওয়ার সুবিধা রয়েছে। এই সমস্ত কারনেই আজ 30 বছরের কম বয়সেই অনেকেই তারা নিজেরাই একটা Flat এর owner হয়ে যেতে পারছেন।

কিছু Mistake এবং কিছু Myths

এবার যথেষ্ট Financial Education না থাকার জন্য অনেকেই এই Home Loan এর সুবিধা নিতে গিয়ে সুবিধার বদলে Trap এ পরে যাচ্ছেন। Financial বিষয়গুলো সম্বন্ধে যথাযথ ধারনা না থাকার কারনে কিছু Myth বা ভুল ধারনা অনেক মানুষকে ভুল সিদ্ধান্ত নিতে বাধ্য করে এবং ভবিষ্যতের Financial Life কে অসুবিধায় ফেলে দেয়। কি রকম সেটা, একটু সহজ করে বলছিএবং সেটা যখন তার উপলব্ধি ঘটছে, তখন তার অনেকটাই দেরি হয়ে যাচ্ছে।।

সব আগে এটা আপনাকে বুঝতে হবে যে আপনার বসবাসের জন্য বাড়ি কিন্তু কোনভাবেই Asset নয়। ওটা একটা Need। অন্ন, বস্ত্র, বাসস্থান এগুলো তো আমরা জানি এগুলো Basic Need। Finance এর ভাষায় যেটা আপনাকে Income produce করে দিতে পারবে না সেটা কোন ভাবেই Asset বলে গণ্য হবে না। যদি আপনি বাড়িটা ভাড়া দিয়ে Rent পান তখন ওটাকে Asset বলে ধরা যেতে পারে।

আর একটা Myth আছে যেটা অনেক মানুষকে ভুল পথে পরিচালিত করে। সেটা হল পরে দাম বেড়ে যাবে, এখন খুব সস্তা, এখন না নিলে পরে আর পাওয়া যাবে না। প্রথমত আজকের যুগে সস্তা আর দামি এইটা খুব Relative। আজকের আপনার যা Income বা Budget সেই অনুযায়ী হয়ত আপনি ভাবছেন সস্তা। ধরুন আজকের কোন Property র Price 10 লাখ। 10 বছর পর ধরুন ঐ ধরনের Property তার দাম চাইছে 15 লাখ। তাহলে অবশ্যই 10 লাখ তো 15 লাখের থেকে অনেক সস্তা, তাই না?

না সস্তা নয়, Simple Excel এই যদি কেউ Calculate করেন তো দেখতে পারবেন যে ওটা বেড়েছে মাত্র 4% হারে। Market এ অন্যান্য জিনিসপত্রের দাম বা Inflation হয়ত বেড়েছে 9%-8% হারে। Bank এর Savings Account এ রাখলেও তো ওই হারেই বাড়ত, কোন tax এর ঝামেলা বা Depreciation হবার ও কোনও সম্ভাবনা থাকত না।

আজকের অল্প বয়সের অনেক Young ছেলেমেয়েরা আছে যারা তাদের কর্মস্থলে হয়ত Rent এ থাকে, এবার প্রত্যেক মাসের Rent যখন তাদের Pay করতে হয়, তখন তাদের মাথায় একটাই বিষয় ঘোরে, এইভাবে এতগুলো করে টাকা ভাড়া দিতে চলে যাচ্ছে এর থেকে আর সামান্য কিছু বেশি দিলে তো Loan নিয়ে একটা Flat কিনে নিলে ঐ ভাড়ার পয়সাটাই EMI হয়ে যেত। আর বেশির ভাগ ক্ষেত্রে Parents রাও সেই যুক্তিকেই সমর্থন করেন। কিছু বছর আগে ঘটে যাওয়া একটা Practical ঘটনা বলছি।

বাস্তবে কি ঘটছে?

ছেলেটির নাম Souvik, কর্ম সূত্রে Bangalore এ থাকে, Rent দিতে হয় 18,000 টাকা প্রতি মাসে, IT Company তে Job করে। এবার অনেক খুঁজে Office থেকে খুব দুরে নয় এরকম একটা Place এ একটা 42 লাখ টাকা দামের 2BHK Flat কিনে নিলো। এর জন্য ও Loan করল 20 বছরেরে Term এ। EMI দিতে হচ্ছে 32,563 টাকা করে প্রতি মাসে। কয়েকটা বিষয় এ প্রসঙ্গে বলছি ভেবে দেখতে পারেন, Souvik দেরও এই কথাগুল বলেছিলাম। কিন্তু যখন ওরা ঐ Flat কেনার Decision নিতে যাচ্ছিল তখন কিন্তু এই যুক্তিগুলো যেগুলো আমি ওদের দিয়েছিলাম সেগুলো কাছে গ্রহণযোগ্য ছিল না। স্বাভাবিক ভাবে “নিজের নামে বাড়ি”, “মাথার ওপর ছাদ”, এই সব Emotional যুক্তিগুলোই বেশি প্রাধান্য পেয়েছিল।

দেখুন, এই সমস্ত বয়সের আজকের যারা ছেলে মেয়ে, এদের চাকরির যায়গার কোন স্থিরতা নেই। এদের Life ভীষণ Dynamic। এরা যদি একবার অল্প বয়সে নিজেদের কোথাও ভুল করে Settle করে বসে তাহলে পরবর্তী সময়ে Carreer এবং Opportunity সব দিক থেকেই পস্তাতে হতে পারে। অনেককে বলতে শুনেছি কি আছে, যখন অন্য কোথাও Opportunity পাবো তখন Flat বিক্রি করে দোবো। এটা কোনও Mobile Phone নয় যে চাইলেই বিক্রি হয়ে যাবে। আমি তো অন্তত খুব কম মানুষকেই দেখেছি সঠিক দামে Hassle free ভাবে Flat বিক্রি করতে পেরেছেন। কারণ এই ধনের Fixed Asset বিক্রি করার অভিজ্ঞতা বেশিরভাগ মানুষের থাকে না।

