In today’s concept of Nuclear Family where one is working and has children studying, he/she wants to buy a flat or house on his own. This want has been made possible due to the benefits of a Home Loan. Nowadays, if a person has an average income, banks are ready to provide home loans. The interest rate is also cheap enough, near about 6 to 6.5%. Additionally, there are many ways of availing exemptions on Income Tax.

For all these benefits, it is not hard to find people below the age of 30 years who have purchased flats on their own.

Now, due to having insufficient knowledge of financial education about home loans, people often fall into traps and lose their money. When this happens, it’s already too late. Some myths or misconceptions due to a lack of proper understanding of financial matters force many people to make wrong decisions and put their financial future at stake.

First of all, you have to understand that a home is a basic need and not any form of asset. Food, clothing, and shelter are necessities. According to financial terms, anything that cannot generate income cannot be termed as an asset. If you rent out your house and earn a stable income from it, it can be considered an asset.

Some Mistakes and Some Myths

Then there is a myth that leads many people astray. They believe the price will go up later on so it’s better to purchase now at a cheaper price. First of all, cheap and expensive are both relative terms. According to your income or budget, it may sound cheaper but in actuality, it may not be true. Suppose the price of any property is Rs. 10 lacs. After 10 years, suppose it would cost 15 lacs, then 10 lacs is cheaper, isn’t it?

No, it’s not cheaper. If you calculate it in an Excel sheet, you will find it has increased at a rate of 4%. Other items in the market may have increased at a rate of 8-9% during inflation. Even if it was kept in the Savings account of any bank, it would have increased at the same rate without any tax problem or deductions.

There are many young people today, who live on rent in other cities. They often feel that the money spent on rent could have been used as EMI for a home loan. In this case, their parents support this notion. I am sharing a practical incident that happened a few years ago.

The Real Picture

The boy’s name is Souvik, working in an IT company in Bangalore and paying a monthly rent of Rs. 18,000. After searching for a long time, he finally purchased a flat for 42 lacs, not far from his office, and for this, he had to take a home loan for 20 years. Souvik pays a monthly EMI of Rs. 32,563. In this context, I am going to say a few things for you to consider. I had told Souvik, too. When they decided to buy a house, I made certain arguments which they did not accept. They counter replied with emotional arguments like ‘having a home in one’s name’ and ‘roof over one’s head’ were important.

Today’s boys and girls have no stability in their jobs. Their lives are extremely dynamic. If they make a mistake and settle down somewhere, then their career and opportunities might be at stake. I have heard them even say, they may sell off the flat when there is an opportunity. But a flat is not a mobile phone that can be sold anytime. I have seen very very few people who had sold their flat hassle-free and at the right price. It is because most of us have no idea or ample experience about selling fixed assets.

In such situations, many people think of letting out their flat on lease. Yet their calculation doesn’t match. I will tell you why.

- Is Souvik going to work at the same company and for his whole life? If the answer is no, what would happen to his flat and the loan he has taken? The rent is Rs. 18,000 and the flat has cost him 42 lacs. So how much is the rent percentage of 42 lacs? 5%, then you have Home tax, Depreciation, Maintenance, etc. So what is the right thing to do? This calculation shows you that you should refrain from buying a flat immediately, instead of living on rent for the time being and saving for the future.

- Souvik’s parents thought that they would sell the flat if they got a better opportunity elsewhere. But very few people have been able to sell their flat or house at the desired price. At least, that has been my experience.

- Flat, house, land, and jewelry, all these things can be sold and earned money. But it is wrong to decide everything is fine without calculating a percentage return. Giving an example to explain the theory better.

