In our country, the number of retail investors investing in Mutual Fund is very less. Today also a lot of people consider Mutual Fund as Equity Share market and SIP as a product. Even I have experienced some people who go to the extreme limit of considering Mutual Fund as Cheat Fund.

Most of us do not try to understand that Mutual Fund products are advised product. Just like RBI is the regulator of the banks, similarly SEBI is the regulator for Mutual Funds. Currently, SEBI has put forward a new regulation that mutual fund investors will get a statement every six months interval, not only mentioning the investors cost of investment, investment valuation, but also the income of the adviser has made from it, the investment company’s CEO’s salary, etc. It will also have the information that if the investor would have directly purchased that product, how much could he had saved.

Regarding this matter, I had asked for opinions from a few people who have been related to me in terms of investment for a long time. I am really thankful to all those who have found time to give their opinions on this matter even after having a very bust schedule. A special thanks to all of you.

My idea is to help people have a better judgment. There are a lot of people who read my blog, but haven’t even started investment in Mutual Fund. There are few who have just started their journey in investment but do not understand the importance of “advised” investment.

Here is some beautiful Feed back –

Prof Santanu Basu,

MBA, PHD in Personal Finance

After years of teaching personal finance and associating with Mr. Roy, I will share my experiences and realization with you.

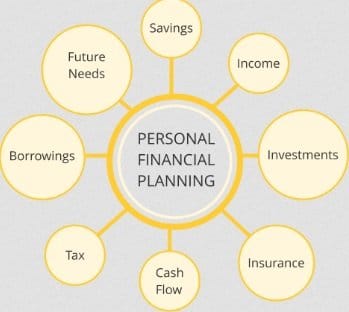

In our country, Bank Deposit, Post Office Deposit, PPF, GPF, PF all are “pulled products”. Endowment Insurance is a tax savings pushed product. But Mutual Fund products are advised product. Personally, I consider Term Insurance also be a an Advised Product. How will some one judge the amount of insurance they require? Even if someone tries to push these products, it doesn’t help much.

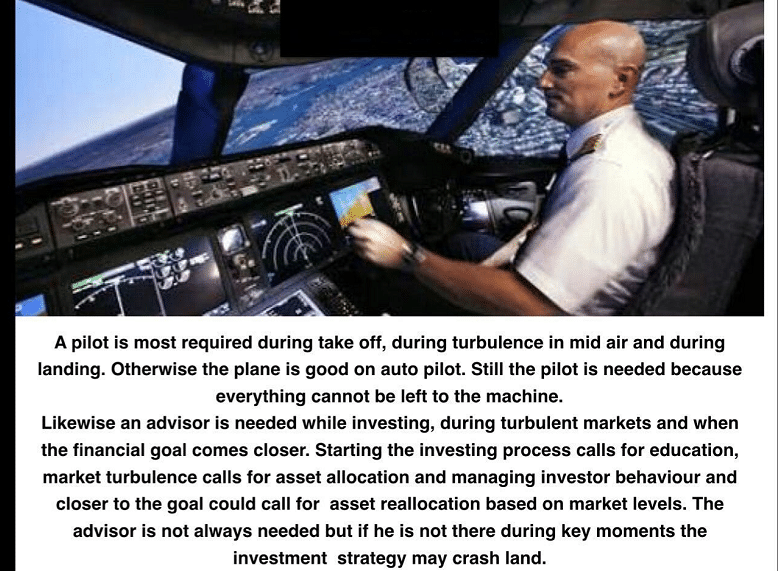

Mr. Roy has shown me his procedure of fund selection. At that time, I realized that this process is not at all as easy as it seems. I have also learned from his blog that performance of funds always rotates. I don’t know how it is possible for an individual to select a fund without a professional advisors suggestions. I have knowledge in a particular field which helps me to earn in that field. But I have no idea about the technicalities of how, when and which fund should be chosen depending on what goal I have. Even I don’t have the time to invest in this.

I came to know from Mr. Roy that SEBI has bought a new regulation which will let investors see the amount of income the advisor will get from that particular investment. We can also see how much we need to pay if we directly make the investment. I really respect Mr Roy and the transparency he has shown in this matter.

Yes, it is true in math’s that if someone have started an investment along with me in direct mode, then he/she will get more returns than me. But life is different from math’s. Life is practical while math’s is just theory. For a long investment, there are several market cycles that one needs to cross, now how will the person who has investment directly know about all these? Who will be there by his side to guide him in times of turmoil? According to my personal experience, the person who is too much worried about returns, takes this small cost as a big factor. But to generate big returns, this minimum cost is nothing.