এমত অবস্থায় অনেকে ভাবেন ভাড়া দিয়ে দোবো, এক্ষেত্রেও হিসাবটা ঠিক মেলে না। কেন বলছি ভাবুন।

- Souvik যেখানে চাকরি করছে ও কি ওখানে Whole Life চাকরি করবে? যদি উত্তর হয় না তাহলে তখন ওই Flat টার কি হবে? ভাড়া দেবে? ভাড়া তো ওই 18,000 টাকাই যদি হয় তা হলে সেটা ওই Flat এর দামের, মানে Flat এর দাম তো 42 Lakh টাকা? তাহলে ঐ Rent 18,000 Flat এর দাম কত Percent হচ্ছে? টেনে টুনে 5%, এর পর রয়েছে বাড়ির Tax, Depreciation, Maintenance এসব।ব্যপার টা কি ঠিক হয়েছে? Actually এই Calculation ই বুঝিয়ে দেয় চট জলদি Flat কেনার থেকে কিছুদিন ভাড়ায় থেকে নিজের ভবিষ্যতের জন্য কিছু Savings করে নেওয়া উচিত।

- এবার Souvik এবং ওর Parents রা ভেবেছিল যখন অন্য কোথাও Better Opportunity পাবে তখন ঐ Flat টা বিক্রি করে দেবে। এই বিক্রি করার কাজটা যে কতটা Tuff সেটা যারা করার জন্য এগিয়েছেন তারাই জানেন। খুব কম মানুষই তাদের কাঙ্খিত দামে তাদের Flat বা বাড়ি বিক্রি করতে পেরেছেন।। অন্তত আমার অভিজ্ঞতা তো সেরকমই।

- এই Flat, বাড়ি, জমি, গহনা এই সমস্ত জিনিসগুলো বিক্রি করে থোক টাকা পাওয়া যায়। এবার ঐ থোক টাকাকে Percentage Return এ Convert না করেই মনে মনে ভেবে নেওয়া হয় যে সব ঠিকই আছে। ব্যপারটা একটা Example দিয়ে বুঝিয়ে বলছি।

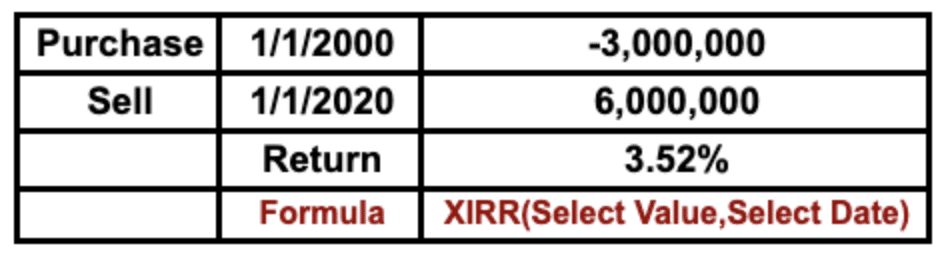

ধরুন একটা বাড়ি কেনা হয়ে ছিল 2000 সালে ধরুন 30 লাখ টাকায়, ঐ বাড়িটা ধরুন বিক্রি করা হোল 60 লাখ টাকায়। আপাত দৃষ্টিতে মনে হতেই পারে বিক্রি করে টাকা Double হয়ে গেছে, মানে অনেক লাভ হয়েছে। লাভ লোকসানের কথা ছাড়ুন, দেখতে হবে কত Percent Return হোল? কেন Percent এর কথা বলছি? কারন, Bank, Post Office, Mutual Fund বা আর বাকি সব ক্ষেত্রেই তো আপনি সব Return হিসাব করছেন ঐ Percentage এ, তাই না? এবার এই যে 60 লাখ টাকা বাড়ি বিক্রি করে পাওয়া গেল ওটা তাহলে কত Percent পাওয়া গেল।

Percentage হিসাব করলে দেখা যাচ্ছে Annualised Return মাত্র 3.52%, যেভাবে আপনার বাকি investment এর Return হিসাব করা হয়। এতো Bank Savings এর Rate, তাও তো এখানে Registration Cost, Tax, Maintenance, Depreciation এরকম আরও হাজর বসয় Consider করা হয় নি।

এই প্রসঙ্গে বলি Return Compare করতে হলে থোক Return কেও Percentage এ Convert করে তার পর Compare করতে হবে। আম আর আপেল এর তুলনা করলে ঠিক হবে না। এই কারণে আমি Simple Excel এর সাহায্যে আপনি কি ভাবে নিজে নিজেই Lumpsum থেকে Percentage Retun Calculate করবেন দেখিয়ে দিলাম। খুবই Simple। ঐ XIRR লেখার আগে একটা = Sign দিয়ে দেবেন। জমি, বাড়ি, গহনা, তারপর Insurance এই সমস্ত থেকে যে থোক টাকা পাবেন তাকে আপনি চাইলে নিজে নিজেই Percentage Return এ Convert করে নিতে পারবেন।

দয়া করে আমায় ভুল বুঝবেন না যেন যে আমি Flat কেনার বিরোধী। একদম না। আমি নিজেও তো Flat এই থাকি। আমি বলতে চাইছিলাম Just না জেনে না বুঝে ঝোঁকের মাথায় যেন কোনও Discission না নিয়ে পরে পস্তাতে হয়। Emotion এক জিনিস আর বাস্তব সম্পূর্ণ আলদা। Emotion একদিন চলে যাবে, তখন তো কঠিন বাস্তবের সামনে দাঁড়াতে হবে, তাই না?

