I have been repeatedly writing to apprise others that if you cannot utilize surplus money properly, you may have to face a lot of difficulties later on. Various people have sent me their cash flow statements. Neither do I know them personally nor do I have any business relationship with them. They are just regular readers of my blog. I noticed something interesting from the statements sent to me. I found almost everyone’s income and expenditure were different, but they followed a similar investment pattern. However, almost everyone thinks that a huge % of their income is invested in a place that will provide below inflation return. Such as insurance, bank FD, PPF, RD, etc. These are all long-term investments but they have below inflation output and erodes huge capital.

There is a saying that mass always follows mass and therefore, a mass may not be successful. Whatever happens in front of the mass’ eyes is everything, any different idea is not accepted by the masses. Again, when many people start following the changed idea of mass, then he has no difficulty in accepting the change. No one can deny that it’s true.

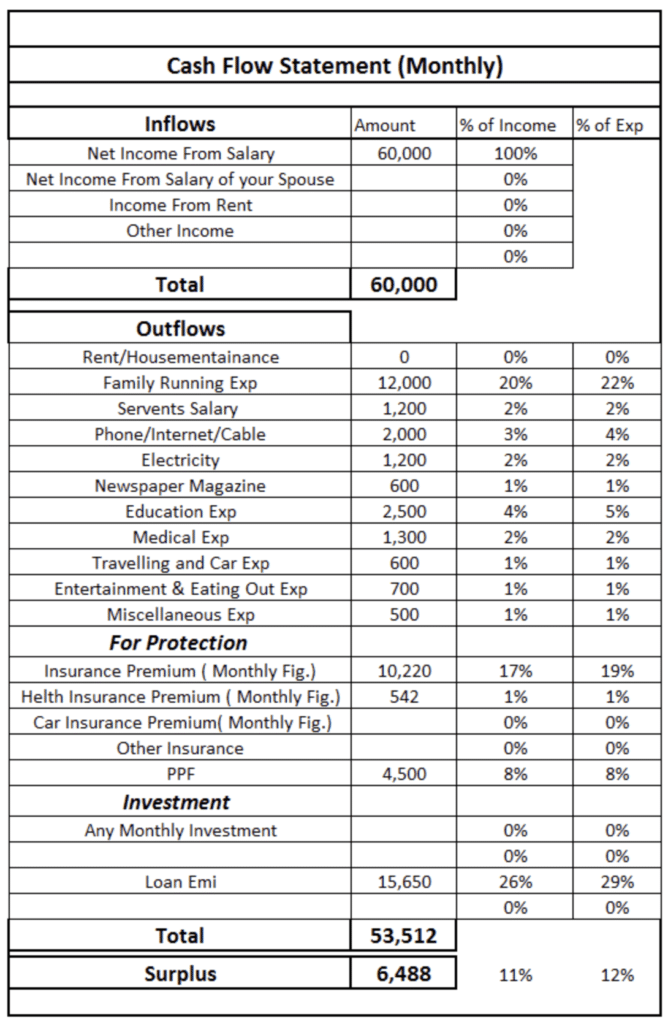

Below is someone’s cash flow statement.

Make An Emergency Fund

The above-mentioned statement tries to understand that the surplus depends on how and which direction it is directed because the financial future depends a lot on the surplus. He should first create an emergency fund. This can be done in the liquid fund of mutual funds in which one can withdraw money at any point in time. It is similar to a bank’s savings account. If you want to know further about this, please click on the link.

Manage Your Expenses

Now I can’t tell you how he manages his expenditure because I don’t know him. (Those who do not have a surplus at the end of the month, should make a cash flow statement. One can easily determine expenditure management from this statement).

Let’s not deviate from the topic. This person’s 39% of income is spent on regular expenses, 26% on EMI, in total 65% of income to manage the present. Now, from the remaining 35%, 25% may be invested in PPF or insurance. Only these two investments are for the long term.

