SIP (Systematic Investment Plan) is a scientific technique. It’s not a product but a system through which you can invest. In simpler terms, you can invest on an installment basis just as you invest in other financial products. So this recurring way of investing on an installment basis is known as SIP. It is similar to the recurring deposit scheme available at banks and post offices.

The best part of SIP is one can invest with a minimum amount of 1000 rupees. Suppose, if someone earns 30,000 a month, he/she can invest only 2000 rupees each month. One can also transfer it from their bank account through ECS. This would save them from queues and hassle free payment of premiums.

There is no set rule for how many months or years one has to continue investing in SIP. Suppose someone has once decided to invest 2000 rupees each month for a period of 10 years. But soon he felt it was a wrong decision and he wanted to change it. If such a situation occurs, one simply has to write an application to close the ECS system with immediate effect.

If you have started the SIP under the guidance of any Mutual Fund distributor and if he has done it online then you can discontinue the SIP by just one call or if you are aware of the online system, you can do it yourself. Yes, you read it right, it is that easy. Think for once, suppose, you have recurring deposits in a bank or post office which you want to discontinue, will it be this easy?

In this covid situation, many had either lost their income or it was reduced. During those times, it was not possible to visit banks and post offices having recurring deposits. It was so crowded. Surprisingly, those who had SIP in Mutual funds done with roy’s Finance, did they ever visit our office, nor did we visit them. A simple phone call by them was enough for us to stop their SIPs. Again, when their situations were normal, they continued with their investment.

Then there are many who want to temporarily pause their ECS deduction in the bank due to some reasons ( expenses for vacation, unplanned requirements, etc). Is it possible to do so? Yes, it is absolutely possible. Do other investment avenues have this kind of unchargeable and hassle free service? Think about it.

We would request you to think about other investment systems where you can avail such facilities. The insurance company decides the amount you are going to pay as premium but in case of SIP, any amount you deposit is your investment. There is a system of penalty or loss in banks, post offices or insurance companies if you withdraw the amount before the time period but in case of SIP, there’s no such set of norms

There’s no such hassles in case of SIP. Do any other conventional investment avenues have these kinds of facilities?

There’s no better way of maintaining discipline in case of Force Savings or Investment than SIP. I have heard people grumble about depositing 5000 a month in the beginning but then praising themselves for taking such an investment decision. Suppose, you started with Rs 5,000 and after a few months, you felt like reducing the amount to Rs3,000. You can increase or decrease your monthly amount anytime in the case of SIP. In one word, the facilities that you cannot avail in other conventional investment avenues, are available in SIP.

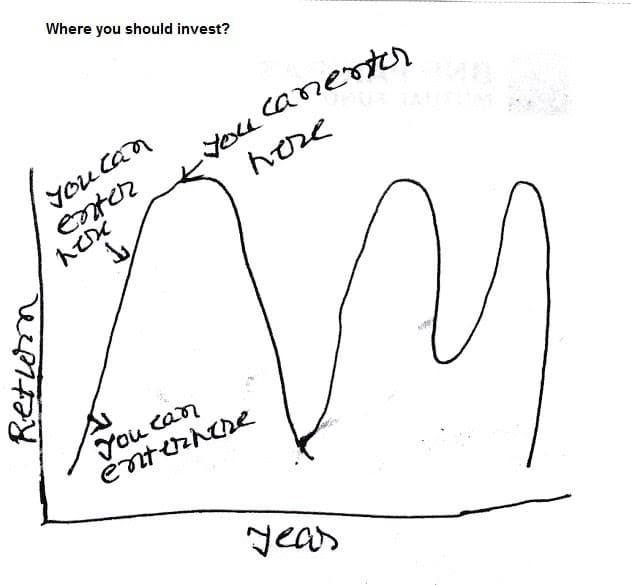

The chart above will make you understand why investing in SIP is recommended. For those who are unaware of how an Equity Market works, let me tell you that the Equity Market may fluctuate from time to time. It keeps on increasing along with those fluctuations from time to time in the long run. However, this volatility is feared by many investors. They do not know that this volatility creates return in the long run.

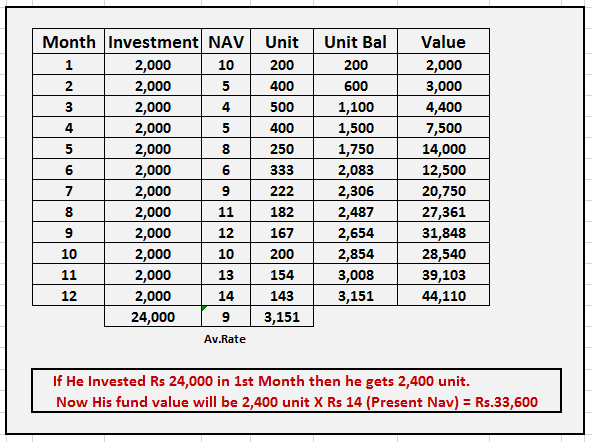

In the above example, this person invests all his money i.e 24,000 rupees then his fund value would be 33,600 after a year and if he could invest 2000 each month, then his value would be 44, 100.

