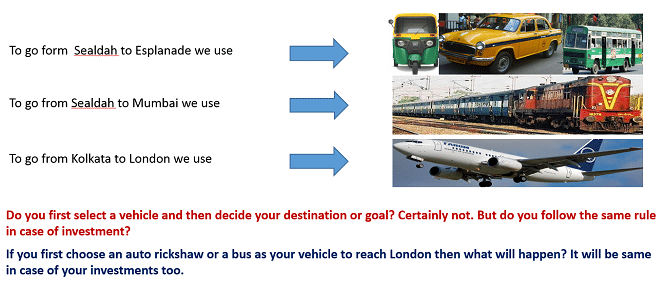

Most of the people have a concept that if they invest in some good product, that product will give a good return, and then he can achieve his entire financial goal. Let’s discuss a bit about this topic. It’s true that without a product there will be no investment. A product is therefore necessary. If illness cannot be cured without medicine, the destination cannot be reached without a vehicle, and the financial success is also impossible without product. But which product is suitable for you, which need to be understood.

The product is like a vehicle. First, you need to decide where to go, then comes the vehicle which is suitable to go to that particular destination. For instance, suppose you want to go Dharmatala from your house, or someone who wants to go to Durgapur, or to Delhi. Not all vehicles will be the same of course. Now if someone wants to go to Durgapur and gets into the vehicle which is scheduled to go for Delhi, what will happen? Whose fault is it- the vehicles or the person who chooses that vehicle?

This is the matter to think. Now there are also some people who cannot even see their destination or purpose. They, however, choose a vehicle according to its performance. Now it happens the obvious. Therefore raises the question, why most of the people cannot see their destination or purpose? Even without going deep into the matter, according to my experience, in most of the cases, it happens to 35 and above aged people. These people cannot see or explain their financial goal. Every time they think of deciding, they remember their previous bitter experiences, previous compromises, without planning for finance in their life etc. Means, logic and passed experiences blocks their dream to achieve the goal. There might be another reason of doing work without pre-planning or without vision in life.

These people decide their vehicle or financial product keeping one thing in mind, and that is to get a good return and another factor, which is safe according to their concept. From my experience, these people can never stay long term in any product, and even if they do so, the reason for which they had chosen the product cannot get. Don’t get me wrong. I have seen this. You may not agree with me. Then comes the question, why cannot you? See, to specify this aim of return or purpose I have seen that was also not very clear. Means, how much percent in return target? Or how much amount target? For how long you want? None of this they learn in specific. The concept they have about safety, they cannot clearly explain. Return and risk are two sides of the same coin that they don’t know about.

So many people have mailed me to ask about some particular product that can give good return. Just imagine, if a patient goes to a doctor and ask for some good medicine to cure his diabetes, how that will be? Generally, I don’t give the answer to this; I don’t give the answer because I don’t have one.

The point is, someone goes to a medical store and buys medicine. Will this happen? Just like no medicine is bad, similarly, no product is bad as well to match your objective with you, a product is very important. For instance, there is numerous asset class, like gold, real – estate, bank- FD, Post office Deposit, company FD, bond, Debenture, Insurance, PPF, Mutual Fund, Share etc. now in these asset class there are also other products. Which product is suitable for your purpose, for that you need professional advice.

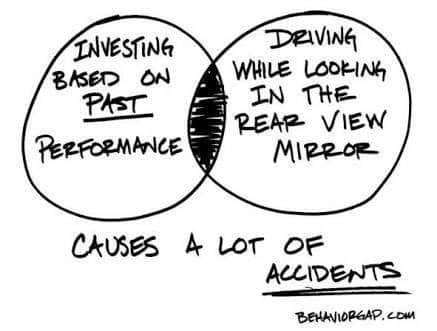

First asset class: each and every product gives an extreme return. Then who runs making purpose in return, he will always run to that asset class that gives more product return, one must understand the basic concept that returns results. Which result? The result of performance management. Keep in mind, performance always rotates. If you remember, even FD or assured return product had given 13% return and interest. Gold gave more than 20% return. Real – estate also gave more return. This same goes for Equity.

