From my experience, I can share that majority of the people usually ignore the most important subject in their life that is – Retirement Planning. Even if very few people think, but there is a big gap between what they think and what the reality is. Due to my profession, I have to discuss with many people of different income classes, about their financial matters. I have noticed in most cases that they have a very casual mentality about their financial planning. Their thought process is like – “It’s ok,” or “It will be managed later on” and so on.

I have thought a lot about this – “Why is it happening like this with most people?” At last, I conclude that due to work pressure on various professions and heavy pressure on monthly expenses, most of the people have built a “manageable attitude” or “stage making up” attitude to manage the urgent situations.

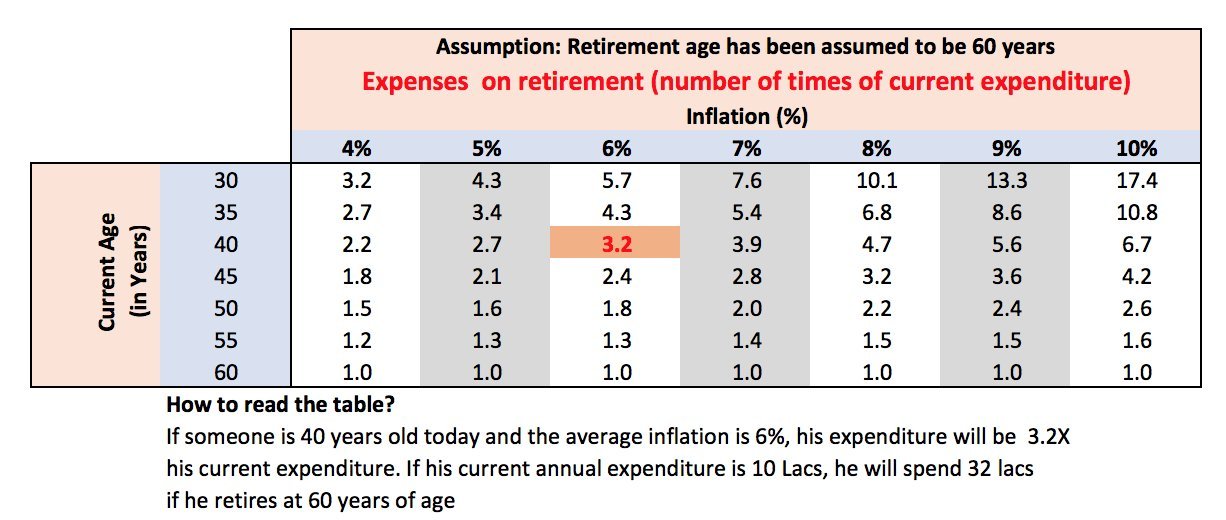

Suppose, a person of 43 years of age has a family running expenses of Rs. 22,500 and he has two pension plans with two different insurance companies for his retirement, in which he pays a premium of Rs. 41,000 annually, and he also deposits Rs. 1,00,000 in PPF Account every year for the same retirement purpose. During our discussion, he becomes surprised when I said to him that “Do you know if the average inflation is 9% then the yearly family running expenditure will become nearly Rs. 100,000 p.m, in the year of your retirement?” Naturally, he couldn’t accept the fact. Actually, he couldn’t realize the sudden shock of his far future. If he increases his pre-retirement lifestyle then his post-retirement expenditure will increase even more to maintain the same lifestyle. Just consider the fact once – how tough it can be to convince a person about this subject who himself is not very serious about his future financial planning? Somehow, it depends upon one’s financial education (not academic education). But “Fact is Fact”, and it turns into a very hard reality in the future.

Now I told him – “To maintain the same expenditure for a lifetime you should accumulate a retirement corpus of Rs. 2 crores, from which you and your wife can spend the same expenditure for a lifetime up to the age of 80 years of your spouse”. I explained to him the fact by a detailed calculation that he cannot reach the retirement corpus by depositing money to Insurance and PPF products. He has to invest nearly Rs. 28,000 p.m. from today to build that retirement corpus. His Insurance policy and PPF are not sufficient enough for that purpose but it is practically almost impossible for him both financially and mentally comprehend this and start an investment of Rs 28,000 p.m now.

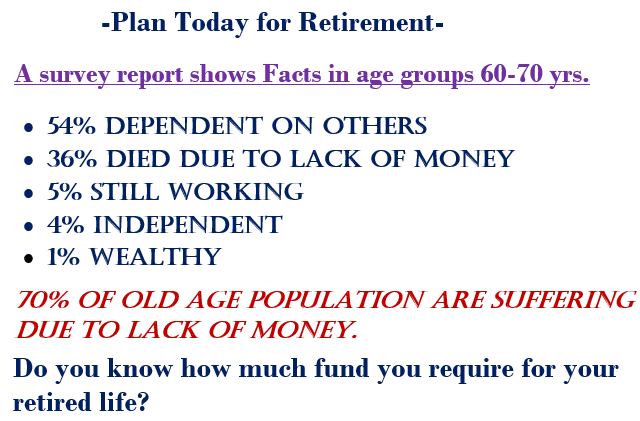

What happen’s now? He as usual started investing by small amounts reluctantly and ignorantly. Now, reaching the age of 50 yrs, his realization will then change completely and he will then realize the fact partially. But its too late now. Somehow he will then manage the required investment of Rs. 28,000 p.m. but there will be no fruitful result at all as he is so late. Reality is very very hard – “Either you pay the price right now or pay the price throughout your life”. Because at around 50 years age, the calculation says that, he needs to invest nearly Rs. 46,000 p.m. to make such required corpus. Then actually there will be no way left for him to make it happen. Now I request you to also think about some other situations he will have to face after retirement – “the nuclear family concept” where nobody actually will be able to support him financially at his age.

