There are still many people who do not have the right knowledge about Insurance and end up buying an Insurance Policy or spend their lives without one. Then, one fine day, when such a situation arises, they regret their decision of not having a policy. Few refuse to shed their old opinions and inflict those ideas into their children’s lives and refrain them from buying essential policies. If a child is born at home, they advise buying Child Policy and endowment plans for Tax savings.

Here, in this article, I will tell you how an Insurance Policy should be.

Insurance Planning

Life Insurance is a very important aspect of one’s life. It is very wrong to judge insurance as a sort of investment. Similarly, not having an insurance policy is also a wrong judgment. Now let me tell you why is it wrong to consider insurance as an investment. Apart from the premium, you are paying, a large part of the amount invested goes to the policy term if for any reason the insured dies to be claimed later on. The remaining amount is then invested in Government Bond and Securities. At present, the rate of Government Bond is 5%. I have purposefully mentioned the rate here so that you can get an idea of the returns from an Insurance Policy.

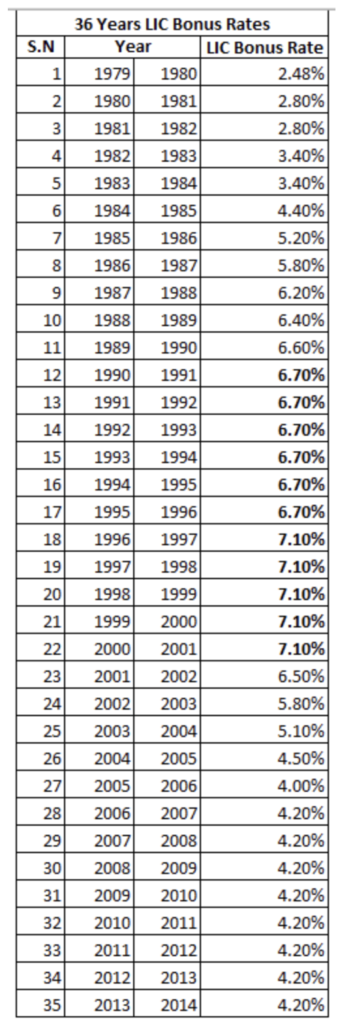

Once the Insurance Company receives this interest, they have to pay the Agent Commission and other office expenses. How much money will they have in their hands to pay you? Insurance Return is basically a bonus. There is no chance that the bonus credited to your policy account every year will be compounded again. Please go through the chart below that shows the gradual decline of the bonus rate (the so-called Insurance Return) in 35 years. Between the years 1987 to 2002, the bonus, given by any Insurance company, was around 6-7% as the interest rate was higher during those times. With time, the interest rate has heavily dropped but many of us are still holding on to the myth.

Insurance Bonus History

The above chart shows the data that I have received till 2013, hopefully, each one of you can understand which direction the trend of bonus was heading to.

Importance Of Life insurance

As I have said before, insurance is an important part of one’s life. What makes me say so? Suppose, there’s a perfect family photo of you, your wife, and your children in your bedroom. Now press your face in that perfect family photograph and imagine what would happen to those smiling faces in your absence. Would those faces be still holding smiles? I think not.

There are many reasons as to why having Insurance is essential –

Expenses Replacement

Firstly, for the security of your family in your absence. That is to say, the way you ran your family while you were alive, should remain the same in your absence, your wife shouldn’t have to withdraw the Fixed Deposit for your children’s education. In a word, Insurance is needed for Expenses Replacement. The death of a man means the death of a husband, the death of a father, a death of a son, and the death of many unfulfilled dreams. Keep in mind that Insurance is not for Tax Savings or Insurance Investment but solely for the protection of your family.

Income Replacement

Another reason is Income Replacement. In other words, the income that you used to run the family should be covered by your Insurance coverage in your absence. The concept is that the money obtained from the insurance should be kept in an assured place by the nominee and can be used to meet the current income. Now think about the Endowment you have and the Insurance policy you have, which of the above-mentioned purposes can they fulfill? If not, then try to realize what purpose this insurance is fulfilling in your life.

I am trying to explain the purpose of proper Insurance planning by giving an example. Suppose a 30-year-old buys a Sum Assured (Life coverage) Insurance Plan for a period of 20 years for 5 lacs because he has been assured that he is entitled to get Rs. 10,65,000 upon maturity. He has to pay a sum of Rs. 27,750 as a premium every year.

Generally, a person doesn’t think of any purpose behind buying insurance. He is only concerned with tax exemption and the amount he will get as a return should be more than what he has invested. So, in the above example, we find the person is paying 27,750 x 20 = 5,51,000 and is getting a return of Rs. 10,65,000 which is almost double the amount he has invested. This is a big mistake. No one calculates the return amount or maybe, they do not know how to calculate the return. Not only that, do you think this 5 lacs is enough for lifetime coverage?

