Any important work, if not done at the proper and correct time in life, one may regret it at a later point in his life. Similarly, in personal finance, if the work is not carried out at the correct time, he may have to suffer very badly. Here are the few mistakes that I am pointing out.

1. Not Buying Health Insurance At The Right Time

Almost every day I find many people of 40-45 years are regretful and want to buy a Health Insurance policy now but due to various diseases their proposal is either rejected or they have to pay an extra premium to get a policy.

The future impact of this on finance is deadly. Suppose, a person has accumulated 50 lacs rupees in 10 years for his retired life. Imagine at the age of 55 years, something unexpected happens and an amount of 10 lacs rupees is spent. This sum of 10 lac rupees is a result of the compounding effect of many days, isn’t it? To withdraw this amount means to start again from the beginning. Only 5 years are left for him to retire. Something may happen to him or his family in his lifetime and the only saviour is this unplanned Retirement fund so what would happen if this is broken? I am feeling sad thinking about this, you all think it out according to your mindset.

If you need to know why someone needs to have a Health Insurance policy in detail, click on the video link below.

2. Not Protecting Your Own Life

When we return from a crematorium, we often get philosophical but it soon disappears from our minds due to the day-to-day activities. Once we leave the temple, we lack devotion. For any reason, if there is no picture of me smiling in the family picture hanging in our house, will the other members of the family have a smile on their faces? Sorry for being so straightforward and not using any sugar-coated words. Every day, I see people procrastinating on this matter. I wonder how my family will survive in my absence. Who will pay for my children’s education and marriage?

3. The Habit Of Spending Uncontrollably

This is a serious problem. In today’s economy, people are spending extra for their needs due to various reasons like media, advertisement, and society. They even convince themselves that those expenses were needed. Judicious is what you need to be instead of being a miser. Today everyone has one or two children but most people have three or four children to take care of. The rest are adopted. Who are they? They are EMI for house building, car loans, credit cards, etc.

The following are some signal points that will help you to determine your position and may be helpful

- If more than 40% of your income per month goes into EMI

- If your loan outstanding is more than 4 times your yearly income

- If you have more than 2 credit cards

- If you have had a revolving credit card from last many years

- If you have too small savings even though you have worked for many years

4. Too Much Investment On Fixed Return Products

I have written a lot about this. I have not written anything new anymore. You may click on the link below to give a reading.

5. Not Creating An Emergency Fund

An emergency situation may come again and again in someone’s life at any time. In most cases, the emergency situation can be managed by money. If you do not have enough savings, you may have to either borrow or break your investments. Both are dangerous.

If you want to know in detail, watch this video by clicking on the link below.

6. Not Utilizing Your Cash Flow Properly

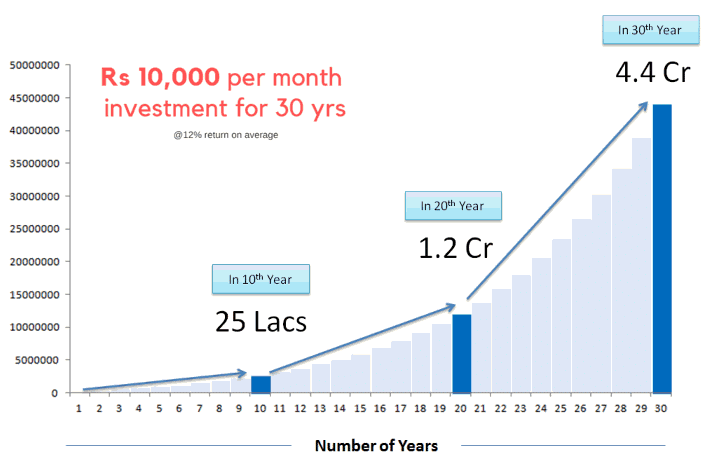

Most parents do not have proper financial knowledge so, at the beginning of their son’s/daughter’s income, they ask them to start an Endowment or invest in Money Back plans or in PPF, FD and divert their growth mindset. Later on, when these people realize these products will not be able to fulfill their financial requirements, it becomes too late. The courage to rectify a mindset is wasted by many. Simple things can become so complicated. How? If someone continues investing Rs.10,000 per month for 30 years then its value stands at 4.4 crores.

Hopefully, you will understand by looking at the chart why I am putting so much emphasis on time and time again. Rs.10,000 for the first 10 years means 25 lacs by investing 25 lacs, 1.2 crores by investing 24 lacs in 20 years, and 4.4 crores by investing 30 lacs in 30 years. I don’t know how many of you will be able to digest this. But it is real. Planning is the solution to all the aforementioned mistakes. If you know how to plan your finances it’s good but if you do not know, you should take the help of a professional financial advisor.

“For those who believe, no explanation is necessary. For those who do not believe, no explanation is possible.

Everything that I have mentioned above is based on my experience over the years. You may have a different opinion or judgment and I respect that. If you have liked the article or it has helped you in any way, I look forward to your feedback.