The National Pension Scheme (NPS) was launched in 2004, as a pure-defined contribution product based pension system, which seems still confused about its design, marketing and taxation even after eleven years since its launch. The scheme has failed to nudge people into long-term savings that might provide a comfortable retirement income due to its cumbersome structure, the corpus taxed at the time of maturity and hence, technically flaw in product itself. With a view to giving a major boost to the NPS, the finance ministry decided to credit Rs 1,000 into each account opened in 2010, for five years to make the product more attractive. Even though, the scheme has not gained so much ordinary people. To rejuvenate and make more attractive the scheme, the Union budget 2015-16 has not only proposed to increase the tax-deductible investment limit for NPS under section 80CCD from Rs 1 lakh to Rs 1.50 lakh but allowed as an additional deduction of Rs 50,000 under a new inserted section 80CCD(1B), over and above the limit under section 80C.

After this announcement, many people may be thinking about using this scheme to make route to pension planning and seeking to have another reason to save additional tax. But, the unfortunate answer is that there is no clarity about its returns and the tax incidence at maturity. Will you invest into that product where no one knows with certainty, and no one in the government has bothered to clarify? So, before investing into the product, it is imperative to understand its core features, explore other options and its tax advantages. Read the fine print and make decision as own.

Like other long-term investment products, the scheme is allowed with a minimum annual contribution of Rs 6,000 and money get locked in till the age of 60. The contributions and investment returns would be deposited in the so called Tier-I account, which cannot be withdrawn. At 60, one will be required to invest 40% of the proceeds have to be compulsorily invested in buying an annuity that given periodical payouts. The remaining 60% can be withdrawn as lump sum. Being the vesting age is 60 years, prior withdrawals are discouraged, that one can withdraw only 20% of the corpus during an emergency. Like any ULIP, it offers also flexibility of choosing from various combinations of debt and equity plans subject to the maximum exposure to equity is limited to 50%. While it is true that NPS returns are market-linked and therefore bound to be volatile, it is good for those who can stomach some amount of risk. That’s all!

Although you now get additional tax deduction for what you invest in NPS, the maturity proceeds are still taxable. This means you have to pay income tax on the 60% that you withdraw from NPS. The annuities that you get are again considered income and are taxable. Under the most other tax-saving and long-term investment products such as public provident fund (PPF), insurance or equity –linked saving scheme, you get a deduction of only up to Rs.1.5 lakh under section 80C. But the proceeds from it are tax-free which get more tax-efficient than NPS appears. Hence, for NPS, the entire corpus withdrawn is added to your income and taxed in line with your applicable slab rate. This could significantly eat into your returns during retirement, especially if in the highest tax bracket.

