Various Persons have given their own opinion. May be your opinion is totally different from that, Whatever may be your opinion, please put your comments.

Asoke Roy,

Consultant.

A large section of people actually are not aware of the importance of taking advice from a professional advisory regarding personal finance, because most of the people are born and brought up in a free advice society. In our society advice is freely available of any type and matter.

Another important point is that most of the people don’t see the picture that their parents are taking advice from professional advisory for their financial matter, rather they saw their parents taking advice either from colleagues or from friends or from bankers or chartered accountant etc. So, actually it is neither the fault of today’s generation nor our previous generations because in the past it was not much necessary to take advice for financial decision.

If we just observe a simple data then we will understand the fact quite easily. In the year 2002, the inflation rate was 3.2% where as bank interest rate was 7.5% – 8%. But in the year 2014 the inflation rate is 9.13% and bank interest is more or less 9%. Thus in the past situation of low inflation rate and high assured interest rate, no one ever needed any advice or suggestions, and there was only a very simple choice to be made – bank or post office? For this kind of simple advice, colleagues and friends were appropriate. But now the economic situation is completely different but the tradition has never changed.

Due to lack of financial literacy and common sense about personal finance, most of the people can not segregate between a product distributor and a financial adviser.

Today the advice is freely available from any bank, friends, parents, colleagues etc. though they are not expert about this subject. Suppose, we all know that the medical representative meet with a lot of doctors for their profession and they also know the names of various medicines which are required for various types of diseases, but still we never go to them for our health problem. Because mere knowing the names of medicines or knowing the features or advantages is not enough to solve the problem. It requires proper diagnosis of the problem which is only possible for a doctor to do.

Similarly friends, colleagues, bankers or chartered accountants may know the name of the product which can give tax benefit or which has given him double return in three years etc. but they don’t know the techniques of selection of the right product for the right person.

A large section of people’s problem is that professional advisors demand fees for their advice. Although those people are willing to pay fees to the doctors, to the lawyers, to the architects even to the broker for purchasing any real-estate property but for financial advice they are not ready to pay fees. The main problem is that, we Indians have been born and brought up in a diet of free advice.

I would like to share a very short story, I read somewhere. What if you are going on a trip and you are offered the opportunity to fly on one of two jet airplanes? The first is piloted by an experienced pilot who is trained and being paid to do the job; the second one has no pilot but you are allowed to fly yourself. If you choose the plane without the pilot, a computer will be installed in the cockpit that hooks you up to an internet site that can tell you everything you need to know about flying an airplane.

Which plane do you want for your journey?

What you are paying for when you hire an advisor is not for just for information as information is something which you can get that almost anywhere. You are paying for the experience. I have been their in bad weather and know how to make a safe landing.

In my opinion, we the common people visit to the professionals like Doctors, Lawyer etc. to take solutions whenever we faces any problems in our life. But in case of personal finance, we require Advisors help so that we will not faces any problem to accomplish our goal. In finance, whenever any body faces a problem like retirement funding shortage then after that (i.e. after retirement) if he goes to any advisor for solution of his problem. The problem will not be solved because the time which was gone will not revert back.

Next important point, in my opinion, whenever we are benefited form Doctors or some other professionals advice then we are willingly refer his name to our colleagues, neighbors, friends, etc. so that they are also get the same benefit like us. But in case of personal finance, generally people wants to conceal the advisors name out of fear or some other reasons. Do you know the name of advisor of richest person in your locality but you may know easily the name of his doctors, or the name of teachers from whom their children taken assistance? I strongly believe that without a professional Advisors help one person cannot create wealth.

Actually this the fate our beloved advisors. People always mix then with mere agent.

My suggestion is that if you are benefited or if your financial advisor create some value addition in your financial life then help your close circle people by referring his name so that your close circle people also get the same benefit what you get from him.

Surprisingly, we Indians are very much reluctant to go to the Financial Advisors at the time of taking financial decisions. Unlike today, earlier there was not so much avenues for investments. People were very much savvy to put their money in Post Office, Bank F.Ds etc and were happy with the returns. Also, some people used to invest in Gold (in terms of ornaments). The situation changed when erstwhile Unit Trust of India came in the scenario with its flagship scheme US’64 in the year 1964. The investors were very much happy with the investment returns. They did not bother about the investment policy or transparency of US’64. The slogan was “In July, US’64 will give dividend and also we can purchase the units in lesser price.” People used to save/ keep their money in cash throughout the year for purchasing the units of US’64 in the month of July. No Financial Advisor’s advice was required to purchase the units of US’64.

