While investing in Mutual Fund, many people get confused between volatility (price fluctuation) and risk. Not all mutual funds will have the same volatility. Equity fund has the maximum volatility, Hybrid Fund has less volatility than that, Debt fund has even less volatility and Liquid Fund has almost negligible volatility. Volatility doesn’t mean risk. It depends on your purpose and your risk taking ability and can be more opportunistic to you than risk.

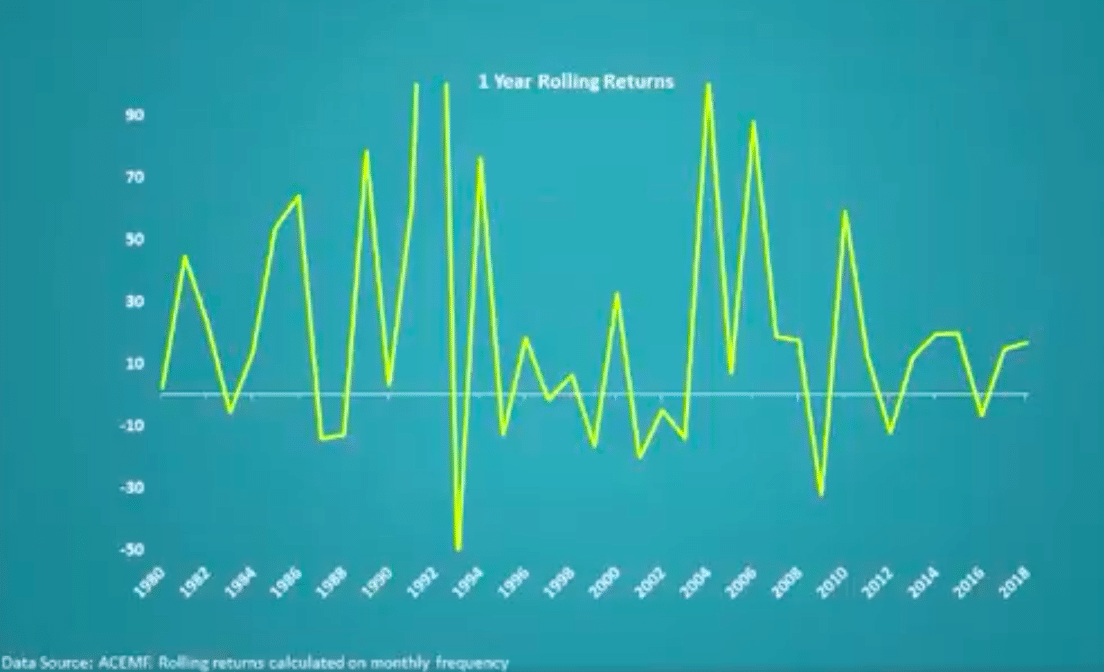

Equity Fund is a lot volatile in the short term like for 1 year.

If we analyze Sensex’s rolling return for one year, then we can clearly see how volatile the returns are. Now if we do a 5-year rolling return analysis, then the picture is quite different.