I felt like laughing when I heard about this news. In our country, where people still consider Mutual Fund as a way to generate quick returns, this regulation will be a big blow for them. This is absolutely my opinion though. Still today, how many of us are able to consider Mutual Fund as an asset class?

Investing by your own and then losing time and money, I don’t think there is anyone having a better experience than me in this. I personally feel safe and secure after associating with Mr. Roy. I personally feel, the small fees that he takes is incomparable to the amount of support and value added services that he provides.

Aloke Roy

Text. Technologist, MBA, Entrepreneur.

Employed or self-employed or business owner whatever we may be, all are busy with our profession, busy in overcoming daily challenges we are facing. After that, neither we have time nor interest to develop deep understanding on various aspects of personal investment decisions. Even if we acquire once, it needs to be updated on regular basis as our environment is changing very fast. So, the profession of financial planner is evolved. In my opinion we must take help of a good financial planner on regular basis to help us planning our investment. Why? Let us go through few facts of our life:

Now-a-days, situation changes very fast. Human civilization took million years to move to Stone Age, thousand of years to move to bronze & Iron Age, then to agriculture, then to industrial revolution. But now-a-days, every day we see new inventions and then it becomes obsolete in no time. Similarly, financial instruments are also changing, how many of us keep track of it in holistic manner?

Earlier people used to build their house as per advice of a Raj Mistiri who hardly knows load of a building and its distribution. So, we often see instances like even a 10 ft X 10 ft small room has a central beam at the roof which was not at all necessary. Not only that, often it is seen, either there are excess no. of columns with excess amount of steel, etc. or inadequate columns risking the stability of the building under natural calamities. Wise person takes advice of architect and civil engineer to construct a house and thus not only guarantees safety in long run (aesthetic beauty is additional gain) but also saves money.

We buy clothes for tailor-made garments. Ready-made garments often look nice but one may have to compromise with fitment. Moreover, if our body shape changes, we need to go for a new garment and a skilled tailor not only makes a perfect fit but also ensures skillful use of clothes. Wise person prefers tailor-made product because of better fit and more cost effective (yes, cost effective) option.

We have started believing that it is better to see a specialist doctor for any specific health issue than showing a general physician and today hardly any wise person seeks medicine from a medical shop instead of showing a good doctor. People have suffered severely, even died, believing advice of a medicine shop keeper who hardly knows name of some common medicines and its common application. But without knowing the disease properly, right medicine can’t be chosen and the disease can’t be cured. Wise person knows danger of taking advice from non-professional people and never risk own life to save few bucks.

In our recent experience we also find that successful doctors keep themselves abreast with new developments, inventions and methods. Some famous doctors who don’t upgrade themselves, slowly lose relevance once they get exposed to their growing weakness.

A good interior decorator not only enhances beauty of a home, but also saves valuable space, ensures storage space of necessary things at right place which improves our functionality. Thus, a wise person gains much more by engaging a good professional interior expert compared to fees paid.

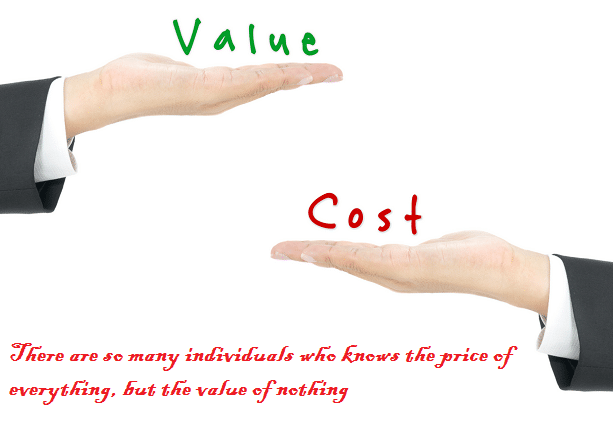

There may be many more arguments on role of an expert. The question is, do we have wisdom to assess real cost vis-a-vis benefit in seeking advice of a good financial expert? Or, we will continue to keep the proverb true even today, “penny wise pound foolish”!