বাড়ি বা Flat কেনার আগে কি কি বিষয় দেখে নেওয়া জরুরি?

এবার ধরুন আপনি ঠিকই করেছেন যে না Flat ই কিনবেন। এবার দেখে নেওয়া যাক কোনো বাড়ি বা Flat নেওয়ার আগে কি কি বিশয় দেখে নেওয়টা খুব জরুরী।

- Promoter/Developer এর সঙ্গে Contract করার আগে সব খুঁটি নাটি শর্তাবলি ভালো করে বুঝে নিন। Promoter এর Lawyer এর ওপোর পুরোপুরি ভরসা না করে হয় নিজে বুঝে নিন না হলে কোনো Lawyer কে দিয়ে যাচাই করে নিন।

- জমির দলিল ঠিক আছে কিনা Search করিয়ে দেখে নিন। Bank Loan দিচ্ছে মানে সে সব দেখে নিচ্ছে এরকম taken for granted ভাবনা না ভাবাই ভালো।

- যে Building টি নিতে যাচ্ছেন তার Plan Sanctioned কিনা দেখে নিন। Plan Sanction হওয়ার 2 বছরের মধ্যে Construction কাজ শুরু হয়েছে কিনা Check করে নিন। না হলে ঐ Plan কে Renew করতে হয়। সেখেত্রে Renew করার Date টি দেখে নিন।

- Flat register করার আগে Promoter বা Developer এর কাছে Completion Certificate চেয়ে নেবেন।

- Construction সংক্রান্ত Internal Specification বিশেষ করে Floor/Kitchen/Toilet এর Mosaic/Marble/Tiles এগুলো আর জানালা দরজার Material এগুলো জেনে নিন।

- Electricity Meter মিটারে পর্যাপ্ত খমতা নেওয়া হচ্ছে কিনা দেখে নিন।

- Electric Wiring এর জন্য যে Cable Use করা হচ্ছে তা যথাযথ কিনা দেখে নিন। AC/Microwave Oven এরকম উচ্চ খমতা সম্পন্ন বিদ্যুত ব্যবহারের Separate Line করা আছে কিনা দেখে নিন।

- Meter Box লাগোয়া Main Switch থেকে আপনার Unit টি পর্য্যন্ত আলাদা Positive, Negative এবং Neutral Line টানা আছে কিনা দেখে নিন।

- Safety Tank এবং নিকাশি ব্যবস্হা ঠিকঠাক আছে কিনা দেখে নিন।

- জলের Tank এবং Under Ground Reserver এর খমতা জেনে নিন।

- Fire brigade থেকে NOC নেওয়া আছে কিনা জেনে নিন।

Home Loan কে কি Insurance Protect করার দরকার আছে?

Home Loan টাকে অবশ্যই Insurance Protect করে রাখুন। যদি পারেন তো Loan Protected Insurance টা নিজে বাইরে থেকে করে রাখুন। এতে অনেক সুবিধা বেশি পাবেন। যারা সরকারী চাকুরী করেন না বা ব্যবসা করেন না তাদের খুব বেশি Long Term এর ভাবনা ভেবে বড় কোনো Flat এ না যাওয়াই ভলো। কারন Private চাকুরীতে আপনি যত Dynamic হয়ে নিজের যোগ্যতা, Experience প্রভৃতি বাড়িয়ে নিয়ে Change করবেন ততই আপনার Income Increase করার সম্ভবনা বাড়বে।

হয়তো কয়েকবছর পর আপনার Income এত বেড়ে গেল যে আপনার বর্তমান Flat টা আর আপনার Life Style এর সঙ্গে ঠিক Suit করছে না। আমি এমন অনেকেই জানি যারা তাদের ব্যক্তিগত যোগ্যতা এতটাই Increase করে ফেলেছেন যে তাদের এমন অনেক Offer আসছে যেগুলো এই Province এই নয়। তখন যেন আপনার ঐ বেশি বড় Flat টা বাধা না হয়। কারন Flat যত বড় হবে তত আপনি যখন Sell করতে চাইবেন তখন Buyer কম পাবেন। এই Technology Era তে খুব কম মানুষই তার Future Predict করতে পারবেন। এই ব্যপারটা নিয়ে আর ইচ্ছা করেই বিশদে যাচ্ছি না।

Tax ছাড় রয়েছে যখন তখন Home Loan নেওয়া তো উচিত?