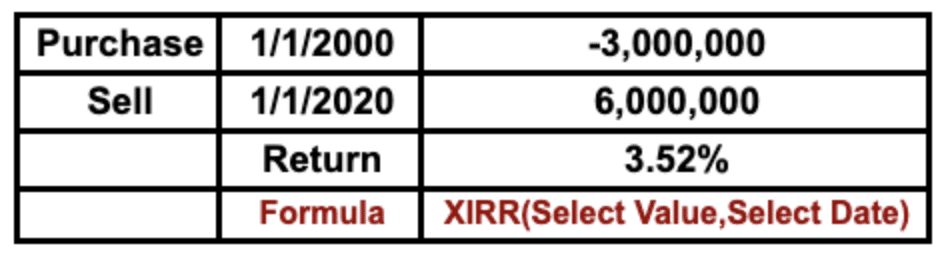

Suppose a house was bought in 2000 for 30 lacs rupees and sold for 60 lacs rupees. Because the money has doubled which means there has been profit. Let’s not talk about profit or loss, but tell me, what is the return percentage? Why am I talking about percentage? Because you have been calculating the percentage return on your investments in banks, post offices, mutual funds, etc, isn’t it? So why not calculate the percentage return in case of selling a property for 60 lacs?

Calculation of percentage shows annualized percentage is only 3.52%, similar to the way your other investments are calculated. The rate of bank savings, registration cost, tax maintenance, and depreciation is not considered here.

In this context, I’d like to say that you have to compare the wholesale return with the percentage if you want to compare the return. It will not be wise to compare mango with apple. For this reason, I have shown how to manually calculate the return percentage from a lump sum with the help of an Excel sheet. Very simple. Put this symbol = before writing XIRR. You can manually convert all the money you get from land, house, jewelry, insurance and calculate the percentage return on your own.

Please do not misunderstand me, assuming that I am against buying a flat. Not at all, I live in an apartment. I just wanted to spread awareness so that one may discuss and not face troubles after buying a flat. Emotion is one thing and completely different from reality. Emotions may go away someday and then one has to face the stark reality, isn’t it?

Important Points To Keep In Mind Before Buying A Flat/House

Now suppose, you are planning to buy a flat. Let’s take a look at what all are important before making the purchase

- Before signing the contract with the promoter/ developer, kindly go through all the terms and conditions. If you don’t trust the promoter’s lawyer, you can verify on your own.

- Search and see if the land deed is correct. One must have a taken-for-granted attitude just because he is providing a bank loan.

- Check whether the building you are going to buy is plan sanctioned or not. Find out whether the construction work has started within 2 years of plan sanction. If not, then the plan has to be renewed. In that case, the date of renewal has to be verified.

- Before you apply for registration, ask for a completion certificate from the promoter.

- Know everything about carpet area and super-built area.

- Check internal specifications related to construction, flooring, whether marble or tiles are used, kitchen, toilet, the material used in windows and doors.

- Check the electric meter for adequate electric efficiency.

- Check if the electric wiring is appropriate. Check if there is a separate line for high consumption of electricity due to the Air conditioner and microwave oven.

- Check if there is a positive, negative and neutral line drawn from the main switch next to your meter box to your unit.

- Check whether the safety tank and drainage system are in order.

- Find out the consumption of water tanks and underground reservoirs.

- Find out if NOC has been obtained from the Fire brigade.

How Insurance Can Protect Your Home Loan?

Home Loans must be insurance protected. Try to get your home loan insured from some outside source. You will have many benefits. Those who do not work in the government sector or have a business, should not plan to buy a huge flat for their good. I believe that the more you become dynamic and upgrade your qualifications and experience or increase your income, the less you like your surroundings, and then you won’t like your current residence or lifestyle. I know many such people who have upgraded themselves to such an extent that they are getting offers from abroad to settle. However, one should keep in mind the bigger a house is, the less easy it is to sell. Very few people can predict the future in this era of technology. I prefer not to delve further into this.

Should Home Loans Be Taken Only Because of Tax Exemption?

