“Mutual fund is not an OTC product, it is an advice based product” – why am I saying this? I will try to make you understand this as quickly as possible. People who want to drive their mutual fund journey all by themselves mainly focus on the mutual fund names that they see in websites, newspaper, hear from some so-called “expert” or decide by seeing their past performance and returns. They don’t pay attention to many technically sound funds which have a huge possibility of good performance in the future.

I will try to explain you this situation by showing you the last 10 years movement of just 2 mutual funds. One of them is HDFC Top 200 Fund, which is a very popularly known Large Cap fund and the other one is DSP Microcap Fund which might be known to some people now but 10 years back no investor would have agreed to invest in this fund. I am not personally biased towards any of these funds. All I am trying to do is to illustrate this topic by taking an example of these two funds. I am not trying to do a review of these funds.

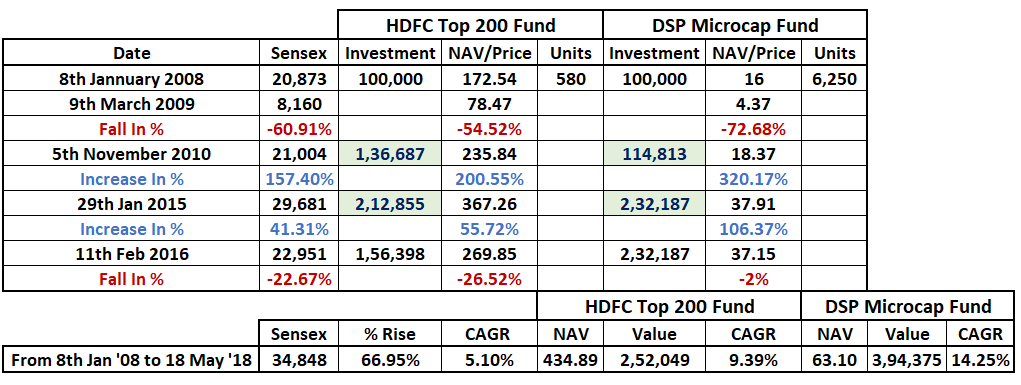

In 2008, when equity market (SENSEX) is at 20,873 points then person X decides to invest Rs, 1,00,000 in the very popular HDFC Top 200 Fund. At that time the NAV of the fund is Rs. 172.54. He used to consider himself as a fund manager and used to observe the movement of the fund twice every day.

At the same time, there was another person Y who consulted with his advisor and invested Rs 1,00,000 with a goal of 15 years in DSP Microcap fund. At that time, the NAV of the fund is Rs Rs.16.

One year later in 2009, the equity market witnessed a huge fall of 60.91% and went down to 8,160 points. The HDFC fund saw a fall of 54.62% and its NAV was Rs. 78.47. At the same time, DSP fund also went down by 72.68% and its NAV was at Rs. 4.37.

This is the time when an investors mindset is put to the real test.

The fund value of the person who invested in the HDFC fund is (580 X 78.47) = Rs. 45,512 while the fund value of the person who invested in DSP is at (6250 X 4.37) = Rs. 27,312. The investment value is same for both of them, Rs. 1,00,000.

“Such a huge loss in just one year?” – the person who has invested in the HDFC fund seeing its past good returns is very disappointed. He is desperately looking for way-outs. At the same time, the media is only promoting negativity. Those so-called experts who suggested him to buy this fund at that time, are not suggesting him to shift to another fund which is showing some promise.

And the person who has invested in DSP fund had a fixed goal of 15 years. He hardly opens and monitors his funds’ movement. He comes to know about this from media and talks with his advisor. His advisor ensures him that there is nothing wrong with his fund at all. This is just a normal market fall. This kind of volatility is expected in the equity market in the short term. He ensures him that his return expectation of 12% in the long run after 15 years will be fulfilled. This is just the beginning. There is nothing to worry.

One year later in 2010, market (SENSEX) went up by 157.40% to 21,004 points. The HDFC fund has increased by 200% to Rs. 1,36,687. But the sad news is that person X has already withdrawn all is investments from HDFC fund listening to the suggestions and advice from his friends and relatives. His friends told him that mutual fund is like cheat fund and convinced him to take out all his money. Now he has lost his money and is in trouble.

But person Y is in no worry at all. He comes to know from his advisor that his fund has also increased to Rs. 1,14,813. He is happy that it has increased but it has still not close to fulfilling his purpose. But his advisor ensures him that it will increase further given the time it needs.

I am not going to go through each of the years now. While analyzing the DSP fund this May, I say that the fund has grown to four times of its value and is at 14.25% CAGR return while the so-called popular HDFC fund is at 9.39% CAGR return and has grown to 2.5 times only. The person has still left with a few more years to fulfill his goal.

It can be that the DSP fund might not perform well in the future while the HDFC fund can perform really well. But how will you judge which fund can perform well and which can’t? Do you want to know why I am saying, again and again, the product is not important planning is important, just CLICK here

- Don’t take decisions considering the short-term returns,

- Only invest keeping in mind your actual purpose and goal and also your risk-taking capabilities,

- It can be very risky to invest in a fund just by looking at its past performance and returns,

- Take help from a qualified advisor,

- Don’t observe your investment every day. It’s a bad habit which will only make you quit in bad situations.

- Have trust on your advisor and what he is telling you.

It is completely up to you to follow this advice. It is your investment, your purpose, your wealth creation so you definitely have the right to follow what you want.

I hope this article will help you make better investment decisions. Don’t forget to share your feedback and comments on this.

2 thoughts on “Mutual Fund Is Not An OTC Product [In English]”

Excellent & thoughtful article.

You are really an advisor. I am very much benefited from your advice.