The person has invested 2000 rupees each month. NAV is basically the purchase price. If you carefully notice that when the price drops, the one who has invested in SIP is excited because he is getting many units with the same amount. Just think about it that someone who has invested 24,000, he may notice that the fund value has become half. But after a certain time, he’d find a fund value of more than 33,600.

I hope I could explain how SIP turns risk into an advantage.

Here, I am trying to explain how an Equity Market works through the above-mentioned image. None of us can predict the market fluctuations based on our investments. The good news is that no matter which direction the market moves to, investors investing in SIP will gain. As explained earlier, as the valuation increases so will the unit accumulation.

Just like you can buy necessary goods by taking a loan and paying EMI, similarly, you can invest in SIP to fulfill your goals. One can apply for a short-term or long-term goal in SIP. Similarly, if someone is looking for a tax exemption, he can apply for that too in SIP. Moreover, one can even invest in SIP for various life goals like Retirement, Child education or marriage, or Vacation.

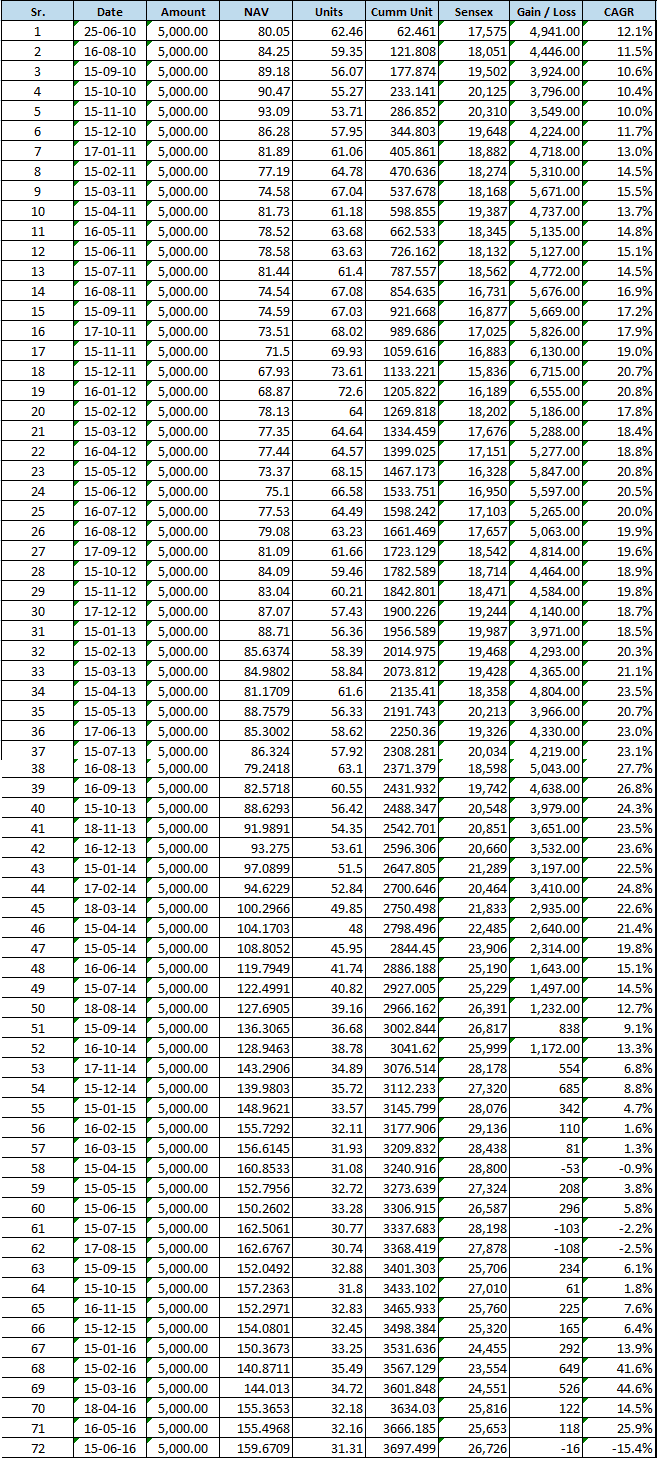

For a better understanding of a 6 years SIP plan, I am sharing a practical example below. It’s no illustration but a fact.

If you carefully note, you will see that this person has invested 5000 rupees for 72 months (5000×72= 3,60,000) and the current value at the present moment is 5,88,503. The CAGR return rate is 16.6%.

The SIP was started on 25/06/2010 when the NAV was 80.05 rupees and the SENSEX (Market Index) was 17,575. That day he had received 62.46 units for 5000 rupees.