Satyaki Banerjee

Chartered Accountant

আমি তো একটা বিষয় ঠিক বুঝে উঠতে পারছিনা যে এত Pharmaceutical Company, Medicine Shop থাকা সত্বেও কেন ডাক্তারের এত প্রয়োজন হয়? দেশে তো Joga র বইয়ের অভাব নেই, তাও কেনো Joga Centre গুলোর এত রমরমা?

আমার মনে হয় Personal Finance হল এমন একটা Subject যেটাকে নিয়ে কাঁচা হাতে বেশি পরীক্ষ্যা নিরীক্ষ্যা করলে তার পরিনাম ভয়ঙ্কর হতে পারে। কারন জীবনে Time এবং Earning Capacity র একটা Limitation রয়েছে। আমি আমার জীবনের অভিজ্ঞতা থেকে কথাটা বললাম।

খরচ বাঁচানোর অনেক উপায় আছে। Value র সঙ্গে Compromise করে Cost বাঁচানো টা মুর্খামি ছাড়া কিছুই নয় বলে আমার ধারনা। আমি তো ব্যক্তিগতভাবে Mr Roy এর মত একজন Polite, Humble, Serious, এবং Knowledgeable মানুষের সঙ্গে Associate করতে পেরে নিজেকে ধন্য মনে করছি।

আমি পেশাগত ভাবে একজন Chartered Accountant। আমি Finance Management ও পড়াশোনা করেছি। আমি হয়তো Terminology Wise কিছু বিষয় জানি কিন্তু কোনটার কি Implication আমার জীবনে ঘটতে পারে তার কোনো অভিজ্ঞতা তো আমার নেই।

Mr Roy এর কাছে সব শুনলাম। আমি বুঝতে পারছিনা এই নিয়মটা করে Regulator Investor এর কি সুবিধেটা করতে পারবে। এটা তো Bank এর একটা Savings Account বা FD করার ব্যাপার নয়।

Mr Tapas Dhar

Software Engineer.

I have been to USA for a long time for my work. Even if I am here, I am not at all worried about my investments, as they are all under the proper care of Asoke Roy. Without a qualified advisor, handling these things by ourselves if nothing but foolishness according to me. In our country, veterinary doctors don’t get the amount of respect that human doctors get, but that is not the case in USA. Here, veterinary doctors get even more respect and love than human doctors.

This is the same thing that is happening in India for financial planners. Still most of us are unable to think beyond “agents”. A certified financial planner is so much more than that. In USA, not only Comprehensive Financial Planning, but Segment wise Financial Planning is also prevalent. Few specialized persons only perform Retirement Planning, while some are specialized on the field of Divorce Planning. Just like doctors.

Here in our country, what SEBI as a regulator is trying to do, is already a big failure in matured markets like USA. Few people are loosing time and money and are again getting back to the advisors.

After being in the IT sector for a long time, and reading various information from websites, media that it is not possible for an individual to maturely manage his/her personal finance. I am saying this, after making this very mistake from 2007 to 2009. Just like swimming, driving, medical treatment cannot be learned from the Internet, similarly personal finance cannot be learned from Internet. Yes, Internet can make you aware of various situations and give you valuable knowledge, but direct plan is like self medication, it is like buying drug from chemist without prescription. That too for life threatening ailments. Just think about it.

A good advisor not only does fund selection for you, but helps you in taking your total financial decision. I have been really benefitted from Mr. Roy after learning proper expenditure management from him. He has taught me what our attitude towards money should be.

Even if I am far away, but I feel secure that Mr. Roy is always there to support me in all my financial problems. He is a big support system for me. I keep regular contact with him through mail. Whenever I visit India, I keep an appointment with him. Every time I have talked with him, I have felt enriched. Leave the small investment commission, whenever I pay him the fees I feel how devalued he is jut because he is working from India. He is a very trustable person.

Nikhil Sil

Ex Accountant

I am a retired person. I have been associating with Mr. Roy for more than 10 years (approx.). Before then I used to trade and invest in direct equity market. I have lost a lot of money in my life. I have noticed in these years that he is just not a financial advisor, He is such a friend who will do his best to make you reach your financial goals at any cost. Those who are too keen in getting more returns from direct investments, just keep in mind that return and risk are two sides of the same coin. If you are blindly running behind returns, who will protect your risk? Without a goal keeper, is it possible to win a football match? This is what I can say from my experience in life.

He periodically reviews my investments and if there is any alteration required depending on the situation, he logically explains it to me and does it. This is a big thing for a retired person like me. One day, one of my debt funds had a surplus of returns, and he was friendly enough to suggest me to take a small vacation.

