SIP (System Investment Plan), is a very simple scientific method of investment, SIP is not a product, it is a system. In simple language, just like you can invest a lump sum amount in any product, similarly you can invest in Instalment Basis also. This way of investment in a recurring way is known as SIP. Just like the Bank and Post Office can make a Recurring Deposit Scheme, similarly, investment on a monthly basis is a way of SIP.

The greatest advantage in SIP investment is that you don’t have to invest a large sum of money. You can invest Rs. 1,000 also as monthly basis. Suppose, a person’s monthly income is Rs. 30,000, he just made an investment of Rs. 2,000 as monthly basis. You can do this also. From your Bank, according to your chosen date, the investment can be made from ECS. You don’t have to go anywhere to deposit premium, or flatter anyone.

In SIP System there is no hard and fast rule about how much you have to invest in month or year. Suppose, that person thought he will deposit Rs. 2,000 for 10 years, now after some month he realized that it was a mistake. You don’t have to worry about it; just a letter to stop that ECS System of Investment will do the job. Now comes the question, what about the money that is deposited? There’s no worry, you can withdraw the deposited sum at any time, or partial, or you can stop the investment but kept the money to withdraw for some future use. Yes, here everything is possible.

Now after reading up to this, I would like to request everyone to think if these advantages will be given in any other investment system? How much money you have to give for the insurance is decided by the insurance company, here whatever you will give is your investment. Whether you have made the insurance in Bank, Post Office or anywhere else, if you don’t invest for the requisite years of commitment, you will suffer, many penalties will be deducted, isn’t? Here, there is no such tension.

There’s no better method for Force Savings and Investment’s discipline maintain than this. I have many people saying that they had made a mistake by making a SIP account for Rs. 5,000 monthly wise, now they think that they have achieved it nevertheless, its fortunate that they have done it. It’s completely normal if you feel that you can’t continue Rs. 5,000 as month wise, and have to increase or decrease the amount according to your financial stability.

Now let’s move on to a technical topic. If anyone thinking about investing in Equity market Linked Fund’s Mutual Fund, but can’t take the risk, then you can take the help of SIP. Here the risk can be minimized. Some also think about investing according to the rise and fall of the market. Here in the SIP system, you don’t have to think about it. Why? Let me explain.

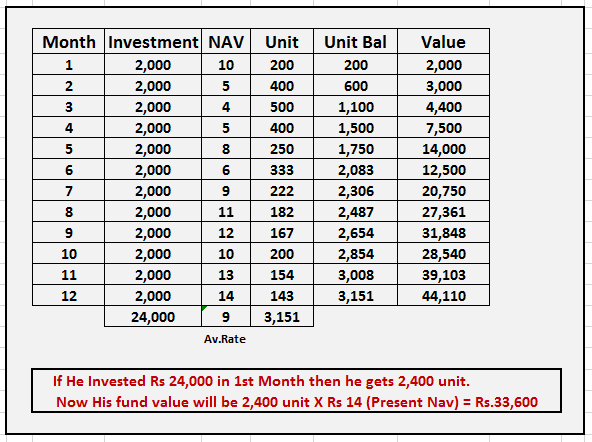

From the chart given above, you can understand why the SIP system is necessary for Investment. Those who don’t have any idea about Equity Market, let me tell that here the Equity Market for a short time can increase or decrease. This rise and fall ultimately go up in the long term plan. But this rise and fall (Volatility) are what the investors are afraid of. But here in the SIP system this rise and fall make the return. From the above example, if a person invested his entire 24,000 rupees in there, then after 1 year the value would be Rs. 33,600, were in investing only Rs. 2,000 month wise you can get Rs. 44,100 after 1 year.

He has gone to invest Rs. 2,000 per month. NAV means purchase price or the amount you pay to buy something. You will notice when the price falls then he who had invested is quite happy because he can buy a large unit at less price. Like the decreasing amount of Rs. 10 to Rs. 5 the unit has increased from 200 to 400, similarly the decreasing amount of Rs. 4 has increased to 500, etc. Now imagine, he who invests that 24,000 rupees, he can see the fund value is half or less. But after some time he will see it as Rs. 33,600 or even more. How SIP makes the risk as its own advantage, I hope you can understand.

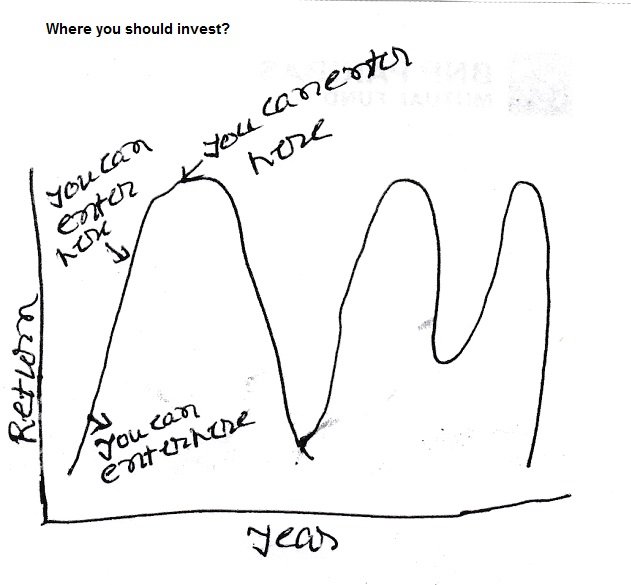

From the diagram above, I have tried to understand the way of executing the Equity market. Now no one knows after investment if the market value will rise or fall, isn’t? I think no one in this world knows that. After investing in SIP System, wherever the market goes, you will get the profit. I have already explained that if reduced the Unit Accumulation will increase, and if increased the Valuation will also increase.