Tax ছাড় পাবেন বলে যারা এই Flat Purchase করতে এগোচ্ছেন তাদেরও আমি অনুরোধ করবো দুবার ভাবতে। Finance এর খেত্রে বেশিরভাগ ব্যক্তিই Present Benefit এর বেশি আর কিছু দেখতেই পান না। অথচ Finance এ সব Decision এরই Good Or Bad Impact আসে Future এ। আপনার প্রয়োজনটা দেখুন, আর আপনার Cash Flow এই মুহূর্তে Loan Emi নেবার জন্য Permit করছে কি না সেটাও তো দেখা উচিৎ। কখনো কোনও Thumb Rule এর ওপর নির্ভর না করাই ভালো। প্রত্যেকটি মানুষের Income Different, Expenditure, Purpose, Ambition, Skill, Dependent,Liablity সমস্ত কিছু Different। সেই অনুযায়ী প্রত্যেকটি মানুষের তার Income অনুযায়ী Loan এর জন্য কতটা EMI থাকা উচিত সেটা নির্ভর করে।

ধরুন একজনের Heart Permit করছে না Trekking করার জন্য, তাও যদি তিনি Trek করতে যান তাহলো বড় বিপদ তো হতেই পারে। এই বিপদটা হয় অতি দ্রুত, আর Finance এর খেত্রে যখন ভুলটা বোঝা যায় তখন হাতথেকে মুল্যবান Time টাই বেড়িয়ে যায়। Oh sorry, আমি এই পর্য্যন্ত এসে পরিস্কার দেখতে পাচ্ছি অনেকেরই Mindset এর সঙ্গে Already Differ করতে শুরু করেছে। ঠিক আছে চলুন, আমি আর এই ব্যপারে কিছু বলছি না, বাকি যা কিছু সেটা পরে কখনো বলা যাবে।

কিভাবে আপনি আপনার Home Loan কে Interest Free করবেন?

এবারে আমি আপনাদের দেখাব যে কিভাবে আপনি আপনার Home Loan কে Interest Free এবং Tension free করবেন। হ্যাঁ, ঠিকই শুনছেন, Home Loan জন্য এর অনেক টাকা Interest এ চলে যাচ্ছে বলে আপনি চিন্তিত? আমার সাথে এগিয়ে চলুন, আমি আপনাদের সব চিন্তা মুক্ত করে দব।

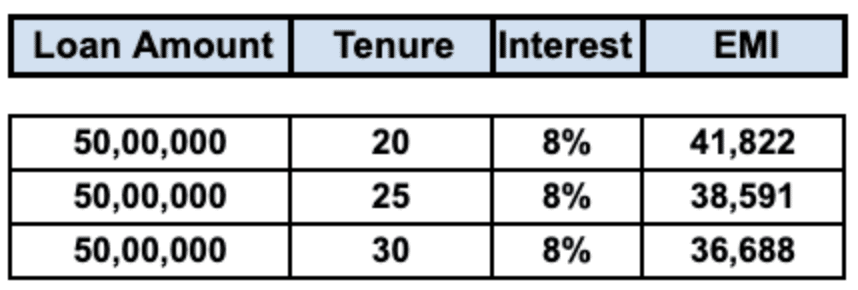

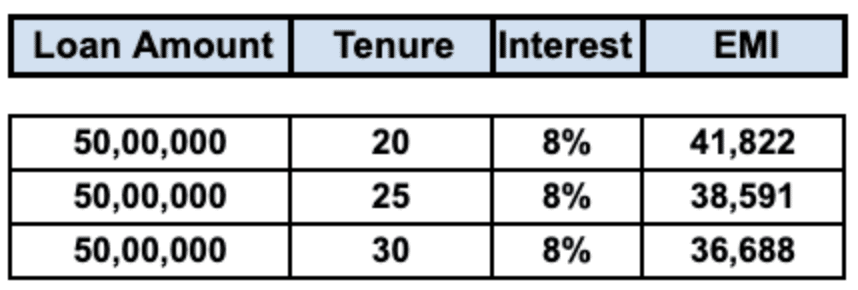

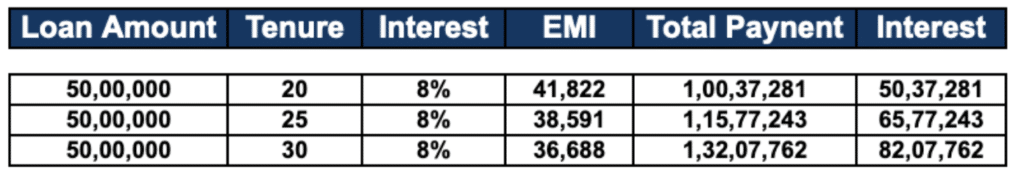

আমি একটা Example দিয়ে বোঝানর চেষ্টা করছি। ধরুন আপনি 50 Lakh টাকা Home Loan নিতে চান। যদি আপনি 20 বছরের জন্য Loan নেন আর যদি আপনার ঐ Loan এর Interest rate ধরুন 8% হয়, তাহলে প্রতি মাসে EMI দিতে হবে 41,822 টাকা। আর যদি 20 বছরের যায়গায় কেউ Tenure টা 30 বছর করতে চান তখন তার EMI কমে হবে 36,688 টাকা। ঘাবড়াবেন না, আমি আপনাকে Tennure বাড়াতে বলছি না। একটু পরেই বুঝতে পারবেন যে Tenure বাড়ালে সুবিধাটা কোথায়।

আমি জানি Tenure বাড়াতে অসুবিধে টা কোথায়। ওত বছর Loan চলবে, যদি আপনার কিছু একটা হয়ে যায় তখন কি হবে? দেখুন আর পাঁচটা Loan আর Home Loan এক নয়।

- Home Loan আপনি নিচ্ছেন আপনার একটা Basic Need Fulfill করার জন্য। আর অন্য যে সমস্ত Loan যেমন Car Loan, Personal Loan, Credit Card Loan ওগুলো Create হয় Lifestyle Maintain করতে গিয়ে।

