Many people invest in Mutual Funds without a proper understanding of what it is or how it works. Then if they face losses, it is natural human behavior to blame the person or the product associated with it. The interest rate given by banks has decreased drastically so has the investment options, therefore, this problem has arisen. Mutual Funds have many types of funds under them. They are Debt Funds and Equity Funds. It is a common wrong belief of people to associate Mutual Funds with the Share Market. I will attempt to introduce you all to other funds of Mutual Funds except Debt funds through this article.

It should be noted that Mutual Funds are governed by Mutual Fund Regulation, 1996 in accordance with the law and by the Securities and Exchange Board of India (SEBI). The product that Mutual Funds manages is called a scheme. Several such schemes come under the Mutual Fund. Each scheme has its own purpose or objective.

It is very important to know the purpose of your investment before investing. Otherwise, you may get on the wrong train and reach Hyderabad (scheme) instead of Delhi. On a serious note, this may cause grave trouble in your future.

The majority of the schemes of Mutual Funds are open-ended which means one can invest and withdraw at any time. In the case of Closed-ended funds, withdrawals can only be done upon maturity. Fixed Maturity Plan (FMP), Capital Protected Oriented Scheme are the types of Closed-ended funds. Then they are a few which are basically Closed-ended funds but for two days of the month, they provide entry-exit like open-ended schemes. These types of funds are called Interval Funds.

The Products or Schemes of Mutual Funds are slightly different than other financial products available in the market. The scheme of the Mutual Fund is called Portfolio. You may have invested Rs. 5000. This amount is invested in various companies and in many cases, the performance of one company with another may be negatively correlated. This minimizes the Risk of Investment. Now think what would happen if someone jumped in looking only at the return and performance without noticing this little technical thing?

Mutual Funds have a few schemes which are known as Diversified Equity Fund. Suppose you have invested in this particular Fund and the Fund invests that amount in different sectors and companies of different sizes (for example, Large companies, Medium companies, Small companies). This reduces the risk as the amount is spread over into different areas. If you judge this Fund by Return or Performance, then you may get cheated in the future. It is important to know how much return the fund has given in different Market Cycles and how much Risk it has taken for it.

Now I am going to talk about two schemes which made many burn their fingers. One is Thematic Equity Fund. In this scheme, money is invested based on a Theme. One of the Themes is Infrastructure. During the year 2007-08, many people believed that investing in this fund would let them make a lot of money overnight. Whenever the Theme doesn’t work out and they all become impatient and skeptical. In most cases, whose only purpose is to get a Return, they have burned their fingers by investing in this type of Risk in short term.

If someone is capable enough to understand which Sector (Auto, Pharma, or Banking) will perform in the upcoming days, then he may invest in Sectors Fund instead of Diversified Funds to get more returns. But the common naive man doesn’t know how to Assess Risk and only sees Returns, and so he gets into trouble. Personally, I avoid this kind of scheme. In case I opt for such schemes, I use a lot of strategies and close monitoring on them.

Schemes of Mutual Funds are managed by Professional Fund Managers and therefore, after extensive research by their Research Team, if they find any Company having high shares and with Expected Growth in the future, they invest in such companies immediately. These types of Funds are called Growth Funds. In other cases, if the Fund Manager finds out about a small company but has the potential to yield high shares in the near future, they invest in them too. These kinds of Funds are called Value Funds.

If there is anyone among investors who fear risks yet want to get a good return, then he may invest in Hybrid Funds. These funds are a mixture of Equity and Debt Fund. Similar to Monthly Income Plan (MIP). The maximum equity exposure can be 30% in this scheme. There are other schemes having less equity exposure. Moreover, if someone wants to invest in the long-term taking fewer risks but expecting higher returns may invest in Hybrid Equity Funds. Here, the equity never goes below 65%.

For someone who fears the volatility of Equity Mutual Funds yet wants to earn higher returns than Fixed Deposit Schemes, he may choose Balanced Advantage Fund. The amount of Equity to be kept in this Fund is based on the valuation of the Equity Market. If the Market Valuation is cheaper then the Fund’s Equity is increased and if the Market Valuation is Costly then the Fund Equity has less exposure. Naturally, these Funds are less risky.

Another popular and very effective Fund is Equity Linked Savings Scheme (ELSS). By investing in this fund, you can avail tax exemption of Rs.1,50,000 under Section 80C. This discount is available with a 3 years lock-in period.

Apart from these, there are other types of funds too. They are Fund of Funds (Like Gold Fund), International Fund, Arbitrage Fund, Exchange Traded Fund (ETF), Commodity Fund.