By taking a loan and giving the EMI we can buy necessary goods, similarly by investing in SIP (like EMI), we can fulfill any goal. We can make a SIP for a Long term as well as for Short term. Similarly, if anyone wants to avoid the 80C Tax then he can also make a SIP account. For Retirement, Child Education or Marriage, Vacation, etc. goals, SIP are a very good way of investment.

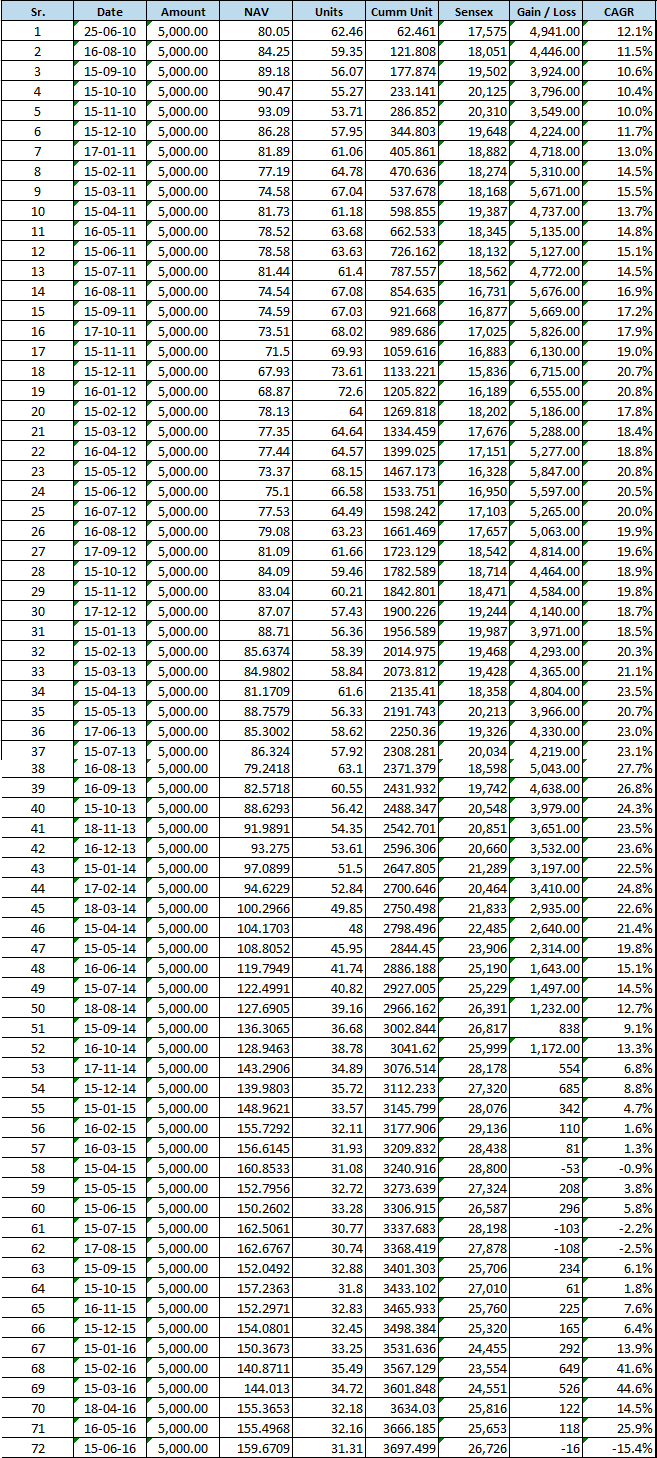

To understand clearly, I am giving an example of a SIP investment of 6 years. This is not an illustration, but a fact. Look at the diagram below.

If you observe carefully, the person has invested Rs. 5,000 for 72 months, and have invested Rs. 3,60,000 whose current value is Rs. 5,88,503. Up to now, the CAGR Return is 16.6%. The day the SIP was made on 25/06/2010 that day NAV was Rs. 80.05, and that day SENSEX (Market Index) was 17,575. That day in return for his Rs. 5,000 he had got 62.46 units. Then NAV had increased to Rs. 93.09 on 15/11/2011 and the Unit Accumulation was 53.71. Then the market had gone down on 15/12/2011 to 15,836, and NAV decreased to 67.93 rupees. That time the unit Accumulation had increased to 73.61. This is the magic of SIP, Equity market will increase and decrease, but here the SIP investor is always in profit if the market increased the NAV will also increase, the Fund value will increase, and if the Market decreases the NAV will also decrease, and the Unit Accumulation will increase. And like this way you can get a huge return in SIP.