- Home Loan এর Interest Rate অন্য যেকোনো Loan এর থেকে অনেক কম হয়।

- Home Loan Insurance এর মাধ্যমে Protected থাকে, তাই আপনার অবর্তমানে এই দেনা Nominee র ওপর পরে না।

- Home Loan এর Principal Money শোধ দেওয়ার ওপর যেমন Tax এর এর ছাড় পাওয়া যায় ঠিক তেমনি Home Loan এর Interest এর ওপরেও Tax ছাড় পাওয়া যায়। এটা খুব বড়ও একটা সুবিধা। শুধু মাত্র এই ট্যাক্স ছাড়ই এই Home Loan কে অন্য সব Loan এর থেকে সম্পূর্ণ আলাদা করে দিয়েছে।

ধরুন কোনও একজন ব্যক্তি 30% Income Tax Slab এ Belong করেন, এবার ধরুন তাঁর Home Loan এর Interest 8%, কিন্তু তিনি তো 8% এর ওপর 30% Tax ছাড় পাবেন? তাহলে 8% এর 30% মানে Rs 2.40 Tax ছাড় হয়ে Effective Interest দিতে হবে (8-2.40)= 5.60%। এবার ভাবুন একবার এই 5.60% Interest Rate এ India তে কি কোনও Loan পাওয়া সম্ভব? যার যত % Tax Slab তিনি কতটা Benefit পাবেন। Benefit কিন্তু কম বেশি সকলেই পাচ্ছেন।

কেন Top up Amount দিয়ে Loan শোধ করতে যাওয়া ঠিক হবে না?

এবার এত সুবিধা যুক্ত Home Loan এর Tenure কিছু মানুষ ধারনার ওভাবে কম রাখতে চান। আবার কোথাও থেকে কিছু টাকা পয়সা Extra পেলেই সাথে সাথে ছুটে যান ঐ অত্যন্ত সস্তার Home Loan টাকে শোধ দিতে। যার Effective Interest এতটাই কম, সেটাকে Bad Loan মনে করে ছুটে যান শোধ দিতে। ঐ টাকাটা শোধ দিতে গিয়ে যে Interest টা দেওয়ার হার থেকে রেহাই পাচ্ছেন বলে মনে করেন Actually ঐ টাকাটাই যদি উনি Loan শোধ না করে যে কোনো যায়গায় Save করতেন এবং ঐ 5.6% এর বেশি Earn করতেন তাহলে তো উনি ঐ Lon শোধ করতে গিয়ে বোকামোই করছেন তাই না।

এইখানে এসে অনেকেই বলবেন যে ওত টাকা যে Interest দিতে হচ্ছে তার কি হবে? আপনি বলতেই পারেন যে আপনি তো বললেন যে Loan কে কি করে Interest free Loan করবেন সেটা বলবেন, বলছিলেন তাঁর কি হোল? খুব মন দিয়ে এর পরের লেখাটা পড়ুন আমি দেখাচ্ছি কি ভাবে আপনি আপনার Loan কে Interest Free করবেন, বা আপনি যে Interest টা Bank কে Pay করছেন ওটা কিভাবে আপনার কাছে ফেরত হয়ে যাবে। তো আবার তাহলে যে Example টা নিয়ে আমি বোঝাতে চেয়েছিলাম সেটা নিয়ে আলোচনা করা যাক।

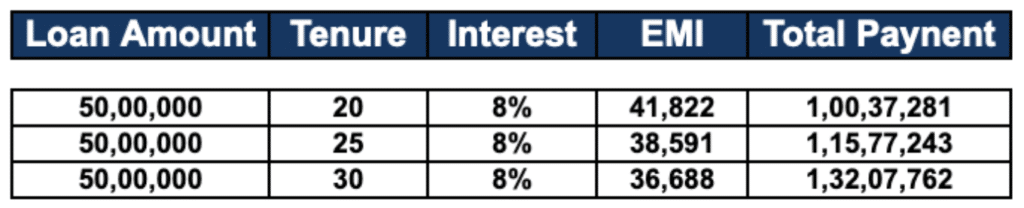

Tenure 20 বছর থাকলে আপনাকে মাসে মাসে EMI Payment করতে হচ্ছে 41,822 টাকা আর 30 বছর Tenure করলে Payment করতে হচ্ছে 36,688 টাকা। Tenure বাড়ালে EMI কমছে। আপনি বলবেন বেশি Tenure রাখলে তো অনেক বেশি পরিমান Interest Bank কে Over the time period Pay করতে হবে। দেখা যাক আগে কতটা বেশি pay করতে হবে?

যেখানে 20 বছর Tenure এ Payment করতে হচ্ছে 1,00,37,281 টাকা, সেখানে 30 বছর Tenure এ 1,32,07,762 টাকা payment করতে হচ্ছে, Approximate 32 লাখ টাকা বেশি Pay করতে হচ্ছে।

তার মানে যেটা দাঁড়াল ঐ যে বেশি Amount টা দিতে হচ্ছে ওটা Actually Interest. কারণ দুটো ক্ষেত্রেই তোও Loan Amount 50 লাখ.