I don’t consider him just as an advisor. He is a person whom I can trust fully. This cannot be measured with money. The amount of knowledge he has acquired and the way he works with full professionalism, I personally fell that the small fees that he takes is in no way comparable to this. I can never consider saving money from the small brokerage that he gets, there are other ways of saving money.

N K Bose

Engineer

In my experience, the Engineers like us, are more conscious about our subject engineering and day to day duty disposal. No doubt lion share of a working day we use to make good our own work. We earn money but our knowledge to maintain the finance is less. So we naturally became less conscious on this finance aspect. Hence in my opinion a financial adviser or a financial guide is essentially required for us. As for example we know the city of Lucknow or Delhi from our knowledge of books and newspaper. But when we take a tour guide during our visit to these places we know better and our knowledge became more perfect and visit became full of more enjoyment. Isn’t it?

However,

I realize why finance adviser is MUST for:

- To assess the market trend. Which is a social, economical and scientific matter today.

- To understand the Global situation on Economics, on which I can take serious decision for to do or not to do.

- Moreover, FA is a good and dependable assistance to whom and where financial things can be handed over safely, it can be shared and full concentration can be focused on own work.

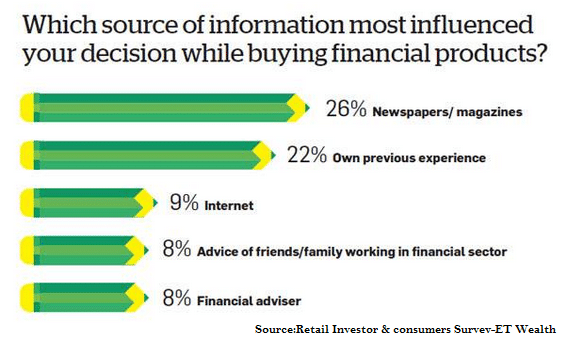

Foot note: Guidance from FA is more essential for the things which should not be done in finance arena with our news (paper) knowledge. Because most of them are as good as Advertisement of fairness cream.

Mr Pijush Kanti Kumar

Lecturer, IT

It is true that Distributors earn more in the long term investments. If you invest one lakh for 20 years , where the insurance commission is taken at 8% in the first year and 2% in the subsequent years and the mutual fund commission if assumed as 0.5% upfront and 0.75% as trail commission (gradual increment of commission is considered here for 20 years). Then total commission paid during the holding period is high for M.F. at Rs.63289.00 and Rs. 46000.00 for Ulips.

But still a dedicated financial planner can help you out to show you a road map by making smart investment choice and timely corrective measures, strengthen your portfolio. There is serious dearth of unbiased advice on offer. Many will advise you to sell the products that fetch them fat commission even if they do not risk profile or portfolio. Most banks and some agent of different AMC are guilty of this practice. So I feel go for fee only planner who will not force you to buy products they recommend. At the end of the day you will be benefited.

Prof G Samanta

Neutrinist

What I feel indian economy in perspective of world trend is likely to be major restructuring. We the common people are not very much aware of it. Day by day we are feeling through higher inflation, lower interest in deposits and newer taxation. In such situation, if we hold our conventional concepts of personal finance, it will definitely envisages crisis. To protect our hard earn money for maintaining our future livelihood it is now essential to get advice from a Financial planner or Financial Advisor. So to say, I have changed a lot in my concept and planning as advice of Mr Roy with a resultant beneficiary.

Prof.Asish Ranjan Das

Chemistry

As you have sought opinion from a lay man like me—-I rather like to share my views:

1) A financial advisor is like a ship with rudder.

2) I feel that advisor allows me to transact thereby helping me to save time in making investment decisions.

3) He is the key person who can give customized recommendations, alerts and notifications about my money, and this is the reality in case of myself.

4) To track expenses across categories, financial advisor can set budget and monitor them with timely alerts! To me his role appears to be the key factor to save more and spend smarter.

5) Finally, in India due to globalization, every person has to depend on a financial advisor in order to achieve something positive.

That’s all, I think I have expressed my understandings!