Just like a long term’s product or asset plus gives a return that has highest return point, lowest return point, similarly average return point is also there. Just when a product rises to its peak return, it starts descending to its average return. Sometimes it descends even more than its average return. I have tried to explain it in the easiest way without technical jargon.

Which Product has the Lowest Point or have touched the Peak, if one has the expertise then he will be the richest man; there will be no question to this. At least I don’t know any such person. When the FD Interest rate was 13%, if anyone had known that the Interest Rate would increase or decrease, then he would be the rarest person among all. Had anyone ever guessed how much the Gold rate would go up before descending down? If it goes up, then how much it will?

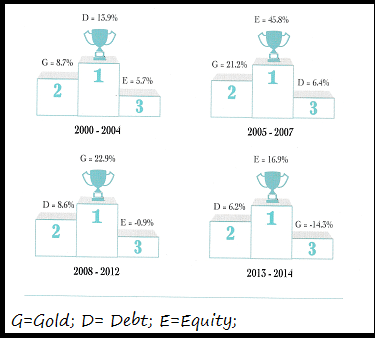

Below the diagram will give an idea.

The truth is he whose purpose is good Return or Result; they generally invest when that Asset Class reaches its peak or gets trapped when the price goes down. From 2000 to 2004, the Debt has given Highest Return, from 2005 to 2007 Equity has given Highest Return, 2008-2012 was the golden age for Gold, again 2013-2014 Equity had held the 1st Position. Who is next has anyone have the idea? Or we will go astray?

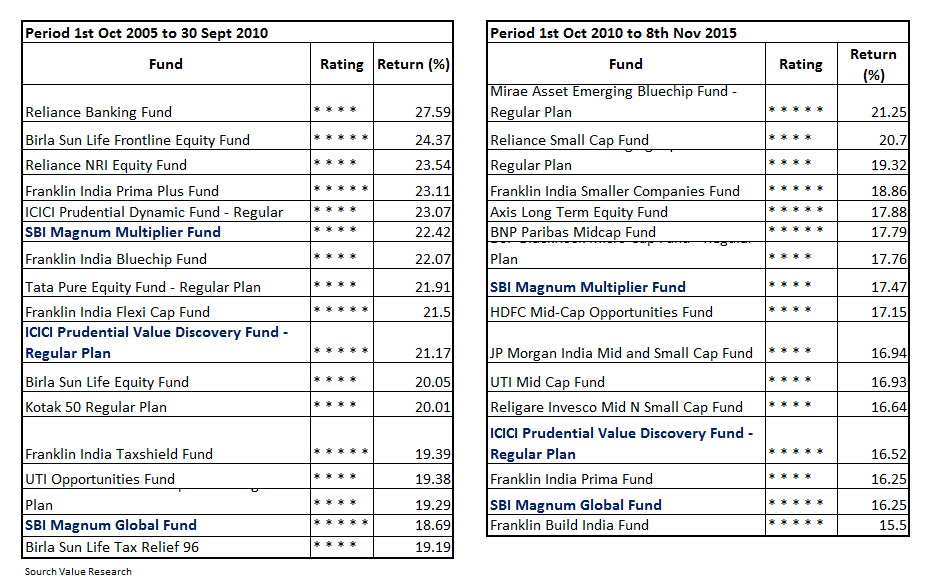

There’s no scarcity of people in Mutual Fund who select a product. They invest in various Website, paper etc in terms of which Product gives the Highest Return, otherwise invest in the product which has Highest Rating. People those who do this, without understanding the concept, I can tell quite firmly that they have wasted their time, which is very essential in Personal Finance. You can do one thing: today the fund you see in the Top Performer Ranking, will you see where they have been two or three years back? Remember performance rotates. Alright, I will show you not two, but five years of Horizon.