তো দেখা যাচ্ছে যে আপনাকে প্রায় 32 লাখ টাকা মত Interest বেশি দিতে হচ্ছে। এবার আমি আপনদের দেখাব যে কিভাবে আপনি ঐ যে Interest আপনি Bank কে Pay করছেন সেটা ফেরত পেয়ে যাবেন। আমি Strategy টা আপনাদের Share করছি, খুব মনোযোগ দিয়ে দেখুন।

Interest যদি আপনি ফেরত করতে চান তাহলে আপনি যখনি Loan শুরু করবেন তখন যে Amount ই আপনার EMI হোক, আপনাকে ধরে নিতে হবে 10% বেশি EMI, মানে যদি EMI হয় 30,000 টাকা টা হলে আপনাকে ধরতে হবে যে EMI 33,000, ১০% বেশি, যদি EMI 50,000 হয় তা হলে 10 % বেশি মানে 55,000 EMI আপনাকে মনে মনে ধরতে হবে।

এবার এই যে আপনাকে মনে মনে EMI 10% Amount বাড়াতে বললাম ঐ Amount আপনাকে Bank কে Pay করতে হবে না, ঐ Amount টা আপনাকে Mutual Fund এ প্রতি মাসে মাসে Invest করতে হবে। মানে 30,000 EMI হলে 3,000 টাকা করে আর 50,000 টাকা EMI হলে 5,000 টাকা করে আপনি প্রতি মাসে Mutual fund এর মধ্যে Invest করতে হবে।

এই টাকাটা এমন যায়গায় Invest করতে হবে যেখানে Bank Interest এর থেকে বেশি Interest পাওয়া যায়। আপনার MF Distributor এর সাথে আলোচনা করুন এই ব্যপারটা উনি আপনাকে Guide করে দেবেন।

আমি জানি Idea টা যেহেতু আমি বলছি, আপনার মাথা থেকে আসেনি তাই হয়ত কারুর কারুর মাথায় আসবে যে এত টাকা EMI দেওয়ার পর আবার 10% Amount কি করে Invest করব? তাহলে আমি বলব, ধরুন আপনি একটা Flat দেখেছেন, বেশ পছন্দ হয়েছে, Down Payment Amount Builder কে দেওয়া হয়ে গেছে, Paper Doccument নেওয়া হয়ে গেছে, এবার Bank বলছে যে Interest Rate 8% নেই বেড়ে হয়ে গেছে 9%, তো ঐ ক্ষেত্রে আপনার EMI Amount তো 10% এর আসে পাশে বেড়েই যাবে, তো এমত অবস্থায় কি আপনি Home Loan নেওয়া বা Flat কেনা থেকে পিছিয়ে আসবেন? Maxium ক্ষেত্রে উত্তর হবে না। Actual যদি 8% Home Loan Interest হয় আপনাকে Interest Amount Free করার জন্য ধরতে হবে 8% এর থেকে একটু বেশি।

দেখুন হয়ত কারুর কারুর মনে হতে পারে আমি Interest Amount যাতে ফেরত হয়ে যায় তার কথা বলব বলেছিলাম তা হলে আমি এখন বেশি দেবার কথা বলছি কেন? যে 10% বেশি দেবেন ওটা EMI নয়, ওটা কন খরচ নয় যে আপনি খরচ করবেন আর অন্যের Income হবে, ওটাকে আপনাকে As per Planning invest করতে হবে, একটাই বিষয় লক্ষ্য রাখতে হবে যেন ঐ Investment থেকে যে Return আপনি পাবেন তা যেন Loan এর interest এর থেকে বেশি হয়।

ধরুন আপনি Loan 50 লাখ টাকার 30 বছর Tenure এ। Interest rate ধরুন 8%, তাহলে আপনার EMI দাঁড়াবে প্রতি মাসে 36,688 টাকা, তো এর 10% মোটামুটি ভাবে 3,700 টাকা। এবার আপনাকে এই Strategy কে Impliment করার জন্য ধরে নিতে হবে যে আপনার EMI Interest rate বারার করনে ঐ ১০% বেড়ে গেছে। এবার আগেই বলেছি ঐ বারতি 3,700 টাকা আপনাকে Bank কে দিতে হবে না, Invest করতে হবে SIP System এ।

ধরে নিলাম ঐ SIP তে যেখানে Invest করা হয়েছে Long Time এ মানে 30 বছর Tnure এ বেশি নয় কম করে 12% Return আপনি পাচ্ছেন। Actual Return vary করতে পারে, আমি এখানে Just Illustration Purpose এ 12% ধরলাম।

তাহলে End Of the Period কি দাঁড়াল, Total EMI Bank কে Pay করা হয়েছে 1,32,07,762 টাকা , এবার SIP র জন্য Invest করা হয়েছে 13,32,000 টাকা, Total 1,45,39,762 টাকা। তাহলে মোটামুটি ভাবে বলা যায় Loan ছিল 50 Laks, Total Payment 1.45 কোটি টাকা। তার মানে বলা যায় 95 লাখ টাকা গেছে Interest দিতে। এর মধ্যে আমি SIP Investment টাকাটাও কিন্তু ধরেছি।

এবার আনুমানিক 12% rate এ প্রতি মাসে 3,700 টাকা করে Invest যেটা আপনি করে ছিলেন ওটার Value কত হয়েছে সেটা দেখি। দেখা যাচ্ছে SIPর মাধ্যমে seperate একটা Wealth Create হয়েছে 1.14 লাখ টাকার মত।

তাহলে দেখুন আপনি Total Pay করেছিলেন Approx 1.45 Crore আর SIP র মাধ্যমে ফেরত পেলেন 1.14 Crore, বেশি পেলেন কত ? 1.45 Crore -1.14 Crore = 31 lakh। তার মানে আপনি 50 লাখ Loan নিয়েছিলেন আর Actually ফেরত দিলেন Bank কে আনুমানিক 31-32 লাখ মত। Interest তো পুরোটাই ফেরত হয়ে গেল আপনার Principal money ও অনেকটা আপনি বাঁচিয়ে নিলেন।

কি করে এই Magic ঘঠছে?