Misuse Of Life Insurance

This kind of insurance is called an Endowment Insurance Plan. Now the sum assured or life coverage is about 16 lacs. Do you think this insurance coverage is enough for his income? Obviously not. It is necessary to know the benefits of an insurance plan. A person’s insurance covers the risk and the interest from which his family can be run in his absence. This is called Income Replacement.

If something fatal happens to that person, his family would be getting 16 lacs rupees. If you consider 8% interest then the amount stands at Rs. 1,28,000 annually and Rs. 10,677 monthly. This amount will neither suffice his income nor his expenditure. So what is the purpose of this insurance plan in reality? The question is if he is alive, would he be getting huge money upon maturity? The answer is yes, he would. Now we need to see if the money that you are considering huge will surprise you if viewed from the return angle.

Insurance Is For Protection Not For Investment

After doing many types of Insurance Policy calculations, I would like to say that the return for Endowment Policy is within 4% to 6%. It is almost impossible to go above it. Savings bank account return is 3.5%, Liquid Fund Return is 6.5% to 7%. These are all short-term products, with no commitment and easy liquidity. So what is the benefit of investing in this insurance? Is it right to be trapped without knowing and understanding? I beg you to think about how you are earning hard-earned money without always giving your family the time they need for the long term.

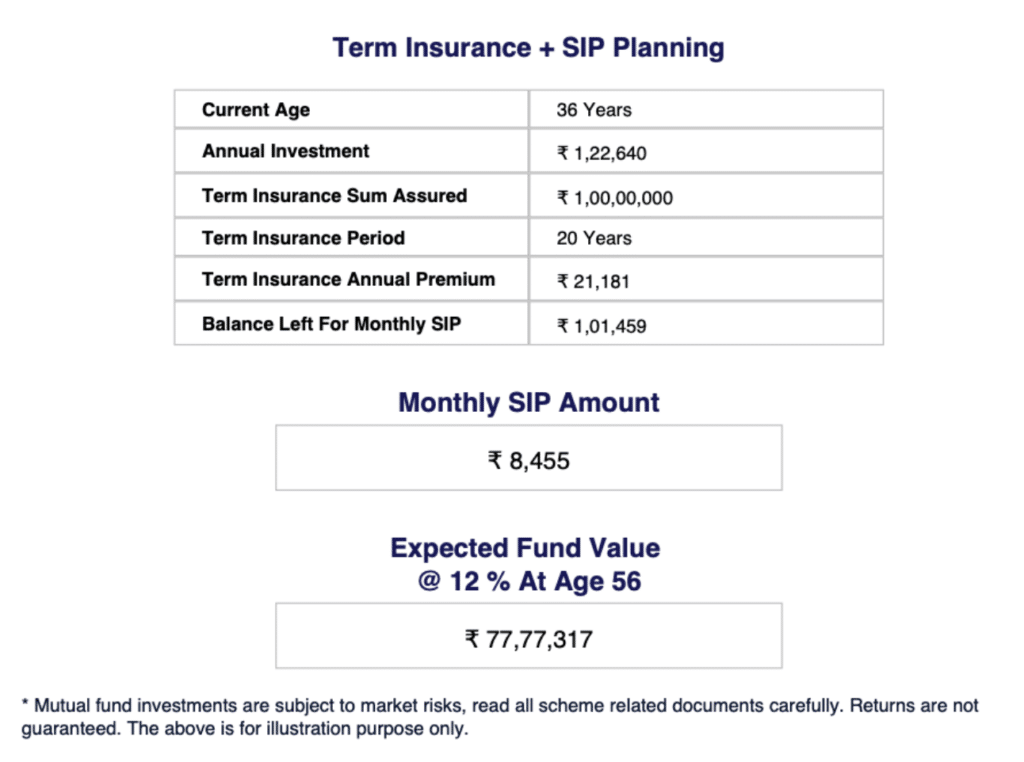

If this can be done, then see how it works. He is 36 years old now. If he takes a term policy having a life coverage of Rs 1 crore at this age, he has to pay a yearly premium of Rs. 21, 181 and a monthly premium of Rs. 1,765.

