Life Insurance is an important part of one’s life. However, due to the lack of proper ideas and insufficient knowledge, many of us fall into trouble. Life Insurance is not any form of investment but a way to protect your family. In simpler words, Life insurance is a contract or agreement through which a person transfers the Financial Risk Premium payment of his life to an insurance company. According to the agreement or contract, if the insured person dies for any reason within the policy period, the insurance company will transfer the risk coverage amount or the sum assured to the nominee.

There are two ways to get a claim from the insurance company. One is the Death Claim and the other is the Maturity Claim.

Death Claim

If the insured person dies for any reason within the policy period, then the amount of risk coverage that was taken in his name can be claimed by the beneficiary specified by him. This is called a Death Claim.

Procedure To Make A Death Claim

- The insurance company has to be informed about the policy holder’s demise. According to the norms of an insurance company, death is seen in two ways. If the insured person dies within 3 years of taking a policy, that claim is called an Early Death claim. If the person dies after 3 years of taking the policy, then the claim is called a Normal Death claim. This categorization is done by the insurance company.

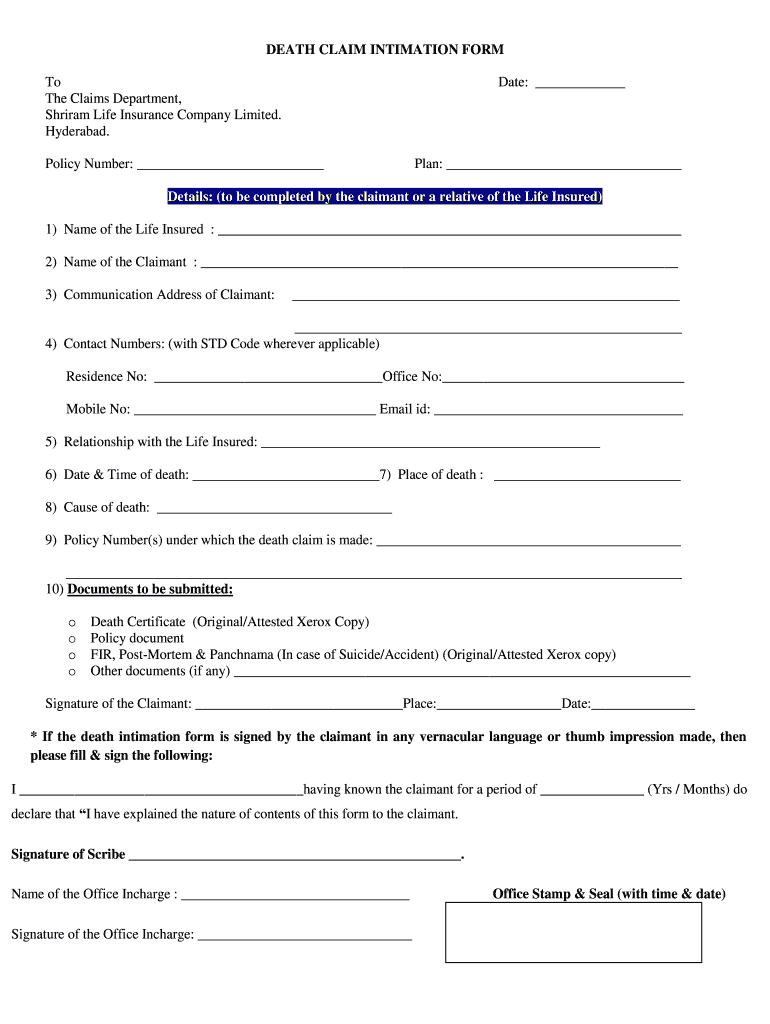

- To inform the insurance company about the death of the insurer, a Claim Intimation form has to be submitted to the insurance company. A picture of such a form has been shared below:

- Next, you need to find out from the insurance company about the documents that will be required to be submitted for the Death claim procedure.

I would like to spread awareness in this context as I have seen many making mistakes and facing trouble.

- Most people are unaware of this policy’s actual benefit, which aids the beneficiary or the nominee in the insurer’s absence.

- For the sake of getting a premium at a lesser price, one must not purchase a Group policy anywhere online.

- Protection and cheap come together, neither in real life nor in a dictionary.

- Does your beneficiary know how much coverage your policy has? Will your family be able to gather the necessary documents in your absence?

- If your beneficiary needs the help of a professional to initiate the claim process, is he/she aware of the contact number or other necessary details of the professional?

Documents Needed For Dealth Claim

I am trying to provide a rough idea of the documents that may be required for a Death Claim because different companies may ask for different documents.

- Death Certificate

- Original Policy Certificate

- KYC documents of the beneficiary

- Age proof of an insured person

- Medical Certificate (as proof of death)

- Police FIR (in case of unnatural death)

- Post Mortem Report i(n case of unnatural death)

- Hospital Record/Certificate (if the patient died in the hospital from an illness)

- Cremation Certificate

- Discharge Form/Certificate

These are the names of the few documents that are normally needed. Now an insurance company may ask for different documents so it is better to ask for a document list from them.

In case of an early death claim, in addition to the above documents, one needs to submit an employment certificate or income proof along with the cremation certificate.

Procedure To Make Maturity Claim

For those who buy insurance considering them as an investment, such policies have a maturity period. To claim the policy upon maturity, one needs to follow the procedure below.

- Generally, the insurance companies will provide you with a maturity claim form before the policy reaches the maturity period. That form has to be filled up to move forward with the claim process.

- Original Policy certificate

- KYC documents

- Bank proof for the maturity amount to be transferred.

Reasons Behind Rejection Of Claims

Below are some reasons why a claim is sometimes rejected which might be useful for you.

1. Non Disclosure or Wrong Disclosure of Facts

Insurance is a legal contract, therefore it is mandatory as well as necessary to declare relevant and true information regarding oneself in the proposal form. An insurance premium is determined by age, profession, annual income, health condition, medical history, hobbies, smoker, or non-smoker. Now, if any of this information is knowingly or unknowingly misrepresented then the claim can be rejected. It is advisable n your part to carefully go through all the information provided in the policy document which you would receive after issuing your policy. If there is any error, you need to rectify it and mail the insurance company immediately. Once you receive the rectified Policy certificate, you may use it.

2. Premium Not Paid In Due Time

Generally, a grace period of 30 days from the due date is allocated to pay the premium. Now if someone fails to submit his premium within the grace period, then his policy will lapse. If someone applies for the claim if there is a lapse, then he will not receive the claim.

3. Not Updating Nominee

Due to a lack of proper awareness, most people make mistakes. Many people nominate their mother and after the demise of the mother, they forget to change it. In that case, it gets difficult to get the claim when the beneficiary name is not updated. Again, many people nominate a minor and then forget to inform the insurance company when the minor turns into an adult. Even if there is a spelling mistake in the name of the nominee then the claim is rejected.

4. Different Exclusions In The Policy Clause

According to insurance norms, there are certain exclusions for which a claim is rejected. For example, if someone commits suicide within a year, if someone dies in an accident and is found intoxicated, or if someone dies of drug overdose then he/she may not receive the insurance claim.

If you think this article has informed you about something you had no idea about earlier, your future security will not increase unless you understand that beneficiary matters. So it is important for your family members to know about this article, even if you don’t know much but they should be thoroughly aware. Please share this article with them or you may read it out to them.

If you have liked this article, please post your feedback in the comments section. Your feedback is very important to us.