শুধুমাত্র ছোট্ট একটা SIP EMI এর সাথে সাথে add করে নেওয়াতে। দেখুন ঐ SIP amount সত্যিই খুব ছোটো, যেদিন শুরু করেছিলেন সেইদিন হয়ত আপনার কষ্ট হয়েছিল, But পরে আপনার Income বেড়ে যাওয়ায় হয়ত আর খেয়ালই থাকত না, সেই ছোট্ট SIP ঐ 30 বছরে Compound effect এর ফলে Interest কে তো free করে দিলই, Principal money র কিছুটাও Pay করতে Help করে দিল।

আমি জানি অনেকে ভাবছেন আমি চাই না 30 বছর ধরে Loan চালাতে, 20 বছরের মধ্যে আমি loan শোধ করতে চাই। তাহলে কি করতে হবে? চলুন সেটাও দেখিয়ে দিচ্ছি।

Loan Amount আগের মতোই 50 লাখ, Interest rate 8%, শুধু Tenure কমে হল 20 বছর, তাহলে EMI হবে 41,822 টাকা। আপনি Just একটা কাজ করুন, Home loan Form এ 20 বছরের যায়গায় 30 বছর লিখে দিন, আপনি বলবেন যে আপনি তো 30 বছরের Loan নেবেন না, তাহলে কেন 30 বছর লিখবেন। আপনাকে ৩০ বছর Loan চালাতে হবে না। আপনি Just 20 years এর যায়গায় 30 years লিখুন।

তাহলে EMI আগের 41,822 টাকা থেকে কমে 36,688 টাকা হবে। EMI কমার জন্য Save হল কত?

যে 5,134 টাকা বাঁচছে ঐ টাকা টাকেই যদি 30 বছরের জন্য SIP করে দেওয়া হয়। আপনি Loan এর Tenure লিখেছেন আমার কথা মত 30 বছর, SIP Tenure লিখেছেন 30 বছর, কিন্তু কোনটাই আপনাকে 30 বছর পরজ্যন্ত চালাতে হবে না।

এবার একটা Comparison summary র মাধ্যমে বোঝা যাক.

20 বছরের জন্য loan নিলে আপনাকে প্রতি মাসে EMI দিতে হত 41,822 টাকা।আর দ্বিতীয় Case এ আমি আপনাকে Suggest করেছিলাম Loan এর Tenure বাড়িয়ে 30 বছর করে যে EMI কমছে মানে 5,134 টাকা করে একটা SIP Invest করতে। দেখুন আপনার দুটো ঘটনাতেই Monthly Outflow একই 41,822। কারণ 36,688 + 5134 = 41,822 টাকা।

আপনার পকেট থেকে দুটো ঘটনাতেই একই Amount বেরনো স্বত্বেও Result কি হচ্ছে দেখা যাক।

আপনি চেয়েছিলেন 20 Years loan, আমি আপনাকে 30 years করিয়েছিলাম। তো 20 বছর পর কি হচ্ছে?

এবার 20 বছর পর আপনি দেখলেন আপনার Loan বাকি আছে 30,23,898 টাকা, SIP থেকে Wealth Create হচ্ছে 47,22,340, মানে 30 বছরের জন্য loan নিয়ে 20 বছরের মাথায় আপনি Loan শোধ করে দিয়ে আপনার হাতে থাকছে প্রায় 17 lakh টাকার মত। আপনি 20 বছরের আগেই মানে 17 বছর 7 মাসের মাথাতেই Loan শোধ করে দিতে পারবেন।

Practically, এত বছরও লাগবে না, কারণ Loan এর Interest Rate আজ থেকে 10 বছর আগে যা ছিল আজ কি তাই আছে না কম আছে? সকলেই জানি কম আছে। আজ থেকে 5 বছর পর Loan এর Interest rate বাড়ার chance বেশি না কমার Chance বেশি? অবশ্যই কমার। আমি তো Interest rate একই রেখে দেখালাম যে 17 বছর 7 মাসের মাথাতেই Loan শোধ করে দিতে পারবেন। বাস্তবে Interest কমবে এবং আপনি 30 বছর Loan লিখেও 17 বছরেরে ও কম সময়েই Loan মিটিয়ে ফেলতে পারবেন।

Frequently Asked Questions

আপনাদের কাছথেকে বিভিন্ন সময়ে পাওয়া কিছু প্রশ্ন এবং তার উত্তর এখানে দিলাম, হয়ত আপনাদের কাজে লাগতে পারে।

Q. Can I get a 0 interest home loan? Can you buy a house with no interest? How can I get interest on a home loan for free? Can you get interest-free loans?

A. না এখন পর্যন্ত Without Interest এ কোন Home Loan পাওয়া যায় না। আপনি যদি চান আপনার Home Loan কে Interest Free Home Loan করতে তাহলে আপনাকে কিছু Strategy Follow করতে হবে। এই Blog তা ভাল করে পুরোটা পরলে আপনি খুব সহজেই এই Strategy জেনে যাবেন।

Q. How do I buy a house interest-free?

A. এই Blog টাকে খুব ভাল করে পরলে আপনি বুঝতে পারবেন যে কিভাবে আপনি Interest Free তে একটা House কিনতে পারবেন।

Q.How can I pay off my 30-year mortgage in 10 years? বা How can I pay off my 30-year mortgage in 15 years? How can I reduce my home loan quickly? Is it better to pay more on a 30-year mortgage or take out a 15-year?