Then came Bank sponsored Mutual Funds, Private Mutual Funds and SEBI which created a revolutionary change in the Indian savings scenario. People came to know the difference between Savings and Investments.

For savings, you may not need the help of a Financial Advisor, but for Investment decision you should take the help of a Financial Advisor like a help of a medical practitioner you needed at the time of any disease. But, surprisingly, still 70% of Indian investors are not so much professional to go to a Financial Advisor for planning his investment by paying professional fees. Rather, they are very much happy to seek the help of their family members at the time of investment, as, still they are ignorant about the difference between Savings and Investments. In the case of Gen X or Gen Y, we still observe that in most of the cases, their parents are taking financial decisions on behalf of them without considering the risk appetite, number of dependents, future needs etc. and that ends in having huge investment in Insurance (treating it as savings vis a vis tax efficient), Bank FDs etc.

When we need the help of a professional?

Better, we should ask ourselves the following questions :

> whether I have jotted down my current needs & future needs.

> Whether I am keeping daily balance sheets?

> Whether I am in a secured job (Though, at present scenario no job is secured).

> Whether I have a clear idea about my future earnings?

> Whether I have a clear idea about how much money I need after my retirement to maintain the same life style that I am enjoying today?

> What will be the cost of medical assistance I or my family need after my retirement?

> What percentage of my earnings will be eaten up by the rate of Inflation?

> Do I have sufficient skills and time to manage my hard earned money?

> If something go wrong in my professional life, whether I will be in a comfortable position?

I do not think, that an amateur (like our relatives / friends etc.) can take care of the aforesaid situations if any of the reply is NO.

We eat bread, vegetables, dal and rice for lunch and dinner. We may have Biryani once in a while. We do not, however, live off Biryani or Tandoori only, just because they thrill our taste buds. If we ever attempt doing so, we would end up bed ridden. In case this happens, we seek control over our food habits.

Similarly, for our financial health to remain in good state we create a portfolio of bank deposits, debentures , equity shares mutual funds , gold and real estate. Like a balanced diet, a balanced portfolio helps.

We consult a doctor when we fall ill. He prescribes medicines with specified dosage. We adhere to the dosage instructions in order to get well. Whether we gulp all medicines at once shot for a speedier recovery? In the case of diabetes or any such diseases, we have to pop pills for years and have to stick to the medication to maintain good health. Likewise, we take the systematic investment plan route in investments for good financial health.

Consulting doctor is much like consulting a financial advisor. Even if, at first go, we are not cured, the doctor changes the prescription. No doctor in this world can ever guarantees us results. The similar things may happen in the case of a financial advisor. Only you can expect his best efforts but not the guarantee, but it is 100 time better to go to a medical practitioner at the time of disease than to a quack and likewise it is 200 times better to go for a professional advisor rather to take advice from a amateur, if you really serious about your Present and Future.

CHILD DEVELOPMENT PROJECT OFFICER / DEPARTMENT OF CHILD DEVELOPMENT, GOVT. OF W.B

Normally people in India don’t think they need professional personal financial advisor. It may have been caused due to several factors.

1) Most of the people in our country think that like well known Doctors or Advocate there are scarcity of well knowledgeable and trustable professional advisor.

2) Most of Indians are savers not investors.

3) In our society we brought up from child hood without planning.

4) People normally wants to try to conceal their savings from others. They do not want to discuss or disclose their finance to others. Having lack of faith they cannot come out to discuss their financial planning beyond their close circle.

5) Due to lack of knowledge and not getting advice, most of the time, most of the people chooses investment vehicle by trial and error method, as a result the accumulation time to reach his goal as been lapsed.

6) Most of the people like guaranteed savings means bank deposit, post office savings, land, gold etc. as it not require any advice.

7) Due to low financial literacy market link investment are not their favorable criteria.

8) In recent past we have seen many agents sold insurance, mutual fund, bond etc. to us, latter we came to know that they had sold us such product only to fulfil their purpose not for our purposes. Above all, the chit fund agent also hamper too much about the reputation of real advisors image.

9) We think that so called educated people are financially educated but it is not true. In our consumerism society without professional advice one cannot grow his personal financial strength.