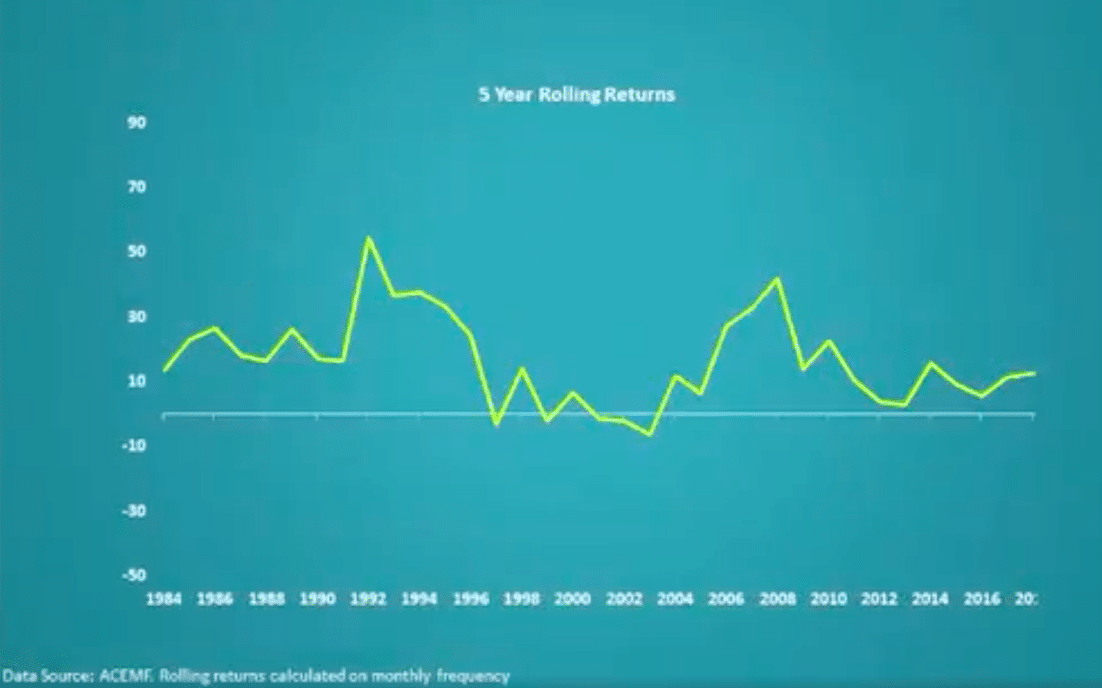

You can clearly see that the volatility has reduced drastically and the possibility of getting negative returns have also reduced significantly. Now let’s have a quick look at the rolling returns graph for 10 years, 15 years and 20 years.