Use Term Insurance For Complete Protection

Term Insurance is real Life Insurance. If the sole policyholder dies for any reason, then he will get the nominee’s life coverage amount. Some people, here, think what if nothing happens, will there be no return? A huge misconception is that the person who is paying the car insurance premium can avail of the benefit, only if there is an accident. But what is he thinking about his family life’s coverage? The problem lies in the lack of knowledge and unawareness of the difference between safety and risk.

Anyway, if he changes the way he was going, then we will see what happens.

If he takes a Term Insurance of Rs 1 crore for a term of 20 years, his monthly expenditure will be Rs. 1, 765. Earlier, he was spending Rs 10,220 per month on Insurance purposes. Investment with insurance is like getting free vegetables with kachori.

After paying a premium for Term Insurance, he has Rs. 8,445 left (10,220-1,765). If he invests this money in a Mutual Fund as SIP every month for 20 years at a 12% return from that fund, he will get Rs. 77,77,317 after 20 years.

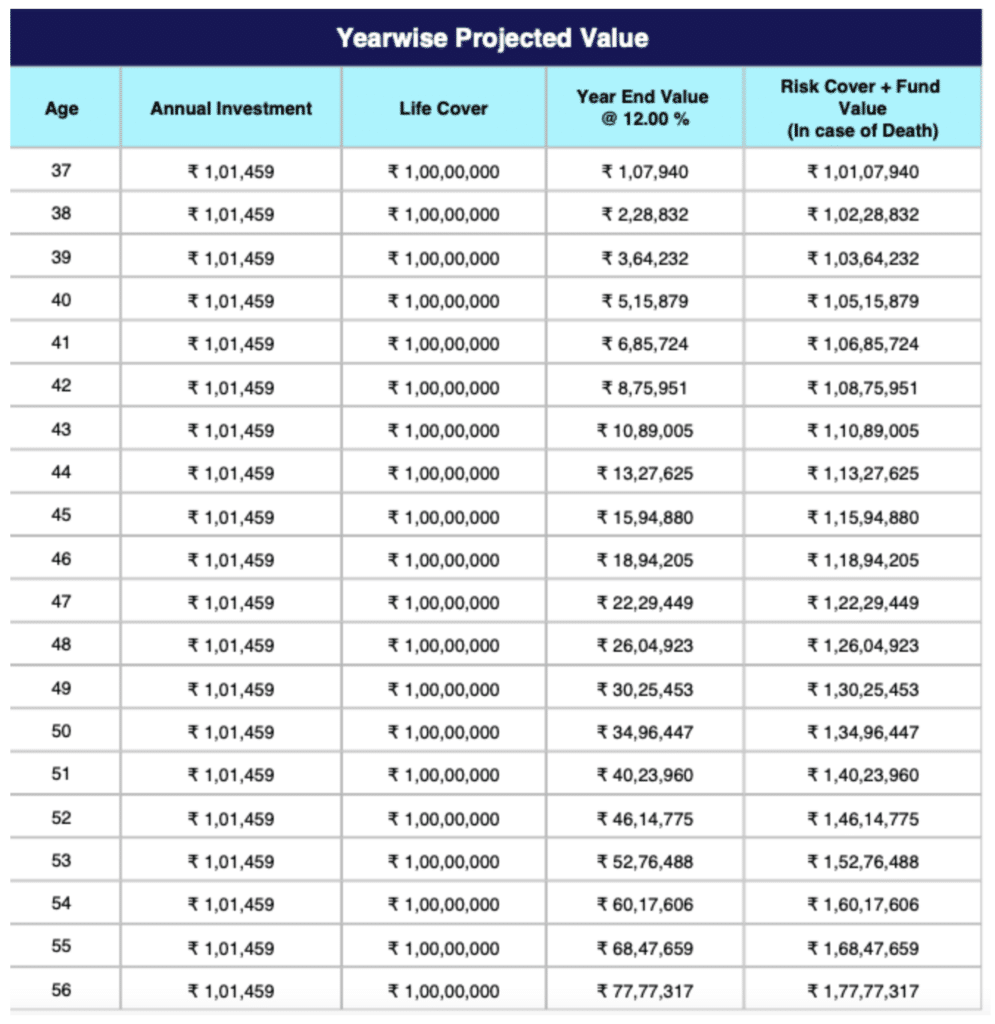

If the person dies due to any reason in this option, then a death benefit will be provided from the Insurance company to his family. The death benefit in the previous option is only 16 lacs rupees. In other words, by spending the same money, the family is getting more security and money. If you look at the chart below carefully, the concept would be clearer.

Suppose a gentleman has done a SIP+Term together. Suppose he dies suddenly at the age of 49 years. At that time, his nominee will get a sum of 1,30,25,453 rupees. Additionally, Rs 1 crore from Term Policy Death Benefit and a fund value of Rs. 30,25,453. And if he had been continuing his old Endowment Insurance Plan, he would receive Rs 16 lacs.

Now if you think you should have taken that Rs. 1 crore from your interest money and continued in the SIP fund of Rs8,455, then upon maturity you would get a return of Rs77,77,317. If there is no death in the next 20 years, you would get that amount at a 12% return. In this term insurance and SIP are combined and in an Endowment Plan but the result is the opposite. This Term Insurance with the SIP option has a lot of liquidity benefits.

What Should You Do?

What to do now if you have old Endowment Insurance? Understand the simple fact that whatever you do now, the loss will be yours. If you continue the policy and drag it to maturity, then there is a huge loss in maturity (as I said earlier). If you chose the policy and surrender, then there will be an immediate loss, but there is an opportunity to make up for the future loss. If there are 3-4 years left till the policy matures then I think the continuation of the policy should be carried out. If there is more time left for the policy to mature then it seems better to book for loss and rectify the future loss.