10) My opinion is, if an advisor have knowledge about different investment options and if he updates himself regularly then only he can create awareness to the common people and he became one of the role model to his investor.

This is not only a big also a vast question for all of us. Being a professional financial Advisor since 1986, I can share few of my personal observation & views.

SOME FACTS ON BASIC EDUCATION & LITERACY:-

1)40% of worlds illiterates live in INDIA. (UNICEF).

2) INDIA ranks 76th amongst 94 developing countries of third world in literacy (UNICEF).

3) Indian school kids ranked 2nd in test conducted on 15 years old to assess their reading, math’s and science abilities by program for International Students Assessment (PISA) in 2012.

4) Only 23% of world population of 18-23 years of age receives higher education. The Indian rate is10.5%

5) 35.5% of Indian families do not know how to operate a Bank account (World Bank).

What leads to disparity in education of young Indians?

Last updated on: July 15, 2014

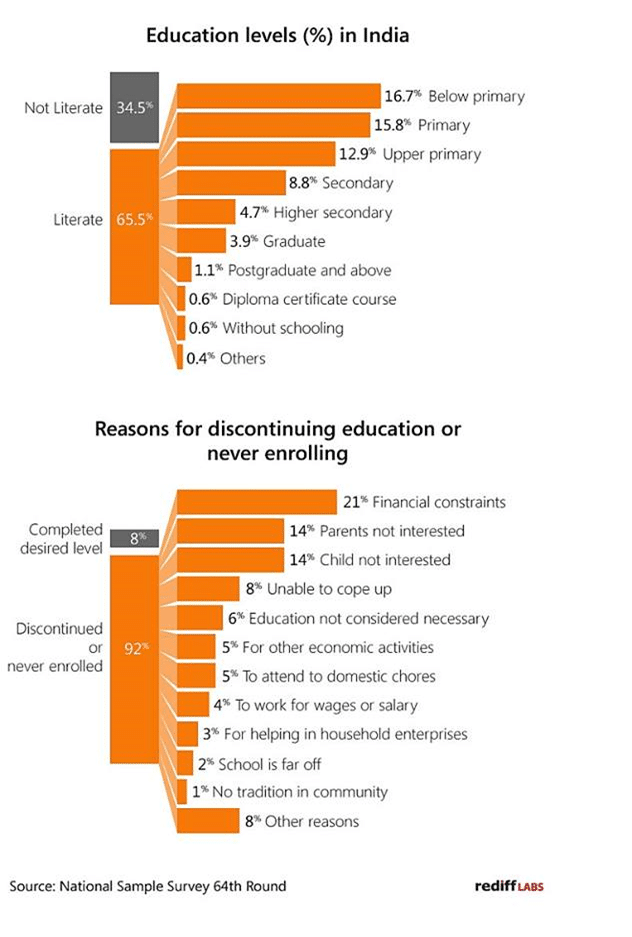

The graphic above shows the level of education in households across India along with reasons for discontinuing or never enrolling in an educational institution. The statistics were reported in the 64th round of the National Sample Survey. The report which provides data for 2012 is the latest source of all information available for education in India.

The survey reported that while over 65 per cent of Indians are literate, only a fraction of the population is highly educated. 16.7 per cent of Indians, the largest chunk inside the literate bracket, have not completed even primary school education.

The survey found that in eight per cent of households Indians discontinued education after they achieved the desired level. For a whopping 21 per cent, however, financial constraints came in the way. In addition, four per cent discontinued education “to work for wages or salary” and another five per cent for “other economic reasons”.

How many of us, have the Financial Literacy & Awareness.!!

The absence of financial literacy can lead to making poor financial decisions that can have adverse effects on the financial health of an individual.

Discipline investments only can create the investor’s portfolio strong & wealthy.

‘Financial Literacy’ is the possession of knowledge and understanding of financial matters. Financial literacy is mainly used in connection with personal finance matters. Financial literacy often entails the knowledge of properly making decisions pertaining to certain personal finance areas like real estate, insurance, investing, saving (especially for college), tax planning and retirement. It also involves an intimate knowledge of financial concepts like compound interest, financial planning, the mechanics of a credit card, advantageous savings methods, consumer rights, time value of money, etc.

