By staying in this profession for a long time and by communicating with people around, I have started to know that most people want to be financially free and create wealth, etc. But by the end of the day in between wanting and getting it, most of the people end up with disappointment for not getting what they wanted. So they start to blame either the fund or the product and also themselves for not knowing or thinking about these things beforehand, for it could have been better. I might say that you are partially correct, why am I saying this come let’s try to make you understand.

Generally, small, average or big service holders or small businessmen or also some self entrepreneurs, these people get engaged amongst this problem, so why only they? Because their amount of income is dependent upon a linear equation. The equation is, RATE X TIME=INCOME. This matter needs a little understanding. RATE means the salary or income you have, take for example the income of an individual is 1 lakh rupees, and the time to be provided for that is 10 hours, therefore the rate per hour is 1,00,000/10=10,000. Now let us assume that the person increases their rate by his/her qualification, quality or by changing his job again and again, and makes it to 20 thousand or 30 thousand per hour. But the question is for how long can they do this? Today experience is not deciding the rate, with experience the salary increases are right, it is increasing, because of the inflation, the real rate is not increasing. Now, who is deciding the rate, employee or employer? Obviously the employer. When someone else is deciding your finances then is it possible to be financially free in this condition? Yes, it is also possible, I will tell you later.

Now imagine if the rate of that income becomes zero for some reason, then whatever time he has in his hand, his income will be zero. This line of the equation is the only big insecurity. Today, most companies are replacing a high-rated employer with a comparatively low-rate employer. Today most employers working on a system base are not experienced, rather they look for creative skills, communicating skills, negotiation skills, etc. That means we can say that at a point that we can increase the rate but it has many limitations also. Above all, the employee here is not able to fix the rate of the Linear Equation. That means from this Linear Equation we cannot easily make unlimited income maybe.

Now in the Linear equation, the other input is time. Nowadays, even the 8 hours working has also been obsolete because in the working area most of the time get involved in Passive than Active time, only to maintain present income. But time is limited for every person, in this equation it is 24hours. Now if the time for the person in this equation becomes Zero or given time is zero, then HIGH RATE X Zero TIME = Zero INCOME.

Now suppose if anybody has his income through rent, then does he have an active income depending on active time? Now suppose if someone writes books, or sings songs, or by doing any creative work, they get royalty income, for them, is this linear equation worth applying?

Any girls or boys who are making a mobile app, which has become popular, an income will be earned by them even if they aren’t working. Suppose someone has an investment in shares of a good company, the dividend income of that person will automatically be earned, isn’t it? Now let us assume that someone has collected Rs 2 crore via processing in investments and suppose growth rate of that fund approximately 12%, now 10% of this 2 crore that the person has, that is, 20 lakhs can be taken as his INCOME, which means monthly the passive income is Rs.1,66,667 approx. For this, the person doesn’t have to spend an active time and at the same time, the asset of 2 crores is increasing. Likewise, there are many people around us who are creating assets and having their passive income.

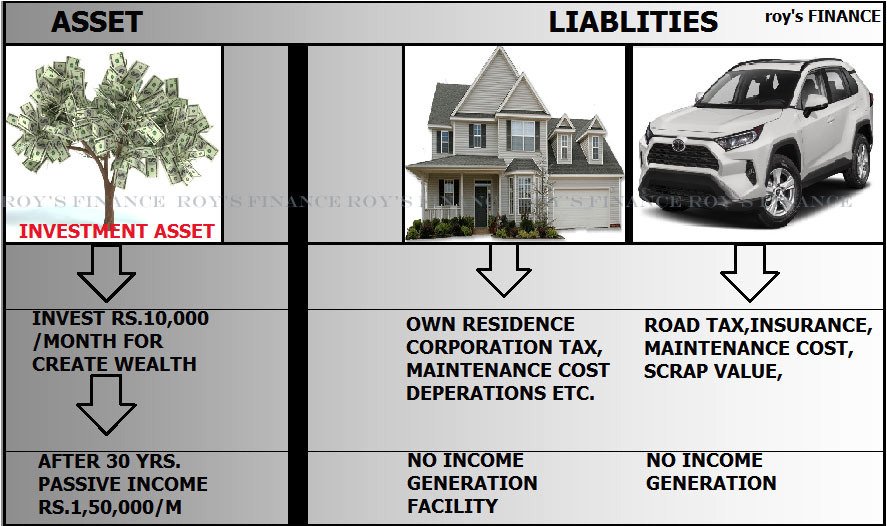

So, here we get to know that, by staying in the linear equation and having limited income and by avoiding instant gratification and using the judicial rule, if we create any investment asset or by creating any creative asset only then we can make our passive income possible, which is not dependent upon the linear equation. In this equation, we work for money and we have to do this by creating assets by which the money will work for me. (some are assets and some are not assets and to understand this you can take help from this book which is by Robert T Kisaki, rich dad, and poor dad).