If the person dies due to some reason, his family would be getting the compensation amount of 5 lacs and the bonus that has been accumulated until the time of his death.

Now the question arises, can this amount replace his monthly income or expenses that he incurred while he was alive?

If the person is alive, then he would get a return of Rs. 10,65,000 after paying a premium for 20 years. The biggest flaw of this insurance product is that it reveals how much return an average person would get after 20-25 years and the amount makes the average person go crazy. Not everyone knows how to calculate return. If we calculate the rate of interest in this example then it’s 5.92% which is a little % more than what banks provide.

In other words, this person has purchased Insurance that can neither meet the needs of his family in his absence nor can yield a good return while he is alive. So the amount of money you are investing is neither providing you with any protection nor giving you any guarantee or investment returns. Always remember sufficient insurance is still better than no insurance at all. So what is the solution? I am going to discuss two solutions below.

Alternative Solution

If the person lacks a risk-taking mindset and doesn’t want to spend more than Rs. 27,550 then he may purchase a Term policy of 50 lacs for 20 years i.e up to 50 years paying a premium of Rs.6000 annually. This Term policy is the ideal insurance policy. Now the remaining amount (27,550 – 6000 = 21,550) can be invested in the PPF account annually. If you continue depositing in the PPF for 20 years with interest @7.8%, you will receive an amount of Rs. 10,39,830. Now you decide, which one is better for you? Even if the person dies all of a sudden, his family will get a compensation of 50 lacs which will also fulfill his purpose of insurance.

What could be the other option? Suppose this person wants an Inflated Adjusted Return then he can opt for a SIP along with this Term insurance by paying only Rs. 450 more annually i.e 2000 each month. As the investment will last 20 years, he can expect a 15% return. In that case, a fund of 35,37,235 needs to be invested even when the Life coverage is active. Through this plan, he was able to create Family Protection as well as Inflated Adjusted Tax-Free Wealth Creation. Now think which one would you prefer?

Both the options have risks involved, the first risk is called Inflation risk. I will explain it. If you look at the 10,39.830 rupees in the PPF account, if the inflation rate is at 9%, then the value would be 1,85,000 at present. Is the amount sufficient to do anything? This option has a silent risk in it. You need planning and advice from a financial mentor who is skilled in managing and controlling risk.

Don’t be afraid. Everyone makes mistakes, I made them too. What would you do if you have already purchased such an insurance policy? What should be done if something goes wrong?

You can click on the link to know more about it.

“You Are Not a Product of Your Circumstances but a Product of Your Decisions”.

Frequently Asked Questions

Many of you have sent questions that I am trying to answer here. Your feedback regarding this article is equally important.

Q: What is Insurance Planning?

A: The method of calculating how much insurance a person should have is called insurance planning. For example, one’s name, current age, Spouse’s Age, Spouse Life Expectancy, Total Child, Child Age, Higher Education Age, Marriage Age, Monthly Expenses, Rate Of Inflation, Risk-Free Rate of Return, Return on Investment, Current Cost of Higher Education, Current Cost of Marriage, Current Insurance Coverage, etc all these important data are considered while purchasing insurance. This is an arbitrary example.

Q.What are the 4 types of Insurance?

A. These are the major types of insurances –

- Health Insurance

- Life Insurance

- Home Insurance

- Car Insurance

Q: At what age should you get Life Insurance?

A: Insurance is for protection. So it is advisable to get one as early as possible. It should also be kept in mind that one cannot opt for insurance anytime they want. If someone falls sick all of a sudden and applies for insurance, his proposal may not be accepted. He cannot be insured even if he wants to. Therefore, one must get life insurance as early as possible.

Q: When should you stop buying life insurance?

A: When one sees that no one is dependent on him, he has created enough wealth and his dependents will have no problem in his absence, then he may stop the Life Insurance.

Q: What are the main plans of Insurance?

A: There are many types of Life Insurance plans, it varies from company to company –

- Term Insurance

- Term Insurance with Return of Premium

- Whole Life Insurance Plan

- Endowment Plan

- Money Back Plan

- Child Insurance Plan

- Unit Linked Insurance Plan

- Group Life Insurance Plan

- Retirement Life Insurance Plan

- Pension Plan

- Single-Premium Insurance Plan

Q: How can Life Insurance help in Estate Planning?

A: Life Insurance can be a worthy part of Estate planning. It is because, through life insurance, one can transfer his desired money to his beneficiary without any hassle of probate in his absence.

Q: Is Life Insurance good for Estate planning?

A: The answer can be found in the previous question.