Since’2011 I have worked more than 87 programmes on Financial Literacy & Investor Awareness Program at remote villages, like singur, and rural. Semi-urban, urban areas and in the media of Radio, Doordarshan & other TV Channels also.

The recent collapse of the Saradha Group (incorporated in 2008), exposes a financial “scam” with an estimated loss of Rs 20K -30K crores. There have been other instances of such scandals in West Bengal in the past ‘Sanchaita Investments’, ‘Verona Commercial Credit & Investments Co’. And ‘Sanchayani Savings Investments Co’. Were responsible for wiping out investor’s wealth of almost Rs 1000 crores due to lack of Investors’ awareness & education. Unfortunately, we have not learnt lesions from such catastrophe.

Most of the people, both literate & illiterate (Academic only) have their own mindset. They don’t change their mind.

1) Most of the business man thinks about investment that his business is the best way of highest & good return that’s why he has no need of other investment product.

2) Most of the service specially Govt. people are invested Tax savings product like LICI, NSC, PF etc. just for tax relief, not for investment.

3) General people of India have a phobia of Income Tax as cobra snake. Always they try to avoid it. And they invest in Gold and Land Property in different name in the family members to avoid the Income Tax.

4) All good financial product need PAN & KYC, A five members family has a PAN Card members. Others members KYC problem.

5) People do not want to express & discuss to the financial advisor about his money & asset due to phobia of Income Tax and local Muscle power. And always try to hide which he has.

6) Financial product is a concept & virtual, it physical shape just a piece of printed paper or D-mat Form .But general people trust more in visible thing like Land, House, Property, Gold, Silver. Stock of jute & food grains. In this sector minimum paper work and less hazard.

So they think that no need of financial advisor for there need. Because, Most of the people, both literate & illiterate (Academic only) have no financial literacy.

FOR GENERAL PEOPLE:-

Ask yourself these questions: The following questions should help you sort out whether you need an advisor:

Do you have the time to do the research?

Do you have much experience, knowledge or skills when it comes to investing?

Can you afford to lose any money?

If things go wrong, are you comfortable taking responsibility for any bad investing decisions?

Do you have a fair knowledge of investments?

Do you enjoy reading about investments and doing research?

Do you have expertise in investments? Do you have the time to monitor, evaluate them and make periodic changes to your portfolio?

If you answered “yes” to the above questions, you may not need an advisor.

If the answer to any of these is ‘No’ then seeking financial advice may be your best option. When trying to decide, also bear in mind the cost of fees against the financial and emotional cost of getting it wrong if you buy without advice

Investors’ awareness & education are not & should not be a govt. initiative. It requires inclusive efforts of all financially literate people of the country, all regulators, educational & professional institutes, market intermediaries, printing & electronic media houses, Investor awareness & financial literacy not only helps in identifying the right product but serves as a preventive medicine ensuring that fraudsters aren’t able to inflict misery on the common people cum investors. It is in this manner that Investor Awareness & Financial Literacy plays a significant role in the economic growth of the state as well as in the country. It also guides the individuals for making a choice borne out of their requirements rather than to suit the market behavior.

We hope that the coming years would see a larger number of our population in the country becoming well aware investors as well as our country will becoming a place of highest growth in the World.

Mr Sanjoy Das

2 thoughts on “Why people are not serious enough to take advice from professionals for their personal finance”

As far as my opinion is concerned , it is stated that you are to screen statistically about the financial status of the persons taken as a sample of study .Most of the people comprising employees and other professionals hardly have the capability to maintain their own expenses . Therefore , they do not feel to take the advice from finance advisor . The persons who have enough surplus money , obviously take advice from professional finance advisors . Therefore , the simple people is the main criteria. One example would suffice you to understand the thing better . A person having no money will not consult a doctor , rather he himself will try to treat using unscientific medicinal agents what he knows . But a rich person will move to the Class I hospital for getting proper medical advice.

Dr Subhas Chandra Mandal

I am very much agree with Mr. Suman Dan, Mr. Soumen Sarkar, Mr. Debasis Ukil and others. My realization is that people of India always think that Financial Planner or Adviser are doing their jobs for their own interest not for them. If any correction (negative) occurs in Funds, Indians always try to blame The Financial Planners. If there is positive correction then Investors never feel to give thanks to The Financial Planner. All people think they are the only Agents.It is our shame. We have to change our views by proper education.

Debjani Banerjee , OMIC India Pvt. Ltd., Kolkata