In the future, for any retired couple, the most adverse situations are things like – huge medical expenditure, huge inflationary pressure, and unmanageable work pressure of their children due to their job, etc. Now just imagine, how much he has to “compromise” on everything. The future will appear more and more relentless in front of him.

Now, please try to think over it in a calm and cool way – is this something we deserve? If not, why should this happen? The only reason is late understanding. We have to plan and arrange our own financial future by considering such socio-economic conditions. We have to take the initiative, so, don’t ignore it.

Actually, the minimum amount which he has been investing regularly in PPF and Insurance, that also in an unplanned way and also in the wrong products is not enough at all. He has been making investments for a very long time but return paying capacity is either below inflation or at par with inflation.

In fact, most people are very casual about their personal finance at an early stage of their life. Financial ignorance, lifestyle expenditure, loan EMI, child education, child marriage planning, etc., and other priorities force them to do such mistakes. Due to a lack of proper knowledge of financial matters, no one thinks over the proper use of surplus cash. But remember, proper use of surplus cash is the indication of financial future planning. But most people, in that time choose products which are either assured or can generate maximum returns in the short term. Both are wrong approaches. To them, planning is less important than the product.

Due to my profession, I have to analyze various individuals’ cash flow statements regularly. I have experienced that a person can protect his/her financial future very easily by talking to a financial planner and doing a proper financial plan. In this way, he can direct his surplus cash towards his financial goal. The situation is like a kid and how he uses his 24 hours for his study or for entertainment largely determines his academic future. The person who starts late, or is trapped in the wrong product, easily gets de-focused with the product, return, risk, and so on, not on “planning”.

I strongly recommend that you should discuss with any financial planner/financial advisor to understand the situation whether the present retirement policy or investments you are making are enough to fulfill your future requirement. As “Retirement” is not any particular age, retirement is that very age when your income will be zero but your expenses are going to go on in their own way as usual. If your retirement corpus can not fulfill your post-retirement requirement then only one word will chase you forever and that is “Compromise”, which is very much painful at such an old age.

16 thoughts on “Retirement Is A Big Thing, Don’t Underestimate It (English)”

Really, I can’t express how much I benefitted after reading your valuable article. Retirement Planning is really a big issue. Thanks Mr. Roy.

Since few months I have been reading your article in your blog. It is beyond my expectations that you give me the answers which I send to you. Just Mind blowing. There is no business relationship between you and me although you wrote these valuable articles in a very simple way for us. Thanks to you. I stay in a very distant place, Nagpur. I shall be very lucky if you would be my mentor. It can be possible if god permit.

It is very little complement to say “Awesome”! I read a very timely article. Sometimes I become panicked. I become thoughtful but then I become courageous so that you are with us.

Your articles are splendid from different aspects. Firstly, the most simple language. very much practical and easy examples ar used by you. Mostly, you explains very easily the real reason of investment. The investors who are associate with you, are very lucky. Thank you very much.

Asoke Da, I am very much pleased after reading your article. Actually we dont know why planning is more important. I demand from you much more articles like that.

I think that most of the people think about “How”. The How part is totally in expert area. It is the duty of an expert, how he accomplish the financial goal. How I will be benefited by knowing the technicalities.

Mr. Roy is completely different from this point of view. He always want to aware us in the “Why Part”. Excellent article is the minimum complement for this writing. Thanks Mr Roy. Please enrich us more and more.

Really retirement Plan is a big issue. We are very much benefited with you.

Excellent! The judical use of surplus cash in a long term, beating inflation etc. These factors are not very easy to deal without the help of an expert, this is my personal opinion. It can be managed with the expertise of a financial advisor. Thans dada.

Your article is very practical. but what can they do who are aged enough and have no pension?

Thanks Mr Roy. After reading your important article it seems that what a crisis I have to face if I am not acquainted with you. If we meet earlier it was rather good for me. However, better late than never.

Very good article. I have learn this type of subject only from you. Even we don’t know how much we are in the right position. Need your guidance always in future…… Keep it up. Thanks.

Just a few month back i met Ray babu and started reading his blogs, now my vision is totally change towards investment .

We unable to realize the future financial destiny. Thanks Ashok Da to make us realize the fact of our old age financial condition and requirement. I am doing plan regarding financial goal but it is also true that I can’t avoid present expenses for livelihood. So from my point of view, if some one wants to make a good corpus he has to start built up from early life. We can remember the famous phrase “Early to bed and early to rise”. If one starts early he could build early this is the main thing in financial planning that is TIME……

THANKS ASHOK DA TO TEACH US TODAY A GOOD LESSON.

Thanks Ashokda. All your analysis are real eye openers that indicate that it is high time we wake up to the financial realities of life & give us good insights into our future

Thank you Mr.Roy.U’ve enplane very elaborately.If possible kindly write something on my age group-Regards.

Retirement is an important issue in every citizen’s life. I did not know this,when I joined in my service life . I lost 15 years of my service life to have a plan for retirement. It has now become an imperative need for every body’s life. Start retirement plan very early just by investing rs.1000 p.m. increase it every year by 500/- for 40 years. You will get your work done.so all are requested to ponder over it seriously. Thanks a lot for your creative writing.