You can fix this with your financial advisor. Your mindset will guide you.

Speaking of what I started talking about at the beginning, he paid Rs 4,500 per month in PPF. If you want to know the reason, he said it was for his post-retirement life. We need to think about it in the future. The interest rate on PPF has come down from 12% to 7.1%. See, where the end of this about the changed situation. To know better, click on the link.

In the medical world, just as disease is detected by various medical tests, cash flow analysis is one of the many tests in personal finance. If you can maintain the correct figure, then you can control your financial situation a lot.

Let the truth be told, a particular fund or product will not be able to fulfill your goal or purpose in today’s age. Only planning and regular monitoring can be done to make your future financially secure, especially if done with the help of an expert. As the economic situation changes, an expert can guide you about the future implications of a product or asset. Those who are just targeting the fund that is giving a good return; 5 stars rated fund, are you sure you won’t have to regret it? Not everyone is doing what they are showcasing. You need to personalize your goals, your family, your income, your mindset likewise. This is why it is called personal finance. Copy and paste do not work here. Keep in mind that a conscious investor can be a protected investor.

Frequently Asked Questions

Your feedback encourages me to highlight a variety of issues. I have received many questions on this subject, I am trying to answer those questions.

Q. Is LIC better than a SIP?

A: LIC is the name of an insurance company and SIP is a system (Systematic Insurance Plan) so there is no comparison between the two. However, I think the question should have been will I do SIP instead of insurance?

SIP is an investment process. Wealth can be created by investing a little money in this system every month. While insurance is a completely different matter. Insurance means protection. A person earning income, his family is living on that income, future goals like children’s education, buying a flat, buying a car, fulfilling, all these will continue as long as he lives and income will continue. But if tomorrow for some reason that gentleman is no longer alive, then how would the family be run or their goals fulfilled? Here, insurance protects the risk.