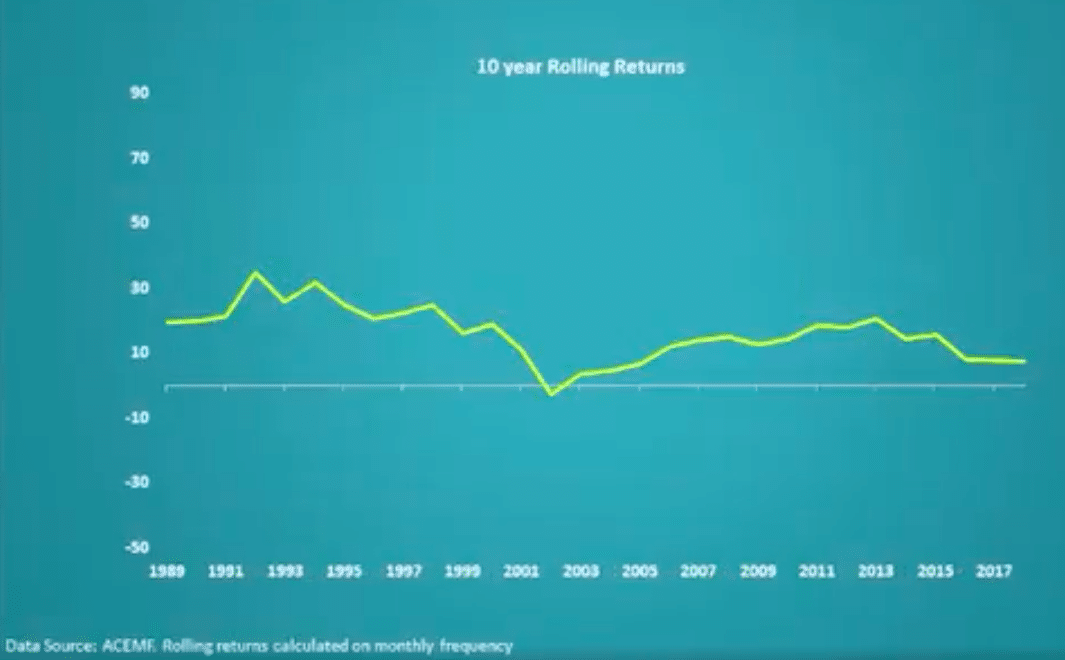

Let’s check out the 10 years return analysis graph first,

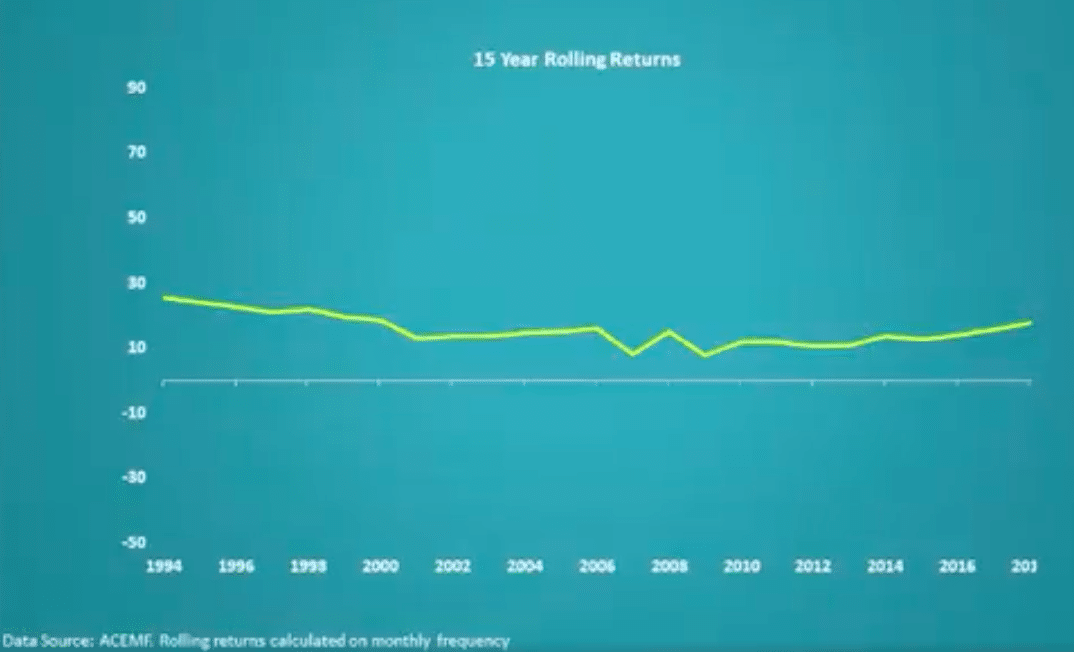

Now, let’s have a look at the 15 years return analysis graph –

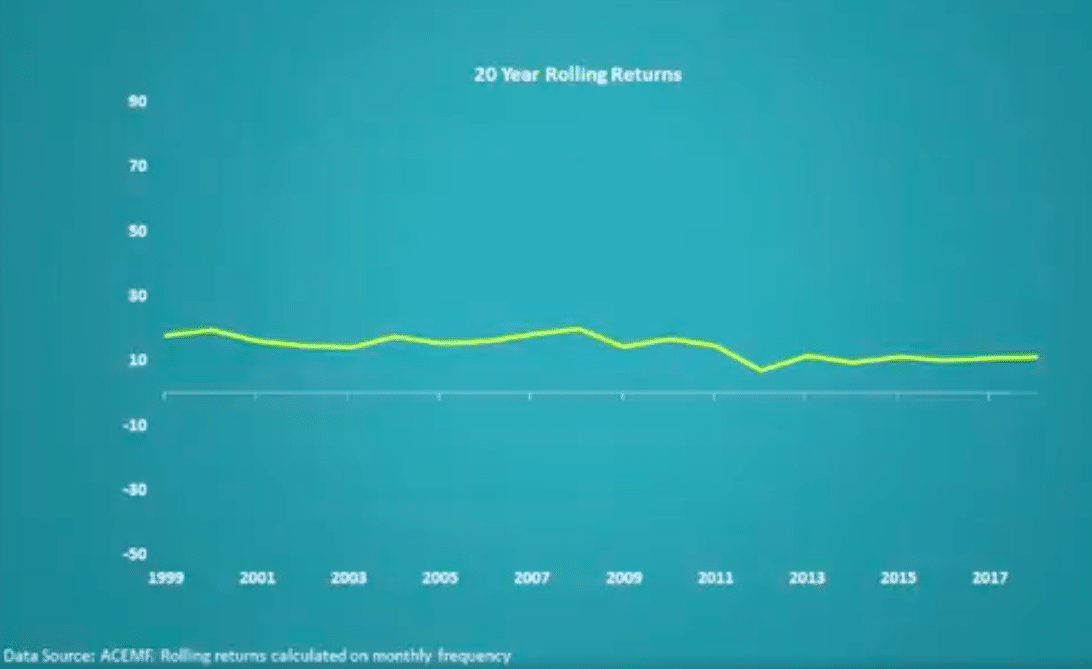

Now, finally, the 20 years return analysis graph –

If you look at all the charts once again from the beginning, you will get answers to a lot of your questions, like –

- Why is Equity Fund risky in short term?

- Will my investment be negative after 20 years?

- How long can we consider as a long-term investment?

- Why patience, discipline, and help from an expert advisor is required for equity investment?

“A picture speaks more than a thousand words”. Looking forward to hearing your feedback on this.

3 thoughts on “How To Create Wealth With Safety [In English]”

Very good article. It’s really an eye opener

Excellent article. Thanks Mr. Roy. We are very much benefited from your article. I feel you are really an advisor.

Volatility is the essence of the equity market which gives money to the investors who can float with it and can tame it. To some it appears a risky affair , a booby trap , rather than a flow of opportunity and a good return. Here comes the utility of SIP which minimises the effect of volatility like using lifejacket while sailing through rough weathers , they are actually intertwined , when the volatility is absent SIP may not appear that much benificial. Anyway volatility rollercoaster will remain always there specially in equity based products but whoever enjoys the ride utimately enjoys the prize in the long run.