I would also request those who are planning to purchase because they would be getting tax exemption to think twice before taking a final decision. Most people do not see anything except present benefits when it comes to financing. In finance, all decisions have either a good or bad impact in the future. Look at your needs, check if your cash flow is permitting you to take EMI right now. It is better not to rely on any thumb rule. Every person’s income is different, skill, ambition, purpose, expenditure, dependent liabilities, all are different. The EMI of a loan depends on a person’s income.

How to Make Your Home Loan Interest-Free?

Now I am going to show you how to convert your home loan into an interest-free home loan and live tension-free. Sounds silly? Not at all. Bear with me, and you shall have your answers and worries dwindled.

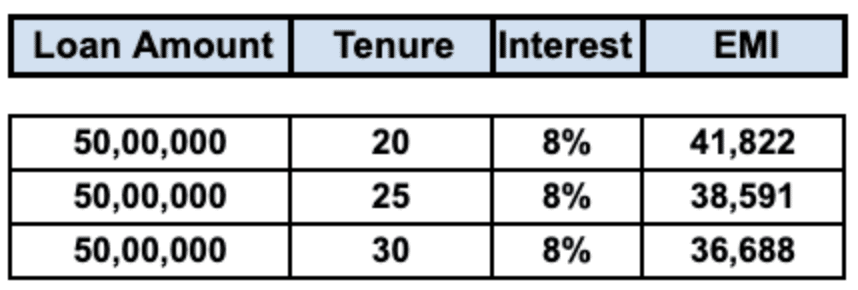

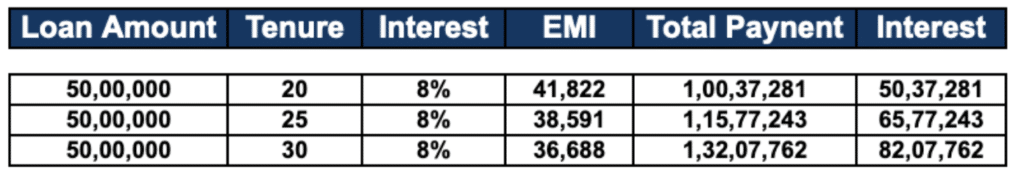

I am going to explain with the help of an example. Suppose you are planning to take a home loan of 50 lacs. If you take this loan for 20 years and the interest rate is 8%, then you have to pay an EMI of 41,822 rupees every month. If someone wants to increase the tenure to 30 years, then the EMI would be reduced to 36,688 rupees a month. Don’t worry, I am not telling you to increase your tenure but you will soon understand where the benefits of increasing tenure lie.

I know where the difficulty lies in increasing the tenure. A certain dilemma arises thinking about what would happen to the loan if something happens to you in the long run. Always keep in mind that taking 5 loans and 1 home loan is not similar.

- The home loan that you are taking is to fulfill your basic needs. And all the other loans like car loans, personal loans, or credit loans are created to maintain a lifestyle.

- Home loan’s interest is much lower than other loans.

- Home loan is insurance protected, therefore, the nominee doesn’t have to bear the debt in your absence.

- Tax exemption is available both on repayment of a home loan as well as interest on home loans.

Why Not Repay Your Home Loan With A Top-Up Amount?

Suppose a person belongs to the 30% Income slab and the interest rate for his home loan is at 8%. So is he going to get a 30% tax exemption on 8%? 30% of 8% means Rs 2.40 whereas effective interest is (8-2.40=5.66). Now think about it, is it possible to get a loan with an interest rate of 5.66% in our country? The benefit is based on a person’s income slab. So each person is entitled to a benefit according to their tax slab.

Some people keep the tenure of their home loan for a shorter period. Again, if they get to earn a little extra money from somewhere, they immediately try to repay the home loan. Someone whose effective interest is so low that they run to repay the loan.

Many people will ask what would happen to the interest that has to be paid. They will further say I was supposed to tell them about converting their home loan into an interest-free home loan, what happened to that? Read the following article very carefully. I am going to show you how you can turn your loan interest-free, or how the bank can return you the interest that you are paying against the loan. So let’s start the discussion with the help of an example already shared earlier.