A.এই Blog টাতে আমি তো সেই Strategy ই আপনাদের Share করেছি। একবার পড়ে নিন, সমস্তটা বুঝে যাবেন। যদি তার পড়েও কোন প্রশ্ন থাকে আমাদের সাথে যোগাযোগ করতে পারেন আমরা Free of Cost Help করব।

Q. Why shouldn’t you pay off your mortgage early? Is it better to refinance or pay extra principal?

A. এই প্রশ্ন টা নিয়ে এই Blog এ Detail এ আলোচনা করা হয়েছে। পড়ে নিন, যদি তার পড়েও কোন প্রশ্ন থাকে আমাদের সাথে যোগাযোগ করতে পারেন, Free তে আমাদের Assistance পাবেন।

আপনার মতামত নিচের এই Comment Section এ পেলে ভালো লাগবে। (এই Article এর মধ্যে যে সমস্ত Example বা Return % ব্যবহার করা হয়েছে সেগুলো Just Concept টাকে বোঝানর জন্য দেওয়া হয়েছে, Mutual Funds are subject to market risk, read offer document carefully. আমি একজন AMFI Certified Mutual Fund Distributor। এই Article টি কোনও Planning বা Advice দেওয়ার জন্য লেখা হয় নি শুধু মাত্র Concept টা clear করার জন্য বা Awareness তৈরি করার জন্য এই Article লেখা হয়েছে।)

13 thoughts on “How Do You Convert Your Home Loan Into An Interest-Free Home Loan? (Bengali)”

Excellent article Mr Roy. Friends, I am already benefited by taking advice from Mr Roy about my home loan. Yes, I also requested to Mr Roy to write such type of article. I think You are a real mentor.

Friends, আমি ব্যক্তিগত ভাবে Mr Roy এর এই ধরনের অনেক Advice এ ভীষন উপকৃত। 2010 সালে আমি ওনার সাথে Consult করে এবং ওনার Advice মতো Loan এর Strategy সাজাই। আজ আমি পরিস্কার বুঝতে পারছি Loan আমার Liability নয়। Thanks Mr Roy আমাদের কথা রেখে এই বিষয়ে লেখা লেখার জন্য।

আমি একটা বিষয় Share করতে চাই। আমার সঙ্গে রায় বাবুর পরিচয় বহু বছর। অনেক বছর আগে উনি আমার ছেলের Education Expenses Provision একটা Plan করে দিয়েছিলেন। প্রথমে আমার করা Insurance Plan গুলোকে Re arrange করে নতুন করে সব কিছু করে দিয়েছিলেন।

দু বছর পর আমার ভাইও ওনার সঙ্গে কথা বলে ওর মেয়ের Education Plan তৈরী করে নেয়। কিন্তু উনি দুজনের জন্য Same Product, Same Strategy apply করেন নি। এই নিয়ে আমাদের অনেক খুঁত খুঁতুনি ছিলো কিন্তু পরে বুঝে ছিলাম উনি যে কথাগুলো বলেন “Product নয় Planning”, “Strategy Individual to Individual Vary করে” এগুলোর যথার্থ মানে। কারন শুরু করেছিলাম একরকম আজ 10 বছর পর দেখি উনি Time to Time Review করে করে কোন যায়গায় এনেছেন। Really Superb। আজ আমরা নিশ্চিন্ত।

আমার দেখা উনি Real একজন ভরসা যোগ্য Advisor।

প্রথমেই যারা Asoke Babu কে এই লেখাটা লেখার জন্য অনুরোধ করেছিলেন তাদের ধন্যবাদ। Asoke Babu কে তো অসংখ্য ধন্যবাদ। অনেক অনেক কিছু জানলাম, বুঝলাম এবং শিখলাম। উনি ঠিকই বলেছেন এত Long Term এর কোনো Strategy কোনো ভালো Advisor এর Close Monitor ছাড়া এগোনো ঠিক হবে না। Investment কেনো Asoke Babu আপনার লেখাগুলো থেকে এখন মনে হচ্ছে গোটা Finance Subject টাই Mindset এর ওপোর নির্ভর করে।

আপনার লেখাতে প্রায়ই পাই যে একজন Awared Investor ই হতে পারে একজন সুরক্ষ্যিত Investor। আপনার এই ক্রমাগত প্রচেষ্টার ফলে আমরা আমাদের Awareness Level অনেকটাই বাড়াতে পেরেছি। বহু মানুষের কল্যানের জন্য আপনার মতো মানুষের সুস্হ শরীর আর দীর্ঘ জীবন একান্ত আবশ্যক।

Excellent article. Thanks Mr Roy.

Thanks dada. I m very poor in math and was surprised when you shared this idea during our meeting.

I m also in process of it and checking with Bank to extend the tenure.

ধন্যবাদ রায়বাবু , অসাধারণ ফরমুলা দিয়েছেন ।

Power of compound interest er idea ke apply kore I.e. tenure of loan ke expand kore ebong ek I songe SIP start korar idea tai unique. Darun presentation Dada. Tobe flat ba bari kena o setar resale value r kotha na bhebe onekei lifetime comfort er kotha bhabte chan ebong tai life er prothomei flat er jonno big investment Kore felen. Ei idea ta ki ekebarei bhul? Pl. comment.

Ebapare ageo advice diyechen, ekhon aro kichu jana gelo, dhanyobad dada.

Thanku Mr Roy for sharing d excellent Idea.

Thanks Dada for sharing this great concept. Its really amazing and help people.

Just awesome. I have already follwed this strategy.Thank Mr Roy.