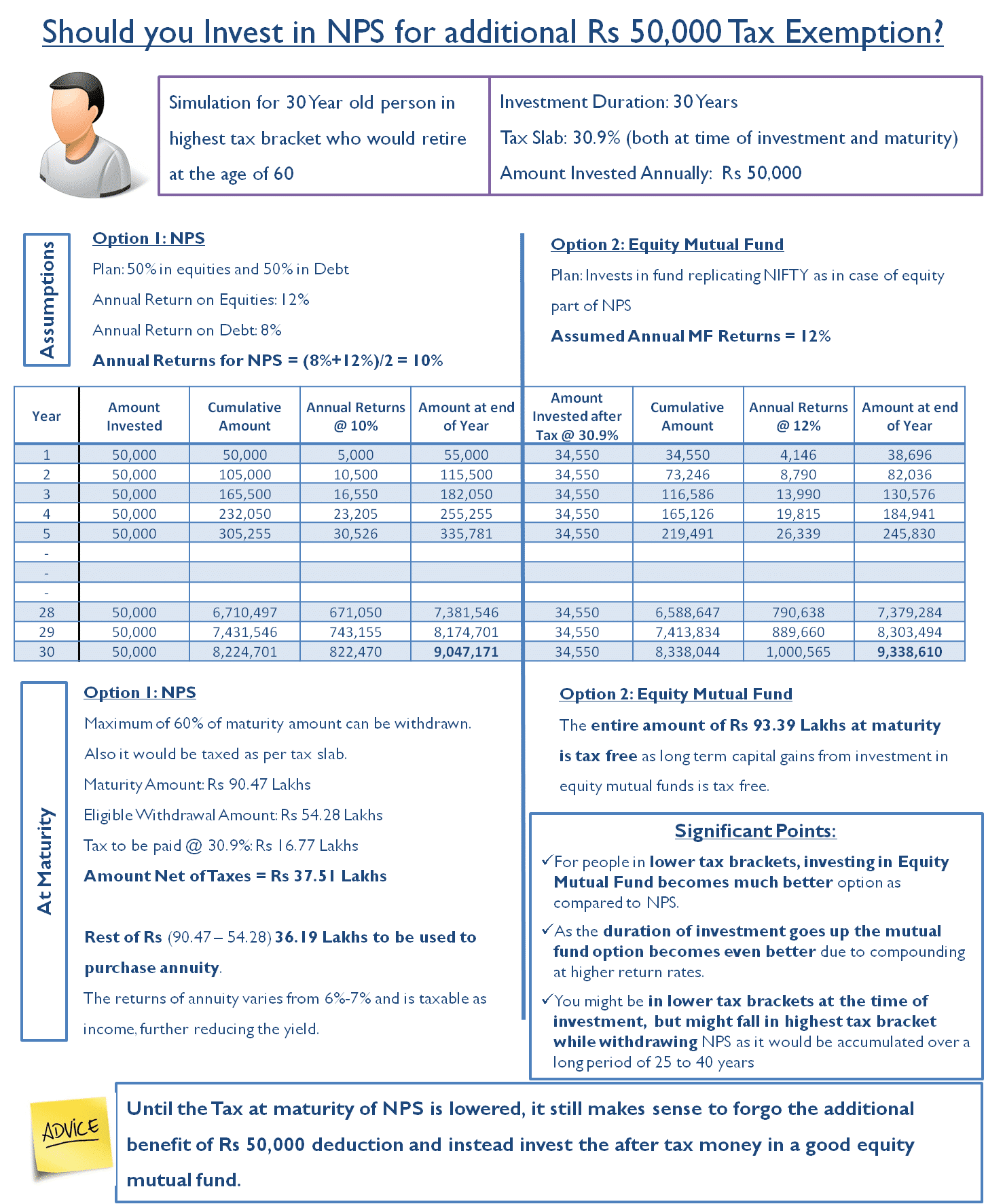

I just take an Example to illustrate this case easily –

After an evaluation of the scheme, drawbacks and other options, therefore, NPS has not found much favour with investors even giving extra Rs 50,000 deduction from taxable income. As per my observations one should not go for complex products to execute the desired asset allocation. Many good long-term simple equity and debt products that can be used for retirement planning such as top-performing equity mutual funds, PPF etc. You can choose between these products or opt for a combination of these instruments, but you must be disciplined and continue investing over a long period. Likewise, you need to ensure that the features suit your risk profile, financial goals and investment horizon. Overall, NPS would remain an unattractive proposition even if you get an additional a tax break.

4 thoughts on “NPS- A Flawed Tax efficient Product.”

Can we invest total amount from NPS to Annuuity plan & Pension from Annuity is taxable ?

No, Susil Babu, Maximum You can withdraw 60% of Corpus and rest 40% will be in Annuity Purchase. Annuity is taxable.

অল্প কিছু আয়কর বাচাবার জন্য NPS করার চেয়ে Equity তে Long turn invest করলে অনেক বেশি Return পাওয়া যাবে বলে আমার মনে হয় এবং return amount taxable নয় । তবে পেনশানের জন্য কি কোন ভালো স্কিম আছে আমাদের দেশে ?

Ashok Babu, Great Eye Opener.