Dr Prosenjit Baidya

Doctor

Due to professional hazards and insufficient time and knowledge regarding Mutual funds it’s very difficult for us to manage money at SIP. That’s why financial advisor is very necessary for us. Though there are many websites which guide you regarding Mutual funds but they only show you the funds that already have been established which may not give you big return in coming future. But financial advisor can predict and guide you properly regarding funds that can perform better

Mr Sudip Sarkar

Govt. officer

Mutual Fund Selection এর জন্য Proper Advice অপরিহার্য্য। Bank এ Invest করার জন্য একজন Investor এর বিশেষ কিছুই করার থাকেনা। কত টাকা এবং কত সময় জানিয়ে Form Fill up করলেই চলে যায়। কিন্তু Mutual Fund এ Investment এর সময় অনেক কিছু বিচার বিবেচনা করতে হয়। Investment Goal, Time Frame, Investor own Risk measurement, Fund Selection, – এগুলোর কোনোটাই ভালো Professional Advisor ছাড়া সম্ভব নয়। এর পর Market Ups and Down অনুযায়ী Fund Changes, If require Profit Book, or Loss Book- এগুলো কি একজন সাধারন মানুষ যিনি নিজের কর্মজগতেই সদা ব্যস্ত থাকেন তার পক্ষ্যে কি সম্ভব? Financial Advisor রা অনেক technically sound হন।

Doctor, Engineer, Advocate প্রভৃতিরা যেমন Fees এর বিনিময়ে Advice দিয়ে থাকেন Financial Advisor দের খেত্রে সেটা হলে অসুবিধেটা কোথায়? Cost বাঁচাতে গিয়ে নিজের বুদ্ধিতে এই ব্যপারটা Handle করতে গেলে হিতে বিপরীত হওয়ার সম্ভবনাই বেশি।

Now I Earnestly request you to give your valuable feed back in any language.

12 thoughts on “Value or Cost – Which is Important?”

খুব ভালো উদ্যোগ। As a Doctor I always try to update myself by reading Journals, attaining seminar etc. I invest time and money to increase my professional knowledge. Now I take fees from my patient by giving them adequate services. এতে অন্যায়ের কি আছে বুঝলাম না।

Any way, I am very much secure with Mr. Roy.

বাজারে তো কোনো জিনিষ কিনতে গিয়ে জানতে পারি না ঐ জিনিষটাতে বিক্রেতা কত লাভ করছে? Bank এ গিয়েও তো আমরা জানতে পারি না বা জানতে চাইও না আমার Deposit এর জন্য Bank এর Income কত? এই দুনিয়ায় তো কেউ Charity করতে বসে নি?

আমি যতটা আন্দাজ করি একজন Advisor এর Business Acquire করা, Business টা Maintain করার জন্য এবং Proper way তে নিজেকে Update করার জন্য বেশ ভালোই খরচ হয় বোধহয়। যদি নাও হয়, একজন আমাকে Income পাইয়ে দিয়ে যদি কিছু Income করেন As per regulation তাতে অসুবিধার কি আছে?

আমি রায় বাবুর সাথে পরিচয়ের আগে যা Income করতাম তার থেকে বেশিই অনেক সময় খরচ করতাম। Investment তো দুরের কথা Savings ই ছিলো না। শুধু Loan আর Loan। রায় বাবুর সাথে পরিচয় হওয়ার পর ওনার পরামর্শ মত চলে আজ আমি ঋনমুক্তই শুধু নয় আস্তে আস্তে Investment ও বেড়েছে। সবথেকে বড় কথা যেটা আমার বাবা মায়ের হয়তো শেখানো উচিৎ ছিলো উনি সেটাই আমায় শিখিয়েছেন, Decipline Life কিভাবে কাটাতে হয়, Expenses Control কিভাবে করতে হয়, আরো কত কি। উনি আমার কাছে Mere Advisor নন, উনি আমার Mentor। আপনাকে প্রনাম রায় বাবু।

আমি Legal Profession এর সাথে যুক্ত। আমি Regular Mr Roy এর Blog পড়ি, তবে Comment করা আর হয়ে ওঠে না। আজ মনে হলো যে মানুষটার কাছে আমি এত উপকৃত, যেখানে এত সমস্ত সব সফল মানুষরা তাদের মতামত জানিয়েছেন, তখন আমারো বোধহয় এবার কিছু জানানো উচিৎ।