Actually, we are conditioned for instant linear gratification in linear equations in our childhood, “study hard so that you can get a good job ’’ likewise there are thousands of sentences in our subconscious mind that are conditioned in our brain. For this reason, only we think that our house is our asset, our car is our asset and also our jeweler is our asset. The reason behind this is because in our so-called linear society these things have been given recognition and gratification. So with this mindset, one cannot control their expenditure. We have to keep in mind our spending habits determine our destiny –rich or poor. Because our lives will be framed according to our habits. Remember our mind is our greatest asset.

Individuals staying in this linear equation have a much bigger problem that is tax burden. Generally, tax has to be given by every income earner whether less or more. but the individuals doing jobs or services are affected by this the most,

See we had taxes in our ancient times as well, Akbar also took taxes from the people on the basis of the number of windows they had in their houses, unbelievable isn’t it? But you should always remember that tax, for any government or for an emperor, is a big source of money. Same as it is now. Even then people wanted to somehow escape from paying taxes, even today people do the same before the servants of the emperor came for the taxes. The people used to cover their windows with mud and once they were gone they used to open the window again.

Then most of the time the government used to take the excuse of the war and play with the emotions of the people and burden them with taxes. Then they used to forget to release them from the burden of the tax. To fight against Napoleon, Britain added a tax burden on the people in 1799. Even America put the burden of tax on its people in the civil war in 1861. In the year 1913 United States US’ constitution amendment permanent the tax.

If I want to gather knowledge about the history of tax, then come to know that Robin Hood used to take money from the rich people and distribute all the money to the common and needy people, slowly turning into a hero for them .then the government for stopping him and to become part of the heroism, for the first time added pressure on the rich people of the society. And as a result of this, the poor people were extremely happy, and rich people were annoyed, but the rich people always controlled the society, economy, and country. And as a result of this, they created pressure above the government of the society, but till this time the government had already fallen into the trap of greed for tax. The government exempted tax from the rich people by their pressure and intelligence, and this was adjusted by adding new taxes for the middle-class people.

Firstly, the middle-class people led a revolution against this, but then, according to the rich people, the government emotionally influenced the middle-class people. They said that the money from the tax is used in developing our country, and the government managed and made them understand their participation and told them that this was their golden opportunity to become a patriot. Even now these sentiments are still affecting.

At the same time, the English introduced the education system in the country which resulted in many jobs, they needed this at that time. By adding taxes on their income the government enjoyed a good income. From here began the burden of taxes on linear income. The indirect tax plan was given by the government to the people of this linear equation to not set their share in the rich people‘s wealth .government increased their income and to the exchange of this the rich people by using their intelligence somehow managed to decreases their taxes, this tradition is still continuing (I’ll discuss more on this topic latter because speaking more about this topic will make this writing much bigger).

Suppose, today you have your income through the linear equation, you and your entire family have gone to a relatives wedding by car, the money involved here is your expenditure to get there isn’t it? Now the owner of your company will have the same expenditure, but he will show this expenditure is for the company’s P and L account, so they will get a discount on tax for business allowable expenditure. This creates a major difference.

A linear equation person who belongs to the 30% tax slab, has to pay his own monthly salary for direct tax. After this comes silent tax, which means indirect tax and this means a tax on all the expenditure. Imagine that the rate of linear income already depends upon the rich employer, and even the time is given by the rich employer, with this only the income is becoming limited, and top of this comes the government’s tax. After this, think about the condition of the logical and emotional middle and upper-middle-class people, their minds have been conditioned that way by their advice and pressure their children to do the same.

If a linear equation person has some ancestral property and if that person can rent it and get income through this, then that becomes passive income where your income will not be dependent on time. The problem will be here as well. Or if you have any creative or technical skills then use them as a source of passive income. Then only money works for you.

Otherwise, you can start investing with a little patience by controlling your present unnecessary expenditure. Always keep in mind that investment is a science of money, making money requires a mindset because if you can’t beat passive income inflation and be tax-effective, then there can be no solution.

Suppose someone at the age of 30 is investing Rs.10,000 per month, then at the age of 55 his approx income will be Rs. 275.6 lakhs, And if someone starts at the age of 35, to invest Rs.10,000 per month, then at 55 age the approx value will be Rs 132.7 lakhs.

Suppose someone at the age of 40 years, starts to invest Rs. 10,000 monthly, therefore when the person is 55 years old the value of the investment will be approx Rs. 61.65 lakhs.

The problem is that most people are conditioned to their mind’s child state and in such a way that they start taking a long time to think. It causes a lot of damage to the creation of passive income.

For example, a person starts investing from 30 years of age, saves Rs.10,000 per month, at the age of 55 it will be worth around 275.6 lakhs. If the same person delays about 6 months for starting the investment, then his monthly investment of Rs.10,000, will become approx Rs. 2.56 crore at the age of 55 years. Time loss in investment takes finance far behind. In 6 months delay, he gave 10,000*6=60,000 rupees less and therefore receives Rs 2.75-Rs 2.56= Rs.19 lakhs less. This is the reason I had said that MIND IS OUR GREATEST ASSET.