During the 10 years period, only three Funds have kept the Star Rating intact. Again you will see, from 2000 to 2007 the Funds those were Brigadier, in 2008 those were turned into a gatekeeper.

The best fund is the Result. After being the Best Fund are you sure you aren’t missing anything in the race? Are you sure you aren’t chasing the golden deer? To look a simple topic in a simple way is the best option. I am telling this from my own experience, many people have brought Speed Boat instead of Submarine due to sheer misunderstanding all for acquiring that speed. If the Media, Website, Fund house can bring any Fund in the front to serve their purpose, your purpose won’t be served. They will give you advice free of cost and you will earn money, is this sounds logical? There are many processes in a short time to Generate Return. Those are, however, not Investment Process.

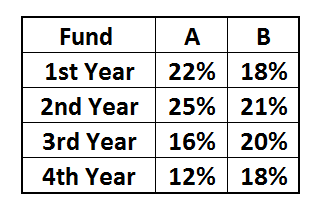

Look the diagram below and think for Long term Investment among High Return Fund A and Consistent Fund B, what will you choose?

Now here comes the question, if you don’t have a very good concept in this Fund Selection Strategy then ask for Help from Professional Financial Advisor. Every Professional Advisor judge several factors like Technical Factor, Risk Factor, and Objective before Fund Selection. I don’t think without proper monitoring one can serve good Product and Purpose Serve, because Economy is always in a state of flux.

For example, suppose two people, both age 30, income 30,000 P.M., Expenses 25,000, the first person’s only dependent is his wife; they live in their own house. Work as a Government Employee. And the second person’s dependents are his wife, one daughter, and his aged parents. He works in a Private Company. Will both the person’s Products be the same?

Two person aged 35, both wants to invest 5,000 Rupees per month, but the person wants to invest for his son’s Higher Educational Purpose, and the second person wants to invest for his Retirement. If both the person’s Higher Performing Fund is received today, imagine what will happen? Means isn’t the matter be like this- one has gastric problem, and the other one has a stone in his gallbladder, both get into the Medical Shop and buys Antacid. Why, because they have not visited the Doctor for Problem Solving, isn’t it? Maybe the Doctor’s fees were saved, but the problem still remains.

The reason for discussing this matter is because many people are there who don’t know me or I don’t know them. They had asked me about this in various emails. I hope I have succeeded in shedding some light into the matter. I think instead of focusing on Product, one should focus on Purpose/ Planning. I am waiting for your response.

(This article was published yearlier in this blog in the Bengali language)

14 thoughts on “A Simple Way You Can Generate More Wealth That Works For Your Future”

Mr. Roy, you have written an excellent article. Even with my busy schedule, I have read Mr. Roy’s entire article but hadn’t commented on it. I had a little hesitation. But today, the article was so good that I had to call him. He told something that really touched me. He told me that suppose a patient came to you and thanked you for your service. That small accomplishment that you have given me is a lot more satisfying.

Friends, from 2007-2009 I personally have visited various websites and have studied them so that I could get a good return after fund selection. But I had faced many “gatekeepers” as per Mr. Roy’s term. But after Mr. Roy’s guidance, I am a tension free man.

He, who is an expert in his own field, we should give him the responsibility instead of taking them in our own hand. Though I have learned it a bit late, better late than never. Thanks, Mr. Roy!

Wonderful article. Thank you.

Excellent and important article. Asset allocation and planning is only the best way for wealth creation. I learned so many things from your various topic.

I also support Mr. Roy’s opinion. If my one small comment can encourage him to write such wonderful articles after many hurdles, then can’t I make a comment? This realization too had come to me after much delay.

This is a very good article that has solved so many unanswered questions. Last of all planning is essential to reach the goal with the help of a good financial advisor.

This is the ultimate solution to reach the financial goal; we need to do first planning with the help of GOOD FINANCIAL PLANNER.