Problem টা হলো Good Advisor and Bad Advisor বাছাই করা নিয়ে। আমি Mr. Kumar, Mr. Aloke Roy, Prof Basu র সঙ্গে সম্পূর্ন একমত। আমি Strongly Believe করি একজন ভাল Advisor ( Just like Mr. Roy) শুধু Investment Return নয়, জীবনের প্রতিটি বাঁকে প্রচুর Value Add করতে পারে। আমিতো আমার House Building Loan নেওয়ার আগে Mr. Roy এর সাথে প্রচুর আলোচনা করে ওনার Suggestion মত এগিয়ে এখন বুঝি ভালোই হয়েছে।

যখনই যে কেউই Particular একটা বিশয় নিয়ে চর্চা করেন তখন তার মধ্যে Vision তৈরী হয়, উনি Future Implication কি হতে পারে তা পরিস্কার আন্দাজ করতে পারেন। এই সুযোগটা একজন Advisor এর কাছে পাওয়াটা একটা বড় ব্যাপার। Mr Roy এর কাছে আমি অনেক অনেক ভাবে উপকৃত, এবং ঋণী। আমি ওনাকে ভালোও যেমন বাশি তেমনি ওনার Dedication, নিজেকে Update করার আগ্রহ, caring attitude এবং সর্বোপরি উনি এত Polite এই মনোভাব গুলোকে শ্রদ্ধা করি।

One of my clients told me a very wise thing, if I have to pay advisory fees for my future financial planning & development, I’ll gladly do because if I’ll give that much time & knowledge to my job, I’ll surely increase my income much more the amount which I’ll pay you as advisory fees.

I have met thousands of advisors in the country. Mr Roy is one of the most transparent, honest and process oriented financial advisor. He works hard and very caring about his clients. I have no doubt that he will achieve fantastic growth in this profession.

Good one

Mutual fund somporke investor awareness ki kore thikbhabe barano jay ei byapare SEBI r bhaba dorkar. Bisesh kore market linked investment er khetre jokhon besirbhag investor i properly updated non, tokhon financial advisor chara ei kaj onno keu korte parben ki? Investor er angle theke bhable jokhon bank ba post office e invest koreo fixed rate of interest paoa jabe na, emon ki besirbhag khetre bhobisyote interest kome jabar sombhabona, tokhon mutual fund er byapare negative mindset nie labh ki? Certified financial planner ther songe jogajog korle bola jete pare investor ra standard professional er guidance e achen. Financial advisor ther fees nie bhaba uchit hobe na, borong ebhabe bhaba bhalo je investor ther investment return er theke onara nijeder fees create kore nite paren, kichudin somoy dile eta automatically investor er kachhe clear hoe jabe. CA, IT Lawyear, Advocates ra to ebhabei client ther justify koren. Mindset change na kore bank ba post office e long term er jonno capital invest korbar habit continue korle capital erosion chara bodhhoy ar kichhu pabar asa nei…..amar to erokom i none hoy.

Very good approach.I want to say some words briefly.All of us who fear snakes,must not have the experience of taste of snake-biting.Snakes are deadly are decoded in our brain for years.Warning before any investment getting people very much fearful.I think,new model can automatically make the door open for any advisor.

The example of Bank lending an Umbrella is excellent and also the thought for VALUE V/S COST.We generally think of putting our money in Bank /Post Office considering that the money is safe ,though the interest rate is less.But never give a thought that what will be actual value of money that we will get after Maturity period .

I am an engineering having worked in Govt, Department as well as in Infra industry/ Aviation Projects.Honestly I have never thought of investing my hardearned money other than Bank.Thanks to Mr Roy who enlighten me with the actual value of money v/s cost.

Thank you Mr. Roy once again

To make a garden planning require, to plant a tree no such plan is require. Mere walking no coach require but for good health jogging require expert advice. No coach require to play football but to be a good player Coach needed.

Just like that if any body wants to just save money no advisor is require but for wealth creation or fulfilment of long term or short-term goal a professional Advisor is must.

Everything required planning then execution. Everybody is not good planner beyond his or her peripherals. He or she may be good planner for his subject or his profession. So when I collect some wisdom and plan from some one, what is the problem to pay him the minimum remuneration. When we purchase a Rs.40 Colgate we also pay the RSM SALARY, BM Salary, Salesman Salary, Distributor Margine, company margine finally Chairman and CEO and MD salary why we are not so much calculative at thet time of purchase. Because we can’t make it our own process. Same thing is here also applicable. We are getting great services for our future old age. We are getting planning, getting thoughts, getting wisdom finally getting moneytory security. So we should pay that minimum amount to those wise persons who are working for us, taking tension for us.