I tried presenting an idea by avoiding the technical terms as much as I could. Finally, I would like to state that just the way Mutual Funds have Schemes and those schemes have objectives, similarly, there are scientific ways to measure the risk, performance of these schemes.

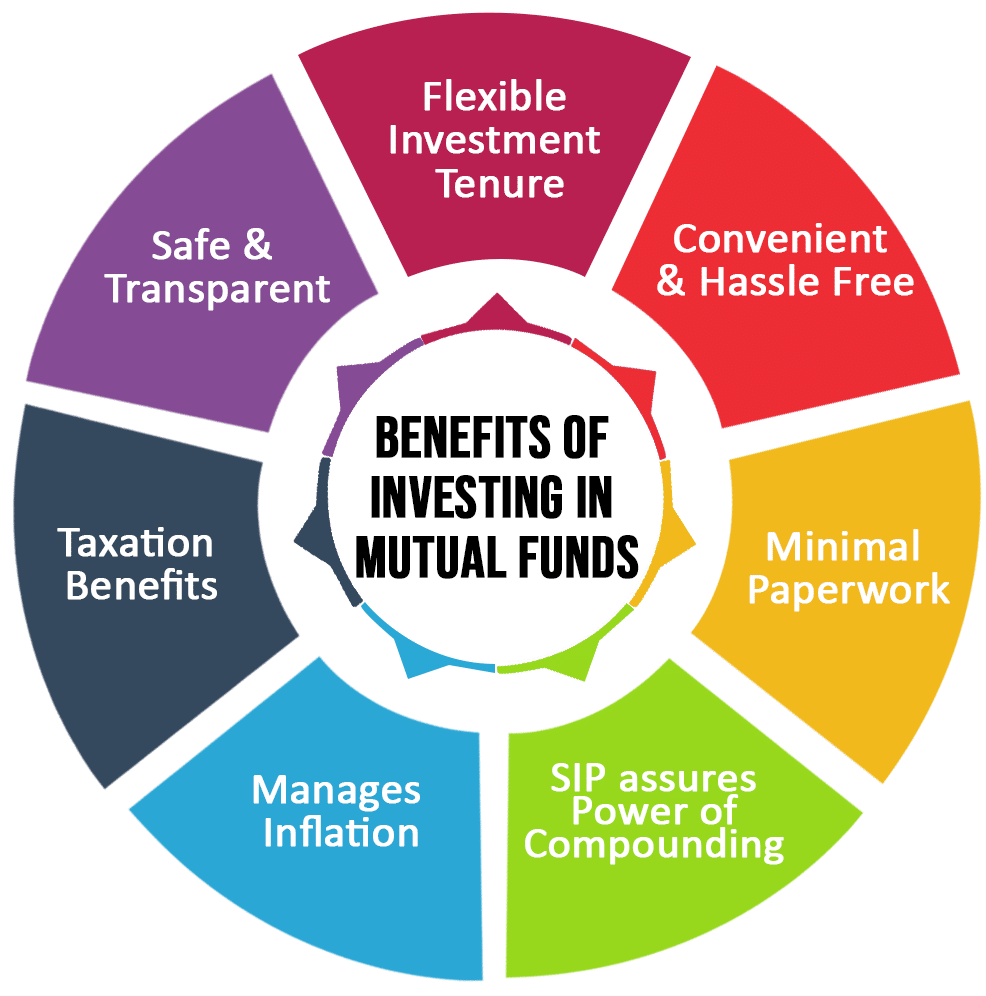

I haven’t come across a single person who had invested in Mutual Funds just in the lure of a good return and left with the same. If that was the case, there would be no Science, Method, or System. The image below may give you an idea as to why you need to consult an experienced Advisor for your Mutual Fund Investment.

The biggest advantage of investing in a Mutual Fund is that one may make a one-time investment of Rs. 5000 and Rs.100 monthly. Even with this little amount, you are allowed to use this money in 30 different research companies. Think about it, is it not of great advantage?

My earnest request to you all is to find a specific Purpose before investing otherwise unnecessary troubles have to be faced.

Many of my readers have dropped questions that I am trying to answer here in a lucid manner.

Q: Are Equity Funds High Risk?

A: In the Short-Term, Equity Funds are more volatile in nature therefore, the risk is also more. However, in Long-Term Investment, the volatility decreases and the return is higher.

We recommend everyone to invest in Debt or Hybrid Funds instead of Short-term Equity Funds.

Q: What is the difference between an Equity Fund and a Mutual Fund?

A: Mutual Fund is a generic Term. It is basically a Pool of Funds where one can invest any amount according to their investment objective. Mutual Funds have various kinds like Debt Funds, Equity Funds, etc.