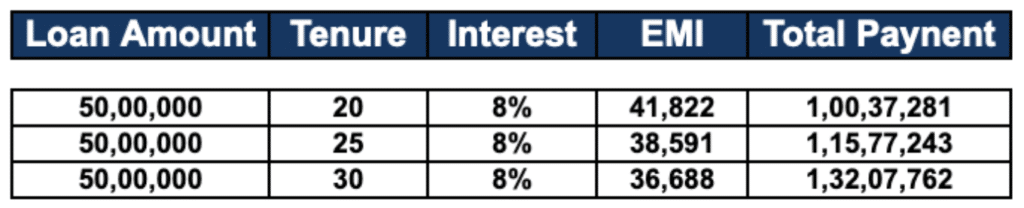

If you have tenure for 20 years, then the EMI you are paying will be Rs. 41,822. Similarly, if it’s for 30 years, you are supposed to pay Rs. 36,688 a month. So, we see that an increasing tenure reduces the EMI. But few may argue that with the increasing tenure, one has to pay more interest over a longer period. Now let’s how much interest are we paying.

In the above-mentioned box, we see that for a tenure of 20 years, we are paying Rs.1,00,37,281 whereas, for 30 years, we are paying Rs. 1,32,07,762. So a sum of approximately 32 lacs is overpaid. That means the extra amount we are paying is the interest whereas the loan amount was only 50 lacs.

So it turns out that you have to pay a whopping amount of 32 lac as interest. Now I will show how you can get back the interest you are paying your bank. I am sharing the strategy with you, carefully go through it.

If you want to repay the interest, then whenever you start the loan, whatever the amount is your EMI, you have to take 10% more EMI, which means if the EMI is 30,000, then you have to take that EMI 33,000. 10% more if EMI If it is 50,000 then 10% more means 55,000 EMI you have to keep in mind.

Now the amount that I have I told you to pay as extra interest, that money you may not have to pay your bank, instead invest in a mutual fund every month. That means if you have an EMI of Rs. 30,000 then you have to invest 3,000 a month and if you have an EMI of Rs 50,000 then you have to invest Rs.5,000 every month.

This money should be invested in such a medium where the interest rate is higher than a bank. It is better to discuss with your MF distributor, they will guide you through this matter. I know because this idea is mine, some of you may worry about investing the extra 10% after paying so much money. So I will say, suppose you came across a flat and quite liked it, and you had already made a down payment. Now the bank states that the interest rate has increased from 8% to 9%, now what would you do? Cancel the down payment and refrain from purchasing the flat or taking a home loan? Maximum people won’t get the answer. The fact is, the interest rate has to be a little higher if you want to turn your loan interest-free.

Some of you may also think that I was talking about converting the home loan into interest-free but now why am I asking you to pay extra interest. Let me tell you, the 10% extra that you are paying is not EMI, it’s no extra amount that you are paying and someone else is earning. You have to invest that extra money through planning keeping in mind that the investment return should be more than the interest rate of the loan.

Suppose you have a loan of Rs 50 lakh for 30 years. The interest rate is 8%, then your EMI will be Rs 36,688 per month, if 10% of it, will be Rs 3,700. Now you have to assume that to implement this strategy, your EMI interest rate has increased by 10%.

I have already said that you do not have to pay 3,700 rupees to the bank, you have to invest in the SIP.

Suppose the investment made in SIP was for the long term and you are entitled to a return of 12% (for illustration purposes) in not more than 30 years of tenure. Actual return may vary.

So at the end of the period, a total EMI of Rs 1,32,07,762 has been paid to the bank and a sum of 13,32,000 has been invested for SIP. Total = Rs 1,45,39,762. So the loan amount was 50 lacs and the amount paid was 1.45 crores. That means 95 lacs were paid off simply as interest. This includes the SIP money too.

