The fundamental concepts of investment are very simple and common to every investor.

However, what I have observed is that, while one works hard for his academic and professional success, the lack of basic financial literacy undermines the individual’s entire financial well-being. I propose to highlight some of the basic investing thoughts, which I hope would be of use to everyone, since there is no one size fit approach to investing.

Wealth creation happens over the long-term and should not be at the cost of giving up the current lifestyle. One needs to invest in such a manner that the overall return on investment is higher than the inflation. Only then we can observe some real wealth creation. Otherwise, the inflation would erode away the wealth.

A basic rule of wealth creation is investing across different asset classes, or what is called Asset Allocation. However different assets have different levels of risks, and one can address these risks by investing over different investment horizons. Higher the risk associated with an asset class, higher is the return potential. Just because one is young doesn’t mean that one can alone take a higher allocation in risky assets like equities. What if the young person had to buy a house, in say the next 2-3 years? A large portion of investment into equities at that time may put him at risk. Therefore the investment horizon is a key while deciding the asset allocation.

The different assets that one considers while creating wealth could mainly be divided into equities, debt, real estate and gold. The least amongst these in terms of risk is debt, followed by gold, real estate and then equities. In that sense, the longest investment horizon that one must have is ideally for equities.

Equities

Look at it this way, when one is buying equities, one is actually buying a part ownership of the business, and that is the reason why one should look at equities as a long-term investment. However Indians investors tend to look at equities as a short term investment. This is indicated by the fact that almost 90% of total trades in the secondary equity market segment are in derivatives, and out of the 10% trades in the cash segment, less than 5% are delivery trades.

I don’t think trading ever creates wealth, holding assets over the long term does. The equity markets have become wholesale in nature. A retail investor would find it difficult to undertake research on a company. A typical research of a company involves creating future assessment of the company’s prospects through earnings models based on various assumptions, viz the growth prospects of the economy, of the sector that the company belongs to and that of the company, growth in expenses and consequent growth in profitability.

That’s where mutual funds come to the rescue. The retail investor can get an exposure to a portfolio with even small sums of money, instead of investing directly. One also needs to remember that Mutual Funds are really collective pass through investment vehicles and hence they would do as well as the market. All that the Mutual Funds can produce is an alpha on the underlying market. So if the underlying market is negative (i.e. say the NIFTY or the SENSEX is negative) then the mutual funds would also be negative.

Typically Indian mutual funds have been seen to deliver 2-5% more than the broad market index, which we call as alpha. This is critical concept for the investors to understand. There is a general tendency to believe that even if the underlying equities market is negative, the mutual funds should still be positive. We must appreciate here that equities market are very volatile. Almost one third of floating stock in the secondary market (after excluding the promoter holdings) is held by the FIIs, and hence anything happening in say Greece, impacts us.

We have a total of about 2 Crore demat accounts, leaving the duplicate accounts that one has (i.e. one for the self and say one jointly with the spouse), we may not have more than 1 Cr genuine investors in a country of over 120 Cr of population. This is a sad state of affairs, perhaps we have more foreign investors who have invested in the Indian equity markets through their pension funds than our own domestic investors.

This has happened mainly on account of two counts – lack of financial literacy and the general investing comfort of the Indian investor with the low risk deposit market ( even though it barely beats the inflation after tax). But we must understand that the volatility of equity markets can also be partially overcome. This can be done by investing regularly in the equities mutual funds through the Systematic Investment Plan (SIP) route.

Essentially when one is buying into a portfolio through say a mutual fund, it’s better that one considers investing at various price points in the market and the SIPs does achieve that objective. The ideal asset allocation to this asset class, after considering the investment horizon, would be about 30 to 50% of financial savings.

Gold

The other asset class which has always fancied Indian investors is Gold. Now, gold is an asset that is very different from the other three asset classes. Gold is the only asset that does not have any cash flow attached to it, till the time it is sold-off. For equities there is dividend, for debt there are interest coupons, and for real estate there is a rental income. However traditionally, Gold has been bought by the investors as a relative protection against inflation or against the financial markets. The current state of global financial markets, especially the Eurozone, is weak and the global investors have been uncertain about the future of the Euro. Hence the demand for Gold continues to be on an upswing.