The NAV on 15/11/2010 increased to 93.09 rupees and the Unit Accumulation was 53.71. However, there was a drop in the market value on 15/12/2011 to 15,836 and the NAV was 67.93 rupees and as usual, the Unit Accumulation was increased to 73.61. This is the magic of SIP. Whether the Equity Markets drops or rises, both changes will benefit the SIP investor. If the NAV rises, consequently the Fund value will also rise so will the Unit Accumulation. This is how one can get huge returns through investing in SIP.

I could have shared a 15 years practical figure but the chart would not be brief which could be difficult to comprehend by many.

So here my question is, is there any other avenue where you can get such Lucrative Inflation-Adjusted Tax Free Return without any commitment or pressure?

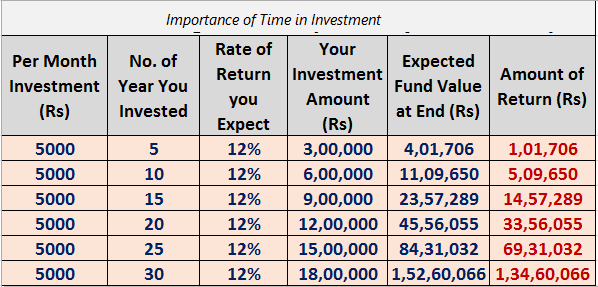

From the above-mentioned example, it is assumed that the investor is not increasing his investment amount every month. Therefore, the return remains stagnant too (although, the returns should increase with time in reality). Just notice the time horizon and its dangerous impact when it moves from 20 to 30 years.

Anyone who believes that SIP has no disadvantages must change his notion as it could be chaotic. It is very essential to know the cons of SIP. Take a look at the above example chart.

6000 rupees have been invested in the 3rd month but the value displayed is 4400, 8000 in the 4th month, and the value shown is 7500. This is where many would stop their ECS and withdraw the full amount. I am sure that after reading this article, many of you will not hesitate to quit in the middle. But the ones who will continue investing 5000 a month can enjoy returns at 12% and create a fund of 45.56 lacs in the next 20 years.

Suppose a 25-year-old decides to invest in SIP with 2000 rupees per month. If the return is at 15% and he continues investing until he is 60, then the Fund Value he would create would be of 2,25,65,336 rupees. Not bad, isn’t it?

Many of you have asked me questions on this subject which I am trying to answer here.

1. What is an example of SIP?

A: I hope the above article will answer this question.

2. What is a Systematic Investment Plan and how it works?

A: You are recommended to read the above article.

3. How do I start a Systematic Investment Plan?

A: If you want to start investing through SIP to create wealth or fulfil any financial goal, first you must complete your KYC. Then you need to determine the purpose and decide how much you want to invest in SIP. You must analyse your risk appetite and choose a fund accordingly. In that case, you may take help from a Mutual Distributor, too.

4. Which SIP is best for 1 year time period?

A: If you want SIP for 1 year, you may choose the Liquid Category of Debt Fund. The benefits of investing in SIP are more than investing in recurring accounts of banks or post offices.

5. Which is the best SIP in India?

A: It is difficult to say which SIP is the best because it is just a system of investment and not any Product or Fund. SIP is a good investment strategy where a person can deposit a certain amount every month after spending on expenses and creating a surplus to fulfill goals or purposes.

6. Which Mutual Fund will give the highest return?

A: There are various avenues of investing in a Mutual Fund. The categories are further bifurcated into different types of funds. Some of them are Debt Fund, Hybrid Fund, and Equity Fund.

Return is all about the results of past performance. Yes, there are several instances where there had been ample returns in case of Equity funds. If someone has invested in an Equity fund just to fulfill their goals, then he can expect to get a Moderate return.

7. Is SIP a good idea?

A: There is nothing good or bad. If someone wants to invest every month, then SIP is the best option. If someone invests 5000 rupees a month for 30 years, he can create a wealth of around 1.5 crores. (Assume return rate 12%)

8. Is investing in SIP safe?

A: I don’t know what safety means here. If you are asking about loss of Capital then I’d say there’s no chance of losing Capital because Mutual Funds strictly follow SEBI regulations.

If you are talking about volatility then I’d suggest you to read the article to understand that the wealth created or goals fulfilled is solely due to the volatility of Mutual Funds.

9. Can I lose my money in SIP?

A: If you invest in a High Volatility Fund for a shorter period without judging your own Investment purpose, Risk Ability then there might be loss but if invested for a long term, the money gains are higher.

10. Is SIP better or a lump sum investment?

A: SIP in the long run or lump sum both are recommended for financial goals. One can create wealth by investing a sum of money each month for a short term managing the volatility or may invest a lump sum amount for long term analysing their risk appetite.

If you want to add some value to this article, feel free to write to us. Your feedback is important to us.

Note: The examples or return % used is used just to explain the concept of SIP. Mutual Funds are subjected to Market risk, kindly read the offer document before investing.

I am just an AMFI Certified Mutual Fund Distributor and this article has no purpose of planning or advising anyone but to clear the concept of SIP and create awareness for the same