Let’s invest 3,700 rupees per month at an estimated 12% rate to see its value. A separate wealth of 1.14 lacs has been created in the SIP.

So see if you paid a total of approximately Rs 1.45 crores and got a return of Rs 1.14 crores through SIP, how much more did you get? Let’s calculate – 1.45 – 1.14 = Rs 31 lacs. That means you took a loan of Rs 50 lacs and returned it to the bank for about Rs 31-32 lacs. So the conclusion is that the interest amount was returned to your principal money and you saved a pretty lot.

How Is This Magic Happening?

Only add a small SIP with EMI. See that the SIP amount is very small, you may have had trouble the day you started, but later your income may have increased and you may not have noticed, that a small SIP of 30 years due to the compound effect has helped you to pay the interest.

I know many people don’t want to run a loan for 30 years, they want to repay it in 20 years. I am going to show you how you can do it.

Let’s keep the loan amount to 50 lacs only with an interest rate of 8% and a tenure of 20 years. So the EMI would be Rs 41,822 a month. So instead of writing 20 years in the home loan form, just write 30 years in the tenure column. The EMI will be reduced to Rs 36,688 from Rs 41,822. So much EMI are you saving? Rs 5,134 which can be invested in SIP for 30 years. Now you have written 30 years tenure as I have suggested, and 30 years for SIP. But the truth is you need not continue any of them for 30 years. How? I will draw a comparison summary and explain.

If you take a loan for 20 years, you would have to pay an EMI of Rs 41,822 per month. See the same, the monthly outflow would be Rs 41,822 in both your cases. It is because 36,688 + 5134 = 41,822 rupees.

Let’s see the results despite the fact that both the amounts are being paid from your pocket. You asked for a loan with a tenure of 20 years and I provided you with one with 30 years. Let’s see what happens after 20 years.

Now after 20 years you see that your loan balance is Rs 30,23,898 and the wealth created from SIP is Rs 47,22,340, which means you have a loan for 30 years and after 20 years you repay the loan and you have about Rs 17 lacs. You can repay the loan in 20 years before 17 years and in 7 months.

Practically, it will not take so many years, because the interest rate of the loan is 10 years ago from what it is today, is it not so low? Everyone knows it is less. After 5 years from today, the chance to increase the interest rate of the loan is more or less the chance to decrease? Of course. I kept the interest rate the same and showed that you can repay the loan in 17 years and 7 months. In fact, interest will decrease and you can write off a loan for 30 years and pay off the loan in 17 years and less.

Frequently Asked Questions

Here are some questions that were posted by many of you. Hope the answers will clear your queries.

Q. Can I get a 0 interest home loan? Can you buy a house with no interest? How can I get interest on a home loan for free? Can you get interest-free loans?

A: No, there is no such loan available without interest. But in order to make your home loan interest-free, you need to follow some strategies. If you read the current blog post carefully, you will get your answer.

Q: How do I buy a house interest-free?

A: Please go through this blog post, you will get to know how you can buy a house interest-free.

Q.How can I pay off my 30-year mortgage in 10 years? বা How can I pay off my 30-year mortgage in 15 years? How can I reduce my home loan quickly? Is it better to pay more on a 30-year mortgage or take out a 15-year?

A. In this blog post, I have shared that strategy with you. Read it once, you will understand everything. If you have any questions after reading this, you can contact us and we will help free of cost.

Q: Why shouldn’t you pay off your mortgage early? Is it better to refinance or pay extra principal?

A: This question has been discussed in detail in this blog. Read on, if you have any questions, you can contact us, you will get our assistance for free.

I would like to get your opinion in this Comment Section below. (All the examples or return percentages used in this article are given to explain just the concept. Mutual Funds are subject to market risk, read the offer documents carefully. I am an AMFI Certified Mutual Fund Distributor. This article is not for any planning or was not written to give advice, just to clear the concept and create awareness.)