The Indian investors have always been fascinated with Gold. In fact the estimated Gold holding in India is about 18000 tonnes and India consumes about 800-900MT every year, about 25% of the world consumption. A significant portion of India has always been left out of in mainstream financial inclusion and Gold in that sense has been used by Indians as a tool for saving.

A rural investor, not having sufficient access to Banking has been known to invest in Gold and use that investment for pledging to take care of his needs, be it for buying seeds for his farm or children’s marriage or any medical urgency.

The price of Gold is also a function of the international price of Gold and the price of rupee in the currency market. For instance, while the last one year Gold price movement gave a -7.81% return to the international investor in dollar terms while a local Indian investor got around 10.84% return due to a large depreciation of the Indian rupee. Again like any asset class, Gold too has had an extended period of low returns. As there is no significant commercial use of Gold, its price is driven largely by investor and jeweller demand for gold and relatively scarce supply.

While there is no investing formula, as to how much one should allocate to Gold, we believe that an ideal approach could be anywhere between 5 to 15% of the total financial savings.

Fixed Income/Debt

The one asset class that investors in India are absolutely comfortable with is fixed income or debt. I think that the only asset class where the investor himself goes and invests is the bank deposits or the Postal deposits while for every other asset class there tends to be an intermediary who would persuade and push the investor into investing. Bank deposits are the safest investment avenue available to the investor and hence offer lower return than the other asset classes. However, within fixed income there are other investments like debentures.

There are different types of debt mutual funds depending on the investment horizon and risk level. There are those where one can invest for a short duration of say one day. Then there are those where one can invest upto1 year. Typically, for investors with the investment horizons of more than one year, long dated debt schemes are recommended. The ideal asset allocation to this asset class would be about 30 to 50% of financial savings.

Real Estate

The last asset that I would deliver upon is the Real Estate.

Whenever there is a large rally in the stock market, the same tends to be followed up by a rise in the real estate prices. My belief is that in the long-term, both the real estate and the stock market returns may be largely similar. Typically, a 14.5% compounded per annum return doubles your initial investment in 5 years. So, if a property value moves up by about 4 times in 10 years, the per annum return from the property investment is actually 14.5-15%. This is the effect of compounding.

As I always say, one can forget all the maths one has learnt at school, except for this basic concept of compounding. An investor can invest in this asset class either directly, or through Real Estate funds. An ideal asset allocation to this asset class would be about 10 to 30% of financial savings excluding the house that one is staying.

Wrapping Up

These different asset classes behave differently in different business cycles. In the recessionary or moderating environment, as what we are current going through, the debt asset class or gold as an asset class outperforms the other asset classes. In case of growth or high exuberance environment, as what we saw in the years between 2004 to 2008, the equity and the real estate asset classes outperforms the other asset classes. It is therefore important to diversify across all asset classes.

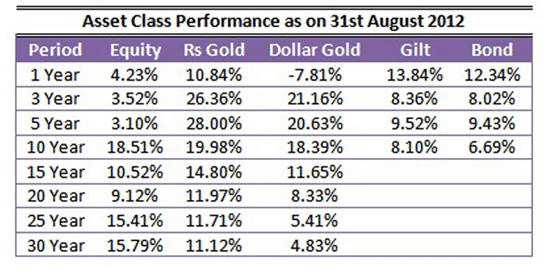

The approx. return of all asset classes over long periods of time are as under. There is no reliable data on real estate hence have given data for only the other three asset classes. I have also given returns for the past periods as of 31st Aug 2012 and as of 31st Aug 2007.

In closing, successful investing requires will to save a substantial sum a long term investment plan, the diligence to stick to it, and modulate the plan according to times, to invest across the asset classes, and to utilize the help of professional and competent financial advisors. Therefore, it helps to reassert that a disciplined and systematic approach to investment will go a long way in fulfilling the aspirations of life.