Ashok Da hats off to you for giving us these great pieces of knowledge by excreting efforts.

I have read all your topics and you can say that I am your blind follower.

I have told many people who still think about FD, LIC etc. I have also shared your Royfinance website with them. I can tell that to read your article and to meet you by personally has hell and heaven differences. I am telling this from my experience.

I am going through all your articles from the scratch, certainly, this one would not be escaped. But sir, you, through your articles, have aptly unveiled the financial scenario unnoticed clawing around us and you have tried through them to make us aware and at the same time showing us the fearsome hole full of its wielding tentacles.

Really it’s an awful situation from which you only steer out. I need to sit with you as soon as possible. Thank you.

Mr. Roy, I don’t have words to thank you. You have written a very important and effective article for us. I also agree with your planning and proper asset allocation strategy with the help of an expert is the only solution.

Please don’t mind. I am just sharing here a realization. As Mr. Roy is sharing here new topics every Friday and trying to educate us about finance, will we be truly educated? I don’t think so, because in his term “mindset” is the right term. I always share his articles with my known circle. There, the people’s interpretations have made me think about this. Some may agree; some may not.

I have even told Mr. Roy, and he has also talked about mindset. With that, he also said that if everyone wins, then who will lose? I feel really upset about this. We still can’t properly be paying importance to his honest effort.

Very good article. To achieve any target one needs expertise. Not every person has the same expertise. To get help from an expert and do that work is the only wittiest choice. Just like we get help from Doctors, Engineers, Advocates, and Teachers – but we don’t do that when it comes to investment and for the mindset. Maybe because we don’t know where to go.

Mr. Roy has shown us that road. Everyone will be beneficial if we read his articles and set our mind accordingly. Then it will become very common to go to a financial planner just like we go to a doctor for help. Thanks again, dada.

Nothing can be achieved without planning. Each and every successful human can reach their goal with proper planning and guidance of the expert. So I hope Mr. Roy plays a role as a financial coach for us.

His excellent and mind changing advice will help so many people like me who have a little bit of ideas about financial planning. Thank you, Mr. Roy. Carry on your writing for us.

Thank you, Mr. Roy, for another enlightening article.

You know me. Fifteen years ago I took an escapist route and blindly followed your guidance. However, I followed your learning curve closely and seldom missed your articles and posts, and learned few basics myself.

I must say, your professionalism, commitment, and enthusiasm are exemplary.

I learned a lot with you but this single article demands special mention.

It summarises everything an investor needs to know before taking a plunge.

Your lucid writing enables even the novice to see things with clarity. Keep on posting such wonderful articles and enlighten us.

Asoke Babu has explained the concept of objective and proper selection of Product.

Those who don’t know about this have been benefitted.

I just have one request to everyone. Please consult a proper Financial Planner before any type of investment, otherwise, your whole money might get spent for nothing.

This is by far the best article on investment I have ever gone through till date. Very logical. If I don’t understand my future purpose then I will also not understand my real requirement.

Investment is a huge subject that needs experience and knowledge. Taking a step without understanding any option will have a 100 percent risk. Also, the investment will not be beneficial.

There are a few basic techniques of investment that we cannot work out due to sheer ignorance. I must say that I am very much thankful to Mr. Asoke Roy. I salute his intention of showing people the right way in a time like this.

Mr. Roy you have exactly narrated the features of investment as a whole.

1. Investment options, in your word the vehicle, should be chosen as per the requirements/destination in your example.

2. Good-Better-Best is the state of investment just like Solid-Liquid-Gas. However, we should rely on an expert to decide our intake.

3. Now between different investment options Investment in Mutual Fund is comparatively better than others. And you rightly justify your views in your write up.

4. The Mutual Fund Investment is like all season product. There are varieties of product for all purpose. In your word whether to go Dalhousie, Durgapur, Delhi, Denmark, and Mutual funds have vehicles / Product.

5. Last but not least the example you have given is really awesome.