I could have also shown you 15 years’ practical figure. The chart would have increased, many would not have understood. This fund, after 20 years, is giving 21% Tax-Free Return. Just imagine, by investing a little bit of amount every month and by commitment without any pressure, is it possible to get this type of Lucrative Inflation-Adjusted Tax-Free Return in any other Avenue?

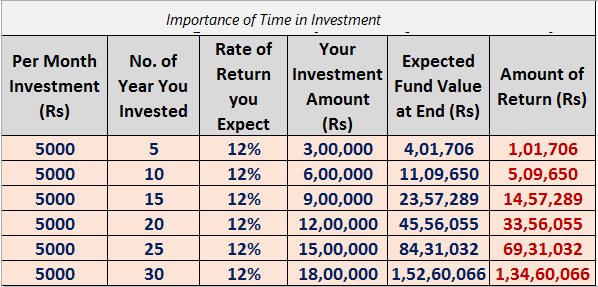

In the above example it had been assumed that investor is not increasing his Investment Amount every month, the Return is also not increasing (whether in reality when the time increases, the return percent also increases), just imagine the situation when the Investment Time Horizon increases from 5 years to 10 years or 20 or 30.

So, is SIP always good? No, not always. If a person doesn’t understand this topic clearly or can’t create his investment mindset, then the trouble comes. How to look at the first example again. After 3rdinstalment, the investment had become 6,000 but the value shows that 4,400, for 4thmonth the investment had become 8,000 rupees, the Value shows Rs. 7,500. Here some stop the ECS and withdraws the amount. I am sure even after reading this article, most of you will quit in the midway. Those who will stay, by investing Rs. 5,000, he will enjoy 12% Return for 20 years and will create more than 45.56 Lakhs of Fund.

Assume, one started earning after 25 years and decided to deposit Rs. 2,000 per month as SIP installment. If the Return of that Fund is 15% then when he will retire after 60 years, the Value of that Fund will be Rs. 2,25,65,336. Not bad, obviously. Because today’s 2,000 investment remains the same even after 60 years of age, isn’t?

Please watch these videos and if you think you want to add any value then please write underneath.

11 thoughts on “A Simple Way of Wealth Creation That Works in SIP System”

Excellent Explanation. Really an eye-opener. I am very much benefited by doing SIP as per the guidance of Mr.Roy. Thank you Mr. Roy. You always try to clear us to invest according to your objective.

I came to know first the SIP concept from Mr Roy. I started investment Rs 5,000 monthly for Tax saving purpose. Now I invest for my various goal Rs 25,000 p.m through SIP. I am Satisfied and happy. Thanks Mr. Roy.

At first, I started RS 5,000 SIP in the year 2007. After that, I realize the logic and its power. In the year 2009 when everybody was unhappy regarding their investment but my investment value was good. I continue my previous SIP and also increase the SIP amount from Rs 5,000 to Rs. 15,000. That time I can recall, Mr Roy told me that correction is temporary but growth is permanent.

SIP is really a unique investment system. No doubt about it.

Not only that, with SIP investment if Mr Roy. is an advisor with that Investment then it will be more SAFE & SECURE.

Hi Mr. Roy,

A very nice and informative piece of article. The illustrations and examples that you provide are so simple and yet so effective.

Thanks

Arpan

Nothing can be better than this explanation. With example, this is an excellent massage to an idle man also. This is enough to understand and inspiration to opt SIP for future upcoming financial planning.

Very nice and lucid too. Examples are also cited for better understandings. Inspiration will definitely inspire to opt SIP for future financial planning.

Beautifully narrated with relevant example.. As you said SIP is for All. May be this would be the best way to invest in capital markets.

This is the best way to invest for future.I think that no one can explain about SIP to me. I understand about SIP is too much late. Ok thank you sir beautiful explained about SIP.

SIP is a good tool for investment. But one requires patience and mental mind set. Some times you may not get your expected return from your SIP at that time you may have to come out from the fund and have to take further initiatives for fresh investment. But 9 out of 10 finds SIP WORKS.

Beautiful article Mr. Roy. You are really always helpful to us.

আমি 2007 সাল থেকে এই SIP System এ Invest করে আজ আমার Retirement Fund প্রায় Ready। আমি 2020 তে Retire করবো। Mr. Roy এর তত্বাবধানে আমার আজ প্রায় 34,000 টাকা করে SIP Investment চলে।

Friends, এটা একটা অসাধারন Investment System। আপনি চাইলে মাঝখানে ঐ SIP Amount এর সাথে Any time any amount Top up অর্থাত জমা করতে পারবেন। আমার দেখাদেখি আমার অনেক বন্ধু বান্ধবও এই SIP র মাধ্যমে Invest করে বেশ ভালো আছে।

Mr. Roy এর মত মানুষকে পেলে তো আর কোনো কথাই নেই। Pilot ভালো হলে খারাপ Weather এও Plane ঠিক Land করে। We are blessed that we are associated with Mr Roy.