In simpler terms, Mutual Fund is a generic term like ‘School’. School can be of any kind- Girl’s School, Boy’s School, or Musical School. Similarly, Mutual Fund is a generic term and has many different Funds in them.

Q: Which Mutual Fund is the best?

A: There is no clear and direct answer to this. It is like asking a doctor which is the best medicine for a headache. It is difficult on the part of the doctor to recommend the best medicine with guaranteed results. So this question is simply invalid.

It is very important to know the investor’s purpose behind the investment, his risk appetite to choose the correct fund for investing. A fund is like a vehicle, you need to know your destination before getting on the vehicle(fund).

Q: Are Equity Funds safe?

A: If someone is worried about Capital Loss, then he may invest in Long-term equity as it is less volatile and generates higher returns. It is probable that these funds can beat inflation therefore, instead of investing in Short-term equities which render higher risks, you can choose Long-term plans.

If someone is worried about losing their money by investing in Equity Mutual Fund then I will tell you there’s no losing money but one has to face the volatility of mutual funds.

Q: Can I lose all my money in a Mutual Fund?

A: Will I meet with an accident if I go out? Will I drown if I go on a vacation to swim in the ocean? Will I suffer from a heart attack if I get on a Roller Coaster ride? Please do not take me otherwise, but all these questions are rhetorical which means they can be both answered in YES and NO.

Now let me make a list and tell you how one can lose their money in Mutual Fund:

1. Investing by focussing only on performance without checking your risk-taking ability and without judging product suitability.

2. By looking at someone else’s investment and returns and not realizing your own purpose or objective behind the investment.

3. If you invest in a fund that has high volatility for a short time.

4. Getting panicked and withdrawing all money during a market correction.

One may avoid these points to avoid losses. Also, it is recommended to consult an AMFI Registered Mutual Fund Distributor to avoid such losses.

Q: How do Equity Mutual Funds work?

A: Each Mutual Fund has an objective. Now when an individual matches his objective with an equity fund, these funds invest in various stocks or scripts according to the fund’s objective. The profit is then distributed among the investors proportionately.

Q: Why are Mutual Funds bad?

A: Nothing can be good for everyone or bad for everyone. I think the question should be what are the demerits of Mutual Funds?

It is important to understand that Mutual Funds are passive investments. In return for the money invested in Mutual Fund, the investor is not given any direct stock but units. This fund is managed by Fund Managers therefore, a small amount is charged as expenditure for the Fund managers. The stock is selected by the one who is investing.

Q: What are the 3 types of Mutual Funds?

A: Mutual Funds have a number of kinds. The 3 kinds are Debt Mutual fund, Hybrid Mutual Fund, and Equity Mutual fund.

Q: Can you get rich by investing in Mutual Funds?

A: Rich is a relative term. So the question should be, can someone create a large wealth by investing in Mutual Funds?

The answer is a yes. Mutual Funds have beaten inflation in a diversified way and helped many to create wealth. So anyone who can realize the importance and working of Mutual Funds can create wealth.

Q: Is Mutual Fund tax-free?

A: One can get tax exemption in Mutual Funds under two categories, they are-

a. One can get an exemption of 1.5 lacs under Section 80C in which the ELSS Category Fund is the most popular. The lock-in period is 3 years. Someone can not only get tax exemptions but also obtain higher returns.

B. One can withdraw money upon maturity and after fulfillment of their specific goals.

Q: What is the safest Mutual Investment?

A: If Safest Mutual Fund means low volatility then different types of Liquid fund or Fixed Maturity Plan can be used under Debt fund.

Q: Do Mutual Funds really make money?

A: Long Time in Mutual Funds means out of all the funds that have passed 15 years, judging by the performance of 67 funds, it has been found that the fund that has given the highest return is 22.96% and the lowest return was at 10.13%. This year’s average return has been 16.19%.

If this is calculated for a period of 20 years, then it can be seen that the highest return in those 20 years would be 24.21% and the lowest return would be 12.53% while the average return would be 18.63.*

Hopefully, it is understandable from this information that the ones who have invested in the Long-term Mutual Funds were able to create wealth or earn money.

*All diversified equity funds which have completed 15 years and 20 years respectively as of 30th April 2018. Anchorage presentation.

Note: The examples or return % used is used just to explain the concept of Equity Mutual Funds. Mutual Funds are subjected to Market risk, kindly read the offer document before investing.

I am just an AMFI Certified Mutual Fund Distributor and this article has no purpose of planning or advising anyone but to clear the concept of SIP and create awareness for the same.

If you want to add some value to this article, feel free to write to us. Your feedback is important to us.