From the current assessment year, the Gov. of India has increased the 80C benefit from Rs 1 lakh to Rs 1.5 lakh. If you want to know about Tax Savings Planning u/s 80 C then most of the people prefer PPF, NSC, GPF or PF, Life Insurance and a very handful of people think about ELSS Mutual fund. (ELSS- Equity Linked Saving Scheme).

One cause may be ignorance and the other is the name “Equity”. But if you plan to do mere tax savings and not create wealth or not fulfill any goal then you may choose any avenue you like. But keep in mind that only ELSS mutual fund have got a 3 years lock-in period while there are others with more or less 5 years lock-in period.

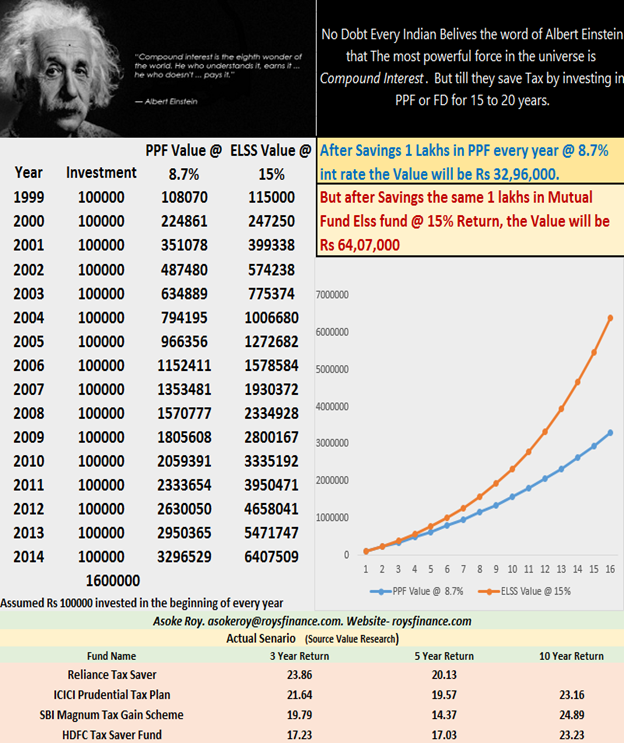

But if you consider to do tax savings with long-term goal fulfillment then you may choose avenues like PPF, PF or GPF. But if the power of compounding is taken as an important parameter then these avenues will not give high returns. In the long term PPF can differentiate your fund value drastically. From below picture you may see the power of compounding effect.

Here I assume if a person invest Rs 100000 in PPF as well as in ELSS mutual fund in same way, then after 16 years of investing, one is actually investing Rs 1600000 in both PPF & ELSS fund but the fund value will be Rs 32,96,529 in PPF but in same period in ELSS fund it will be Rs 64,07,509, almost double compared to PPF.

Obviously you may put a question that in Equity there is uncertainty and I agree with you, for this reason I have given the past 5 and 10 years return of some ELSS Mutual fund in the above image. As per expert opinions, in the long run only Equity can give you the return which can beat inflation.

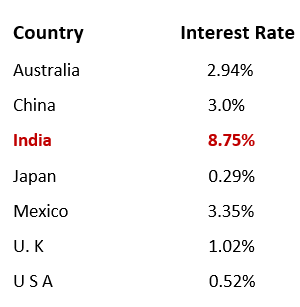

In long term there is also interest risk in PPF. In the year 1986 the interest rate in PPF was 12% but today it is only 8.7%. Who knows what will be the interest rate in future? I have put forward the interest rates of some developed countries –

In spite of this, I think that PPF is a good asset class. But if we select PPF in lieu of Equity just because of ignorance and fear of equity, then it can be a big disaster.

9 thoughts on “For Tax savings U/S 80C ELSS and PPF”

Thanks, very important information. I have a question that every fund house gives near about same return ?

Thanks for your quarry. Generally, all good fund can generate more or less same return in the long run. But which fund is good fund, it is an important question. The return at present which you see it is the result of their past activity. So past good return is not the only indicator of a good fund.

Good information, please continue

Thanks Dr. Samanta

Your untiring efforts to inform the Investors is truly praiseworthy and now it is the call of Informed Investors what pathway they would opt for.

Thanks Mr. Das.

Thank you for your most valuable information. Within your example 4 Funds are there, we can still depend on these funds? Please continue your evaluation.

Regards

Debjani

Should I stop PPF investment….. or continue it with small amount as emergency fund….

Pathway of investment is clear, thanks for the information to us.I want your continuous support.