Insurance is a very important aspect of a person’s life. One needs to keep in mind that protection comes before wealth creation.

Q. Are my mutual funds insured? Or are mutual funds insured in India?

A: Yes, several AMCs like ICICI Mutual fund, Nippon Mutual fund, ABSL Mutual fund have arranged to provide insurance benefits along with their SIP. For ‘One Plan, Many Opportunities’, you can watch this video.

Q. What is a medical advantage feature in the ICICI fund?

A: This is a feature that only ICICI Mutual funds have. There are several funds specified under which these features are covered. If someone invests in those specific funds with those features, then the fund house investor issues a Medical Advantage card. If at any time, the investor is admitted to the hospital for a medical issue or has to go to a diagnostic center to do a test, then the investor will be able to take advantage by showing that card without paying any cash. The money that is being billed will be deducted from the Investor fund. Investors who take advantage of this Medical Advantage feature will also get a discount on their medical bill or diagnostic center bill. To know more about Liquid funds and their advantages, you may click this link.

Q. Is SIP really worth it?

A: Many people have met many of their needs through Recurring deposits at any bank or post office. In the same way, through this SIP system, not only in India but all over the world, many people have met their needs and created a lot of wealth.

We also have many people who have fulfilled many financial goals of their lives by investing through SIP. I think it is better to understand the SIP system first, to know more about SIP, click here.

Q. Why is SIP bad?

A: SIP itself is neither good nor bad. It is a system. If someone understands and follows it, then it can give him a good result, and if he hears something that someone has just said or someone has a good return without understanding anything, then he may have a bad experience.

Q. What are the disadvantages of SIP?

A: Hopefully, you have got the answer to this question from the previous question. If you still have any doubts, click on the link https://youtu.be/Y4zKf_SFAYA

Q. Can I lose all my money in SIP?

A: Starting without understanding a subject can have bad consequences. I think you should know and understand well before doing anything about finance, or else you may have to bear a lot of losses.

To know how you can create wealth through SIP, read our blog post by clicking on the link.

Q. What is a SIP and its benefits?

A: SIP is a monthly investment method. Just like the Recurring Deposit Scheme of any bank or post office. Many benefits are available under SIP, such as-

- There is no need to invest a lot of money at one time, whether it is to fulfill a financial goal or create a very large wealth. Just like the monthly expenses are met, one can use the surplus amount by investing in SIP.

- It is often believed that the ones who speculate the market and invest get a benefit from SIP. It is because, in a long time, there is an opportunity to invest in both good times and bad times through SIP.

- For those who think market volatility is a risk, SIP is a great opportunity as well as a very good scientific tool to manage risk.

- It is possible to reduce the investment rate by averaging by investing through SIP in the long term.

- It is possible to invest in any large, medium, and small companies at the same time through SIP by investing only by Rs500. In this way, diversification is not possible for so little money.

If you want to know how to utilize the benefit in a better way, click on the link.

Q. Is SIP better or a lump sum?

A: Both SIP and lump sum are effective enough to meet the financial goals and needs in the long period. It is possible to create a good wealth creation by managing the volatility of the short period by investing a very small amount of money according to one’s ability through SIP. It is also possible to create a very large wealth in the long term.

Q. Is SIP better than PPF?

A: The question is similar to, “Is mango better than apple?”

SIP is a system or a process, not a product. While PPF is a product. So both are two opposite poles. I request you to first kindly understand the difference between the two, SIP and PPF.

Note: The examples of return % are used just to explain the concept of Equity Mutual funds. Mutual funds are subjected to Market risk, kindly read the offer document before investing. I am just an AMFI Certified Mutual Fund Distributor and this article has no purpose of planning or advising everyone but to clear the concept of SIP and create the concept of SIP and create awareness for the same.